IBM 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

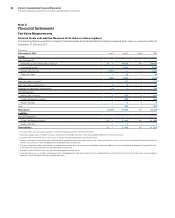

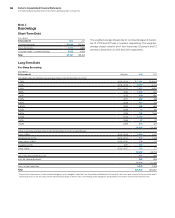

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

97

The following tables provide a quantitative summary of the derivative and non-derivative instrument related risk management activity as of

December 31, 2012 and 2011 as well as for the years ended December 31, 2012, 2011 and 2010, respectively.

Fair Values of Derivative Instruments in the Consolidated Statement of Financial Position

($ in millions)

Fair Value of Derivative Assets Fair Value of Derivative Liabilities

At December 31:

Balance

Sheet

Classification 2012 2011

Balance

Sheet

Classification 2012 2011

Designated as hedging instruments

Interest rate contracts

Prepaid expenses

and other

current assets $ 47 $ 50

Other accrued

expenses

and liabilities $ — $ —

Investments and

sundry assets 557 733 Other liabilities ——

Foreign exchange contracts

Prepaid expenses

and other

current assets 135 407

Other accrued

expenses

and liabilities 267 273

Investments and

sundry assets 5—

Other

liabilities 78 155

Fair value of

derivative assets $744 $1,190

Fair value of

derivative liabilities $ 345 $ 428

Not designated as hedging instruments

Foreign exchange contracts

Prepaid expenses

and other

current assets $142 $ 82

Other accrued

expenses

and liabilities $ 152 $ 84

Investments and

sundry assets 23 21

Other

liabilities —11

Equity contracts

Prepaid expenses

and other

current assets 97

Other accrued

expenses

and liabilities 78

Fair value of

derivative assets $174 $ 110

Fair value of

derivative liabilities $ 159 $ 103

Total debt designated as hedging instruments

Short-term debt N/A N/A $ 578 $ —

Long-term debt N/A N/A 3,035 1,884

To t a l $918 $1,300 $4,116 $2,415

N/A—Not applicable