IBM 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

100

The companies have also agreed to a 10-year exclusive manu-

facturing sourcing agreement in which GLOBALFOUNDRIES will

provide server processor semiconductor technology for use in

IBM Systems. The agreement provides the company with capac

-

ity and market-based pricing for current semiconductor nodes

in production and progression to nodes in the future for both

development and production needs. As part of the transaction

agreement, the company will provide GLOBALFOUNDRIES with

certain transition services, including IT, supply chain, packaging

and test services and lab services. The initial term for these tran-

sition services is one to three years, with GLOBALFOUNDRIES

having the ability to renew.

The transaction will be completed as soon as is practical,

subject to the satisfaction of regulatory requirements, customary

closing conditions and any other required approvals. The transac-

tion is expected to close in 2015.

In the third quarter of 2014, the company recorded a pre-tax

charge of $4.7 billion related to the expected sale of the Micro-

electronics disposal group, which was part of the Systems and

Technology reportable segment. The pre-tax charge reflected

the fair value less the estimated cost of selling the disposal group

including an impairment to the semiconductor long-lived assets

of $2.4 billion, $1.5 billion representing the cash consideration

expected to be transferred to GLOBALFOUNDRIES and $0.8 bil-

lion of other related costs. The asset impairment was reflected

in property, plant and equipment, net and the other estimated

costs of disposal were reflected in other accrued expenses and

liabilities and other liabilities in the Consolidated Statement of

Financial Position at September30, 2014. These estimates may

be adjusted, and the company may incur additional charges prior

to the closing of the transaction. All assets and liabilities of the

business are reported as held for sale at December31, 2014. The

cash consideration is expected to be transferred over three years

with $750 million transferred at the closing date. The actual net

cash related to the transaction will be adjusted by the amount of

the working capital due from GLOBALFOUNDRIES, estimated to

be $200 million.

Reporting the related assets and liabilities initially as held for

sale at September30, 2014 was based on meeting all of the criteria

for such reporting in the applicable accounting guidance. While

the company met certain criteria for held for sale reporting in prior

periods, it did not meet all of the criteria until September30, 2014.

In addition, at September30, 2014, the company concluded that

the Microelectronics business met the criteria for discontinued

operations reporting. The disposal group constitutes a compo-

nent under accounting guidance. The continuing cash inflows

and outflows with the discontinued component are related to the

manufacturing sourcing arrangement and the transition, packag-

ing and test services. These cash flows are not direct cash flows

as they are not significant and the company will have no significant

continuing involvement.

Each acquisition further complemented and enhanced the com-

pany’s portfolio of product and services offerings. Green Hat helps

customers improve the quality of software applications by enabling

developers to use cloud computing technologies to conduct test-

ing of a software application prior to its delivery. Emptoris expands

the company’s cloud-based analytics offerings that provide supply

chain intelligence leading to better inventory management and

cost efficiencies. Worklight delivers mobile application manage-

ment capabilities to clients across a wide range of industries. The

acquisition enhanced the company’s comprehensive mobile port-

folio, which is designed to help global corporations leverage the

proliferation of all mobile devices—from laptops and smartphones

to tablets. DemandTec delivers cloud-based analytics software to

help organizations improve their price, promotion and product mix

within the broad context of enterprise commerce. Varicent’s soft-

ware automates and analyzes data across sales, finance, human

resources and IT departments to uncover trends and optimize

sales performance and operations. Vivisimo software automates

the discovery of big data, regardless of its format or where it

resides, providing decision makers with a view of key business

information necessary to drive new initiatives. Tealeaf provides a

full suite of customer experience management software, which

analyzes interactions on websites and mobile devices. Butterfly

offers storage planning software and storage migration tools, help-

ing companies save storage space, operational time, IT budget

and power consumption. Platform Computing’s focused technical

and distributed computing management software helps clients

create, integrate and manage shared computing environments

that are used in compute-and-data intensive applications such as

simulations, computer modeling and analytics. TMS designs and

sells high-performance solid state storage solutions.

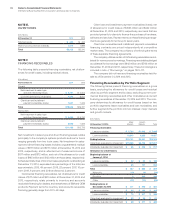

For the “Other Acquisitions,” the overall weighted-average

life of the identified amortizable intangible assets acquired is

6.6years. These identified intangible assets will be amortized on

a straight-line basis over their useful lives. Goodwill of $1,880 mil-

lion was assigned to the Software ($1,412 million), Global Business

Services (GBS) ($5 million), GTS ($21 million) and STG ($443 mil-

lion) segments. As of the acquisition dates, it was expected that

approximately 15percent of the goodwill would be deductible for

tax purposes.

Divestitures

2014

Microelectronics—On October20, 2014, IBM and GLOBAL-

FOUNDRIES announced a definitive agreement in which

GLOBALFOUNDRIES will acquire the company’s Microelectronics

business, including existing semiconductor manufacturing assets

and operations in East Fishkill, New York and Essex Junction,

Vermont. The commercial OEM business to be acquired by GLO-

BALFOUNDRIES includes custom logic and specialty foundry,

manufacturing and related operations.