IBM 2012 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

117

Note R.

Stock-Based Compensation

Stock-based compensation cost is measured at grant date, based

on the fair value of the award, and is recognized over the employee

requisite service period. See note A, “Significant Accounting Policies,”

on page 82 for additional information.

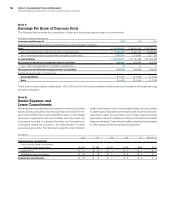

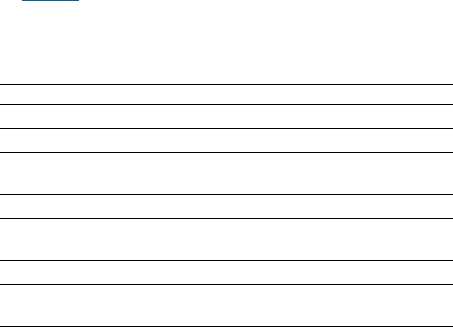

The following table presents total stock-based compensation

cost included in the Consolidated Statement of Earnings.

($ in millions)

For the year ended December 31: 2012 2011 2010

Cost $ 132 $ 120 $ 94

Selling, general and administrative 498 514 488

Research, development

and engineering 59 62 48

Other (income) and expense (1) — (1)

Pre-tax stock-based

compensation cost 688 697 629

Income tax benefits (240) (246)(240)

Total stock-based

compensation cost $ 448 $ 450 $ 389

Total unrecognized compensation cost related to non-vested

awards at December 31, 2012 and 2011 was $1,101 million and $1,169

million, respectively, and is expected to be recognized over a

weighted-average period of approximately three years.

There was no significant capitalized stock-based compensation

cost at December 31, 2012, 2011 and 2010.

Incentive Awards

Stock-based incentive awards are provided to employees under

the terms of the company’s long-term performance plans (the

“Plans”). The Plans are administered by the Executive Compen-

sation and Management Resources Com mittee of the Board of

Directors (the “Committee”). Awards available under the Plans prin-

cipally include stock options, restricted stock units, performance

share units or any combination thereof.

The amount of shares originally authorized to be issued under

the company’s existing Plans was 274.1 million at December 31, 2012.

In addition, certain incentive awards granted under previous plans,

if and when those awards were canceled, could be reissued under

the company’s existing Plans. As such, 66.2 million additional

awards were considered authorized to be issued under the com-

pany’s existing Plans as of December 31, 2012. There were 121.2

million unused shares available to be granted under the Plans as

of December 31, 2012.

Under the company’s long-standing practices and policies, all

awards are approved prior to or on the date of grant. The awards

approval process specifies the individual receiving the grant, the

number of options or the value of the award, the exercise price or

formula for determining the exercise price and the date of grant. All

awards for senior management are approved by the Committee. All

awards for employees other than senior management are approved

by senior management pursuant to a series of delegations that were

approved by the Committee, and the grants made pursuant to these

delegations are reviewed periodically with the Committee. Awards

that are given as part of annual total compensation for senior man-

agement and other employees are made on specific cycle dates

scheduled in advance. With respect to awards given in connection

with promotions or new hires, the company’s policy requires approval

of such awards prior to the grant date, which is typically the date of

the promotion or the date of hire.

Stock Options

Stock options are awards which allow the employee to purchase

shares of the company’s stock at a fixed price. Stock options are

granted at an exercise price equal to the company’s average high

and low stock price on the date of grant. These awards, which

generally vest 25 percent per year, are fully vested four years from

the date of grant and have a contractual term of 10 years.

The company estimates the fair value of stock options at the date

of grant using the Black-Scholes valuation model. Key inputs and

assumptions used to estimate the fair value of stock options include

the grant price of the award, the expected option term, volatility of

the company’s stock, the risk-free rate and the company’s dividend

yield. Estimates of fair value are not intended to predict actual

future events or the value ultimately realized by employees who

receive equity awards, and subsequent events are not indicative

of the reasonableness of the original estimates of fair value made

by the company.

During the years ended December 31, 2012, 2011 and 2010, the

company did not grant stock options.