IBM 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146

|

|

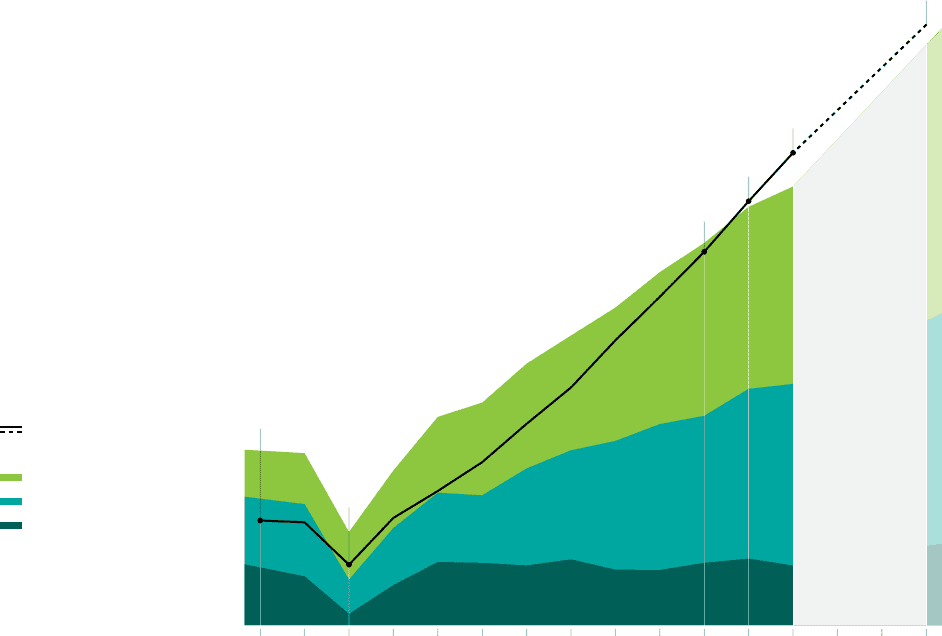

Our 2015 Road Map continues the drive to higher value—

with the expectation of at least $20 operating (non-GAAP)

EPS in 2015.

5. This delivers long-term value and

performance for all key IBM stakeholders —

investors, clients, employees and society.

* Excludes acquisition-related and nonoperating

retirement-related charges.

** 2000 and 2001 exclude Enterprise Investments

and not restated for stock-based compensation.

Sum of external segment pre-tax income not

equal to IBM pre-tax income.

• Software becomes about

half of segment profit

• Growth markets

approach 30 percent

of geographic revenue

• Generate $8 billion

in productivity through

enterprise transformation

• Return $70 billion

to shareholders

• Invest $20 billion

in acquisitions

2000 2002 2010 2011 2012 2015

$13.44

$15.25

$11.67

$3.32

$1.81

Services

Software

Hardware / Financing

Operating (non-GAAP) EPS*

Segment Pre-tax Income*, **

$

20

At Least

Operating EPS*

Revenue Growth

A combination of base

revenue growth, a shift

to faster growing businesses

and strategic acquisitions.

Share Repurchase

Leveraging our strong cash

generation to return value

to shareholders by reducing

shares outstanding.

Operating Leverage

A shift to higher-margin

businesses and enterprise

productivity derived

from global integration

and process efficiencies.

Key Drivers for 2015 Road MapKey 2015 Road Map Objectives:

11

Generating Higher Value at IBM