IBM 2012 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2020 Management Discussion

International Business Machines Corporation and Subsidiary Companies

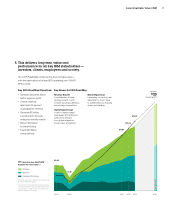

including Risk Management, Price and Promotion Optimization and

Sales Performance Management. The value proposition in busi-

ness analytics uniquely leverages the integration between the

software portfolio and the Global Business Services (GBS) con-

sulting expertise. In 2012, business analytics revenue increased 13

percent compared to the prior year, led by the GBS consulting prac-

tice. Within cloud computing, the company’s SmartCloud portfolio

addresses the full scope of enterprise client requirements. In 2012,

the company continued to see strong demand for the foundational

offerings in hardware and software that help clients build and run

their private clouds, as well as for cloud-based solutions, like the

company’s Software as a Service (SaaS) offerings. With strong

global growth, cloud revenue for 2012 increased 80 percent com-

pared to the prior year. The Smarter Planet growth initiative expanded

significantly in the past year—measured in terms of offerings, mar-

kets, clients and revenue performance. Clients are leveraging the

company’s growing capabilities in areas like: Smarter Commerce,

Social Business and Smarter Cities, and in next generation systems,

like Watson, which are helping clients with their complex challenges.

For the year, Smarter Planet solutions generated revenue growth of

over 25 percent versus the prior year. Overall, within the offerings in

business analytics, cloud and Smarter Planet, approximately half of

the revenue is software. Therefore, as these offerings become a

larger percentage of total revenue, they are driving the higher quality

revenue stream and improved mix and margins.

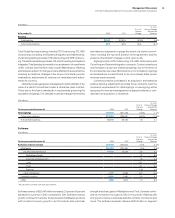

The consolidated gross profit margin increased 1.2 points

versus 2011 to 48.1 percent. This was the ninth consecutive year of

improvement in the gross profit margin. The operating (non-GAAP)

gross margin of 48.7 percent increased 1.5 points compared to the

prior year. The increase in gross margin in 2012 was driven by margin

improvements in Software and both Global Services segments, and

an improved revenue mix driven by Software.

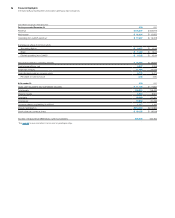

Total expense and other income decreased 2.5 percent in 2012

versus the prior year. Total operating (non-GAAP) expense and other

income decreased 3.9 percent compared to the prior year. The year-

to-year drivers were approximately:

Total Operating

Consolidated (non-GAAP)

• Currency* (5) points (5) points

• Acquisitions** 3 points 2 points

• Base expense (0) points (2) points

* Reflects impacts of translation and hedging programs.

** Includes acquisitions completed in prior 12-month period.

Pre-tax income grew 4.3 percent and the pre-tax margin was

21.0 percent, an increase of 1.3 points versus 2011. Net income

increased 4.7 percent and the net income margin was 15.9 percent,

an increase of 1.1 points versus 2011. The effective tax rate for 2012

was 24.2 percent compared with 24.5 percent in the prior year.

Operating (non-GAAP) pre-tax income grew 7.3 percent and the

operating (non-GAAP) pre-tax margin was 22.2 percent, an increase

of 2.0 points versus the prior year. Operating (non-GAAP) net income

increased 8.0 percent and the operating (non-GAAP) net income

margin of 16.9 percent increased 1.6 points versus the prior year.

The operating (non-GAAP) effective tax rate was 24.0 percent

versus 24.5 percent in 2011.

Diluted earnings per share improved 10.0 percent year to year

reflecting the growth in net income and the benefits of the common

stock repurchase program. In 2012, the company repurchased

approximately 61 million shares of its common stock. Diluted earn-

ings per share of $14.37 increased $1.31 from the prior year. Operating

(non-GAAP) diluted earnings per share of $15.25 increased $1.81

versus 2011 driven by the following factors:

• Revenue decrease at actual rates $ (0.30)

• Margin expansion $ 1.38

• Common stock repurchases $ 0.73

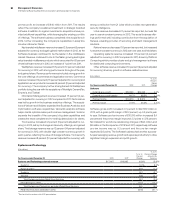

At December 31, 2012, the company’s balance sheet and liquidity

positions remained strong and were well positioned to support the

company’s objectives. Cash and marketable securities at year end

was $11,128 million. Key drivers in the balance sheet and total cash

flows are highlighted below.

Total assets increased $2,780 million ($3,242 million adjusted for

currency) from December 31, 2011 driven by:

• Increases in total receivables ($3,053 million), goodwill

($3,034 million), marketable securities ($717 million) and

intangible assets ($395 million), partially offset by

• Decreases in prepaid pension assets ($1,899 million), cash

and cash equivalents ($1,511 million) and prepaid expenses

and other current assets ($1,224 million).

Total liabilities increased $4,032 million ($4,511 million adjusted for

currency) from December 31, 2011 driven by:

• Increased retirement and nonpension postretirement benefit

obligations ($2,044 million), total debt ($1,949 million),

taxes ($1,635 million) and total deferred income ($399 million),

partially offset by

• Decreases in other liabilities ($1,389 million) and accounts

payable ($565 million).

Total equity of $18,984 million decreased $1,252 million from

December 31, 2011 as a result of:

•

Increased treasury stock ($12,168 million) driven by share repur-

chases and increased losses in accumulated other comprehensive

income/(loss) of ($3,874 million) driven by pension remeasurements,

partially offset by

•

Higher retained earnings ($12,783 million) and common stock

($1,980 million).

The company generated $19,586 million in cash flow provided by

operating activities, a decrease of $260 million when compared to

2011, primarily driven by a decrease in cash due to receivables

($1,290 million) and an increased use of cash for accounts payable

($675 million), partially offset by a decrease in net taxes paid ($999

million) and the increase in net income ($749 million). Net cash used

in investing activities of $9,004 million was $4,608 million higher than

2011, primarily due to an increase in cash used of $2,719 million

associated with net purchases and sales of marketable securities