IBM 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 Management Discussion

International Business Machines Corporation and Subsidiary Companies

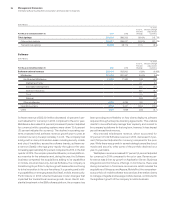

($ in millions except per share amounts)

For the year ended December 31, 2013: GAAP

Acquisition-

Related

Adjustments

Retirement-

Related

Adjustments

Operating

(non-GAAP)

Gross profit $48,684 $ 394 $ 629 $49,706

Gross profit margin 49.5% 0.4 pts. 0.6 pts. 50.5%

SG&A $23,451 $(394) $ (376 ) $22,680

RD&E 5,743 — (57) 5,686

Other (income) and expense (333) (16) — (349)

Total expense and other (income) 28,440 (410) (433) 27,597

Pre-tax income from continuing operations 20,244 804 1,062 22,110

Pre-tax margin from continuing operations 20.6% 0.8 pts. 1.1 pts. 22.5%

Provision for income taxes* $ 3,363 $ 57 $ 333 $ 3,753

Effective tax rate 16.6% (0.4) pts. 0.7 pts. 17.0%

Income from continuing operations $16,881 $ 747 $ 729 $18,356

Income margin from continuing operations 17.2% 0.8 pts. 0.7 pts. 18.7%

Loss from discontinued operations, net of tax $ (398) $ — $ — $ (398 )

Net income $16,483 $ 747 $ 729 $17,959

Diluted earnings per share:

Continuing operations $ 15.30 $0.68 $ 0.66 $ 16.64

Discontinued operations $ (0.36) $ — $ — $ (0.36 )

* The tax impact on operating (non-GAAP) pre-tax income is calculated under the same accounting principles applied to the GAAP pre-tax income which employs an annual

effective tax rate method to the results.

Consolidated Fourth-Quarter Results

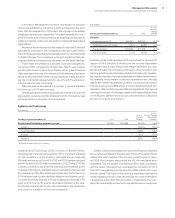

($ and shares in millions except per share amounts)

For the fourth quarter: 2014 2013

Yr.-to-Yr.

Percent/

Margin

Change

Revenue $24,113 $ 27,385 (11.9)%*

Gross profit margin 53.3% 52.4% 1.0 pts.

Total expense and other (income) $ 5,767 $ 7,235 (20.3)%

Total expense and other

(income)-to-revenue ratio 23.9% 26.4% (2.5) pts.

Income from continuing operations

before income taxes $ 7,094 $ 7,102 (0.1)%

Provision for income taxes from

continuing operations $ 1,580 $ 885 78.4%

Income from continuing operations $ 5,515 $ 6,216 (11.3)%

Income from continuing

operations margin 22.9% 22.7% 0.2 pts.

Loss from discontinued operations,

net of tax (31) (32) (1.7)%

Net income $ 5,484 $ 6,185 (11.3)%

Earnings per share from continuing

operations:

Assuming dilution $ 5.54 $ 5.76 (3.8)%

Consolidated earnings per share—

assuming dilution $ 5.51 $ 5.73 (3.8)%

Weighted-average shares outstanding

Assuming dilution 995.4 1,080.0 (7.8)%

* (7.6)percent adjusted for currency; (2.3) percent adjusted for divestitures and currency.

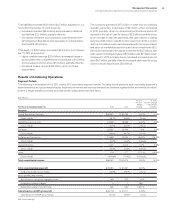

The following table provides the company’s operating (non-GAAP)

earnings for the fourth quarter of 2014 and 2013.

($ in millions except per share amounts)

For the fourth quarter: 2014 2013

Yr.-to-Yr.

Percent

Change

Net income as reported $5,484 $6,185 (11.3)%

Loss from discontinued operations,

net of tax (31) (32)(1.7)

Income from continuing operations 5,515 6,216 (11.3)

Non-operating adjustments

(net of tax):

Acquisition-related charges 186 268 (30.5)

Non-operating retirement-related

costs/(income) 84 164 (49.1)

Operating (non-GAAP) earnings* $5,785 $ 6,649 (13.0)%

Diluted operating (non-GAAP)

earnings per share $ 5.81 $ 6.16 (5.7)%

* See page 52 for a more detailed reconciliation of net income to operating earning.

Snapshot

In the fourth quarter of 2014, the company reported $24.1 billion

in revenue and delivered diluted earnings per share from continu-

ing operations of $5.54 as reported and $5.81 on an operating

(non-GAAP) basis. The results of continuing operations exclude a

net loss from discontinued operations of $31 million related to the

announced divestiture of the Microelectronics business. On a con-

solidated basis, net income in the fourth quarter was $5.5 billion,