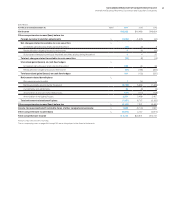

IBM 2014 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

86

NOTE A.

SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying Consolidated Financial Statements and

footnotes of the International Business Machines Corporation

(IBM or the company) have been prepared in accordance with

accounting principles generally accepted in the United States of

America (GAAP).

Within the financial statements and tables presented, cer-

tain columns and rows may not add due to the use of rounded

numbers for disclosure purposes. Percentages presented are cal-

culated from the underlying whole-dollar amounts. Certain prior

year amounts have been reclassified to conform to the current year

presentation. This is annotated where applicable.

On October20, 2014, the company announced a definitive

agreement to divest its Microelectronics business and manufactur

-

ing operations to GLOBALFOUNDRIES. The assets and liabilities

of the Microelectronics business are reported as held for sale at

December31, 2014. The operating results of the Microelectronics

business have been reported as discontinued operations. Prior

periods have been reclassified to conform to this presentation to

allow for a meaningful comparison of continuing operations. Refer

to noteC, “Acquisitions/Divestitures,” for additional information on

the transaction.

Noncontrolling interest amounts of $6 million, $7 million and $11

million, net of tax, for the years ended December31, 2014, 2013 and

2012, respectively, are included in the Consolidated Statement of

Earnings within the other (income) and expense line item.

Principles of Consolidation

The Consolidated Financial Statements include the accounts of

IBM and its controlled subsidiaries, which are primarily majority

owned. Any noncontrolling interest in the equity of a subsidiary

is reported in Equity in the Consolidated Statement of Financial

Position. Net income and losses attributable to the noncontrol-

ling interest is reported as described above in the Consolidated

Statement of Earnings. The accounts of variable interest entities

(VIEs) are included in the Consolidated Financial Statements, if

required. Investments in business entities in which the company

does not have control, but has the ability to exercise significant

influence over operating and financial policies, are accounted for

using the equity method and the company’s proportionate share

of income or loss is recorded in other (income) and expense. The

accounting policy for other investments in equity securities is on

page 95 within “Marketable Securities.” Equity investments in non-

publicly traded entities are primarily accounted for using the cost

method. All intercompany transactions and accounts have been

eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with GAAP

requires management to make estimates and assumptions that

affect the amounts of assets, liabilities, revenue, costs, expenses

and other comprehensive income/(loss) (OCI) that are reported

in the Consolidated Financial Statements and accompanying

disclosures. These estimates are based on management’s best

knowledge of current events, historical experience, actions that

the company may undertake in the future and on various other

assumptions that are believed to be reasonable under the circum

-

stances. As a result, actual results may be different from these

estimates. See “Critical Accounting Estimates” on pages 68 to 71

for a discussion of the company’s critical accounting estimates.

Revenue

The company recognizes revenue when it is realized or realizable

and earned. The company considers revenue realized or realizable

and earned when it has persuasive evidence of an arrangement,

delivery has occurred, the sales price is fixed or determinable and

collectibility is reasonably assured. Delivery does not occur until

products have been shipped or services have been provided to

the client, risk of loss has transferred to the client, and either client

acceptance has been obtained, client acceptance provisions have

lapsed, or the company has objective evidence that the criteria

specified in the client acceptance provisions have been satisfied.

The sales price is not considered to be fixed or determinable until

all contingencies related to the sale have been resolved.

The company recognizes revenue on sales to solution pro-

viders, resellers and distributors (herein referred to as “resellers”)

when the reseller has: economic substance apart from the com-

pany, credit risk, title and risk of loss to the inventory; and, the fee to

the company is not contingent upon resale or payment by the end

user, the company has no further obligations related to bringing

about resale or delivery and all other revenue recognition criteria

have been met.

The company reduces revenue for estimated client returns,

stock rotation, price protection, rebates and other similar allow

-

ances. (See Schedule II, “Valuation and Qualifying Accounts and

Reserves” included in the company’s Annual Report on Form

10-K). Revenue is recognized only if these estimates can be rea-

sonably and reliably determined. The company bases its estimates

on historical results taking into consideration the type of client,

the type of transaction and the specifics of each arrangement.

Payments made under cooperative marketing programs are rec-

ognized as an expense only if the company receives from the client

an identifiable benefit sufficiently separable from the product sale

whose fair value can be reasonably and reliably estimated. If the

company does not receive an identifiable benefit sufficiently sepa-

rable from the product sale whose fair value can be reasonably

estimated, such payments are recorded as a reduction of revenue.

Revenue from sales of third-party vendor products or services

is recorded net of costs when the company is acting as an agent

between the client and the vendor, and gross when the company