IBM 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.64 Management Discussion

International Business Machines Corporation and Subsidiary Companies

OTHER INFORMATION

Looking Forward

The company measures the success of its business model over

the long term, not any individual quarter or year. The company’s

strategies, investments and actions are all taken with an objective of

optimizing long-term performance. A long-term perspective ensures

that the company is well-positioned to take advantage of major

shifts occurring in technology, business and the global economy.

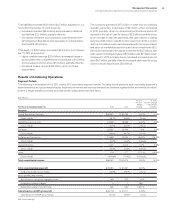

Within the IT industry, there are major shifts occurring—driven

by data, cloud and changes in the ways individuals and enterprises

are engaging. In 2014, the company had strong performance in

its strategic imperatives that are focused on these market shifts.

Revenue from the company’s cloud, analytics, mobile, social and

security solutions together increased 16percent compared to

2013, including the impacts of currency and the divested indus-

try standard server business. In total, the strategic imperatives

generated $25 billion in revenue, approximately 27percent of

total consolidated revenue, including software content that rep-

resented a higher percentage than the overall company. As a

result, the strategic imperatives deliver gross profit margins that

are better than the consolidated gross profit margin on average.

In 2014, the company continued to take significant actions to drive

the shift towards its strategic imperatives with targeted invest-

ments, as well as moving away from areas that do not support the

strategic profile.

The company’s strategic direction is clear and compelling, and

the company has been successful in shifting to the higher value

areas of enterprise IT. The strong revenue growth in the strategic

imperatives confirms that, as does the overall profitability of the

business. The company expects the industry to continue to shift.

The company expects revenue from its strategic imperatives to

continue to grow at a double-digit rate. These offerings are as high

value as other parts of the business, which continue to manage cli-

ents’ most critical business processes. As the cloud business gets

to scale, and with ongoing productivity improvements across the

business, the company expects to have an opportunity to expand

margin. In addition, the company expects to continue to allocate

its capital efficiently and effectively to investments, and to return

value to its shareholders through a combination of dividends and

share repurchases. Over the longer term, in considering the oppor-

tunities it will continue to develop, the company expects to have

the ability to generate low single-digit revenue growth, and with a

higher value business mix, high single-digit operating (non-GAAP)

earnings per share growth, with free cash flow realization in the

90’spercent range. This is a longer term growth trajectory, not an

absolute end point or a multi-year objective.

In the near term, there are a few dynamics that are incon-

sistent with that longer term trajectory. Specifically, in 2015, the

company will be managing certain transitions in the business. As

an example, while it is fully participating in the shift to cloud, the

margins in that business are impacted by the level of investment

the company is making, and the fact that the business is not yet

at scale. The company expects an improvement in margin in 2015

as the business ramps, but, it will not yet be at scale. In addition,

the company expects a continued impact to its software transac-

tion revenue growth, as customers continue to utilize the flexibility

that the company has provided to them, as they commit to the

company’s platform for the longer term. There are also cyclical

considerations. Given the geographic breadth of the business, the

company has seen challenges in some of its markets—notably

many of the growth markets. The company continues to believe

that these are important markets over time, and it continues to

invest to capture these opportunities. However, the company is

not expecting a robust demand environment in many geographies

in 2015. The company also expects a continued impact from cur-

rency in 2015. At January 2015 spot rates, the impact to revenue

growth is expected to be 5–6points, but, as with all companies

with a similar global business profile, with the dollar strengthen-

ing, the company also expects that currency will have a significant

translation impact on its profit growth. The company also expects

some cyclical benefits in 2015, including the new mainframe

product cycle and a full year of POWER8 availability.

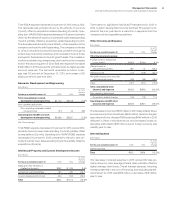

Overall, looking forward to 2015, the company expects to con-

tinue to grow in many areas of the business. It expects to deliver

strong growth in the strategic imperatives and margin expansion,

while continuing a high level of investment and hiring, shifting

to areas that have the best opportunity. However, in the current

currency environment, and considering the impact from the

completed divestitures, total revenue as reported is not expected

to grow in 2015. The company expects to have less workforce

rebalancing charges in 2015 versus 2014, and while it may have

certain gains, it does not expect to replicate the $1.8 billion of gains

recorded in 2014, resulting in a net impact to profit growth. Overall,

the company expects GAAP earnings per share from continuing

operations for 2015 to be in the range of $14.35 to $15.10, and oper-

ating (non-GAAP) earnings per share to be in the range of $15.75

to $16.50. For the first quarter of 2015, the company expects mid

single-digit earnings per share growth from continuing operations

compared to the first quarter of 2014, primarily driven by the large

workforce rebalancing charge that was taken in the prior year.

Overall, and most importantly, the company expects to exit 2015

with a higher-value, higher-margin business.

Within the company’s earnings per share expectation for

2015, the company is expecting a 2–3 point benefit from share

repurchases—less than the impact in 2014. The company enters

2015 with approximately $6.3 billion of repurchase authorization

remaining, and the company is assuming it will utilize the majority

of the remaining authorization in 2015. The timing of repurchases

will determine the final impact to earnings per share in 2015.

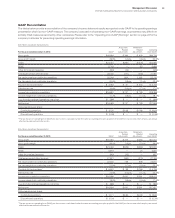

From a segment perspective, the company expects that the

launch of the new mainframe, along with the success in POWER8

that the company experienced in the fourth quarter of 2014, will

generate momentum in 2015. As a result, excluding the impact

of divestitures, the company expects Systems and Technol-

ogy to deliver revenue growth in the mid-single digits in 2015.

Within Global Services, the company has not assumed a revenue