IBM 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Actual shares outstanding at December31, 2014 and 2013 were

990.5 million and 1,054.4 million, respectively. The average number

of common shares outstanding assuming dilution was 93.0 million

shares lower in 2014 versus 2013. The decrease was primarily the

result of the common stock repurchase program.

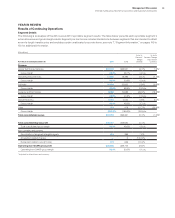

Results of Discontinued Operations

The loss from discontinued operations, net of tax, was $3.7 bil-

lion in 2014 and $0.4 billion in 2013. The loss in 2014 included a

non-recurring pre-tax charge of $4.7 billion, or $3.4 billion, net of

tax. The charge included an impairment to reflect the fair value

less estimated costs to sell the Microelectronics business, which

the company initially reported as held for sale at September30,

2014. The charge also included other estimated costs related

to the transaction, including cash consideration expected to be

transferred of approximately $1.5 billion. The cash consideration is

expected to be paid over the next three years and will be adjusted

down by the amount of the working capital due from GLOBAL-

FOUNDRIES, estimated to be $0.2 billion. In addition, discontinued

operations includes the operational net losses from the Microelec-

tronics business of $0.3 billion in 2014 and $0.4 billion in 2013. The

discontinued operations effective tax rate in 2014 was 30.2per-

cent compared to 44.8percent in 2013. The year-to-year decrease

in the rate was driven primarily by a one-time tax charge of $428

million in the third quarter of 2014 in connection with the disposal.

See noteC, “Acquisitions/Divestitures,” on pages 100 and 101

for additional information regarding the divestiture transaction.

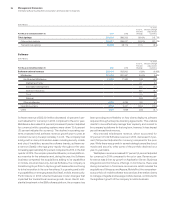

Financial Position

Dynamics

At December31, 2014, the company continued to have the finan-

cial flexibility to support the business over the long term. Cash and

marketable securities at year end were $8,476 million. During the

year, the company continued to manage the investment portfolio

to meet its capital preservation and liquidity objectives.

Total debt of $40,804 million increased $1,087 million from

prior year-end levels. The commercial paper balance at Decem-

ber31, 2014, was $650 million, a decrease of $1,808 million from

the prior year end. Within total debt, $29,103 million is in support

of the Global Financing business which is leveraged at a 7.2 to 1

ratio. The company continues to have substantial flexibility in the

market. During 2014, the company completed bond issuances

totaling $6,852 million, with terms ranging from 2 to 10years, and

interest rates ranging from 0.30 to 3.63percent depending on

maturity. The company has consistently generated strong cash

flow from operations and continues to have access to additional

sources of liquidity through the capital markets and its $10 billion

global credit facility, with 100percent of the facility available on a

same day basis.

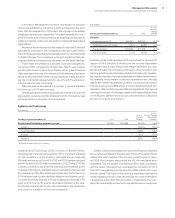

Consistent with accounting standards, the company remea-

sures the funded status of its retirement and postretirement plans

at December31. At December31, 2014, the overall net under-

funded position was $16,932 million, an increase of $5,498 million

from December31, 2013 driven by a decrease in discount rates

and changes in U.S. mortality rate assumptions, partially offset

by strong asset returns worldwide. At year end, the company’s

qualified defined benefit plans were well funded and the cash

requirements related to these plans remain stable going forward

at approximately $600 million per year through 2019. In 2014, the

return on the U.S. Personal Pension Plan assets was 10.1percent

and the plan was 102percent funded at December 31. Overall,

global asset returns were 12.2percent and the qualified defined

benefit plans worldwide were 97percent funded at December 31.

During 2014, the company generated $16,868 million in cash

from operations, a decrease of $616 million compared to 2013. In

addition, the company generated $12,372 million in free cash flow,

a decrease of $2,649 million versus the prior year. See pages 66

to 67 for additional information on free cash flow. The company

returned $17,944 million to shareholders in 2014, with $13,679 mil-

lion in gross share repurchases and $4,265 million in dividends. In

2014, the company repurchased approximately 71.5 million shares

and had approximately $6.3 billion remaining in share repurchase

authorization at year end. The company’s cash generation permits

the company to invest and deploy capital to areas with the most

attractive long-term opportunities.

The assets and debt associated with the Global Financing

business are a significant part of the company’s financial posi-

tion. The financial position amounts appearing on page 82 are the

consolidated amounts including Global Financing. The amounts

appearing in the separate Global Financing section, beginning on

page 73, are supplementary data presented to facilitate an under-

standing of the Global Financing business.

Working Capital

($ in millions)

At December 31: 2014 2013

Current assets $49,422 $51,350

Current liabilities 39,600 40,154

Working capital $ 9,822 $11,196

Current ratio 1.25:1 1.28:1

Working capital decreased $1,374 million from the year-end 2013

position. The key changes are described below:

Current assets decreased $1,928 million (an increase of $1,119

million adjusted for currency), as a result of:

• A decrease of $2,589 million in cash and cash equivalents

and marketable securities; and

• A decline of $1,375 million ($734 million adjusted for currency)

in trade receivables primarily due to the decline in revenue

and improved customer collections; partially offset by