IBM 2012 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

130 Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

130

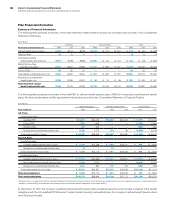

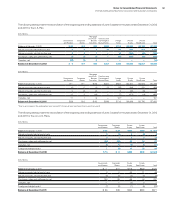

The following table presents the company’s defined benefit pension plans’ asset classes and their associated fair value at December 31, 2011.

The U.S. Plan consists of the Qualified PPP and the Non-U.S. Plans consist of all plans sponsored by the company’s subsidiaries.

($ in millions)

U.S. Plan Non-U.S. Plans

Level 1 Level 2 Level 3 To t a l Level 1 Level 2 Level 3 To t a l

Equity

Equity securities (a) $13,618 $ 11 $ — $13,629 $6,426 $ — $ — $ 6,427

Equity commingled/mutual funds (b)(c) 32 1,877 — 1,909 240 7,751 — 7,991

Fixed income

Government and related (d) — 15,105 29 15,134 — 8,479 96 8,575

Corporate bonds (e) — 7,387 12 7,398 — 1,409 39 1,447

Mortgage and asset-backed securities — 838 45 883 — 36 — 36

Fixed income commingled/mutual funds (b)(f) 262 715 246 1,223 72 7,136 — 7,209

Insurance contracts — — — — — 988 — 988

Cash and short-term investments (g) 286 2,390 — 2,675 145 361 — 506

Hedge funds — 1,140 713 1,853 — 417 — 417

Private equity (h) 0 — 4,098 4,098 — — 262 262

Private real estate (h) — — 2,790 2,790 — — 580 580

Derivatives (i) 10 (15)— (6)(2) 866 — 864

Other commingled/mutual funds (b)(j) — — — — 9 114 — 123

Subtotal 14,207 29,446 7,932 51,586 6,890 27,557 977 35,425

Other (k) — — — (368) — — — (62)

Fair value of plan assets $14,207 $29,446 $7,932 $51,218 $6,890 $27,557 $977 $35,362

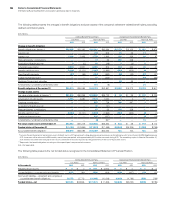

(a) Represents U.S. and international securities. The U.S. Plan includes IBM common stock of $132 million, representing 0.3 percent of the U.S. Plan assets. Non-U.S. Plans include

IBM common stock of $35 million, representing 0.1 percent of the non-U.S. Plans assets.

(b) Commingled funds represent pooled institutional investments.

(c) Invests in predominantly equity securities.

(d) Includes debt issued by national, state and local governments and agencies.

(e) The U.S. Plan includes IBM corporate bonds of $13 million, representing 0.03 percent of the U.S. Plan assets.

(f) Invests in predominantly fixed income securities.

(g) Includes cash and cash equivalents and short-term marketable securities.

(h) Includes limited partnerships and venture capital partnerships.

(i) Primarily includes interest rate derivatives and, to a lesser extent, forwards, exchange traded and other over-the-counter derivatives.

(j) Invests in both equity and fixed income securities.

(k) Represents net unsettled transactions, relating primarily to purchases and sales of plan assets.

The U.S. nonpension postretirement benefit plan assets of $38 million were invested in cash, categorized as Level 1 in the fair value hierarchy.

The non-U.S. nonpension postretirement benefit plan assets of $112 million, primarily in Brazil, and, to a lesser extent, in Mexico and South

Africa, were invested primarily in government and related fixed income securities and corporate bonds, categorized as Level 2 in the fair

value hierarchy.