IBM 2012 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

124 Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

124

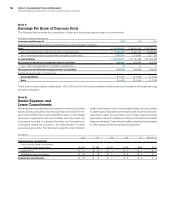

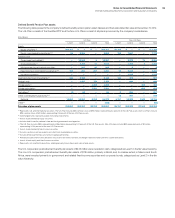

The following table presents the changes in benefit obligations and plan assets of the company’s retirement-related benefit plans, excluding

defined contribution plans.

($ in millions)

Defined Benefit Pension Plans Nonpension Postretirement Benefit Plans

U.S. Plans Non-U.S. Plans U.S. Plan Non-U.S. Plans

2012 2011 2012 2011 2012 2011 2012 2011

Change in benefit obligation

Benefit obligation at January 1 $54,085 $51,293 $ 42,861 $42,584 $ 5,273 $ 5,123 $ 901 $ 872

Service cost ——443 505 36 33 14 11

Interest cost 2,196 2,456 1,779 1,843 200 236 64 67

Plan participants’ contributions ——47 53 200 228 ——

Acquisitions/divestitures, net 0(0)26 (48)2(0)0(1)

Actuarial losses/(gains) 3,810 3,551 6,365 812 104 244 76 47

Benefits paid from trust (3,184) (3,121)(1,987) (1,995)(551) (623)(6) (7)

Direct benefit payments (97) (95)(454) (462)(35) (32)(27) (27)

Foreign exchange impact ——77 (423)——(24) (60)

Medicare/Government subsidies ————53 65 ——

Amendments/curtailments/settlements/other ——161 (8)——21 —

Benefit obligation at December 31 $56,810 $54,085 $ 49,319 $42,861 $ 5,282 $ 5,273 $1,019 $ 901

Change in plan assets

Fair value of plan assets at January 1 $51,218 $50,259 $ 35,362 $35,722 $ 38 $ 35 $ 112 $ 120

Actual return on plan assets 5,596 4,080 3,742 1,052 0010 13

Employer contributions ——557 728 746 397 10

Acquisitions/divestitures, net ——40 (27)———(0)

Plan participants’ contributions ——47 53 200 228 ——

Benefits paid from trust (3,184) (3,121)(1,987) (1,995)(551) (623)(6) (7)

Foreign exchange impact ——305 (537)——(8) (15)

Amendments/curtailments/settlements/other ——(8) 367* ——10 —

Fair value of plan assets at December 31 $53,630 $51,218 $ 38,058 $35,362 $ 433 $ 38 $ 119 $ 112

Funded status at December 31 $ (3,180) $ (2,866) $(11,261) $ (7,499) $(4,849) $(5,235)$ (900) $(789)

Accumulated benefit obligation** $56,810 $54,085 $ 48,369 $42,063 N/A N/A N/A N/A

*

Includes the reinstatement of certain plan assets in Brazil due to a 2011 government ruling allowing certain previously restricted plan assets to be returned to IBM. Beginning June

2011, the assets will be returned to IBM monthly over a three year period, with approximately $200 million returned during 2012. The remaining surplus in Brazil at December 31,

2012 remains excluded from total plan assets due to continued restrictions imposed by the government on the use of those plan assets.

** Represents the benefit obligation assuming no future participant compensation increases.

N/A—Not applicable

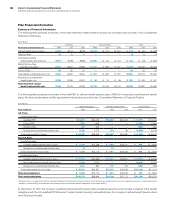

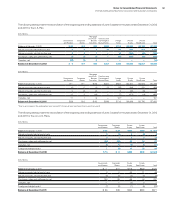

The following table presents the net funded status recognized in the Consolidated Statement of Financial Position.

($ in millions)

Defined Benefit Pension Plans Nonpension Postretirement Benefit Plans

U.S. Plans Non-U.S. Plans U.S. Plan Non-U.S. Plans

At December 31: 2012 2011 2012 2011 2012 2011 2012 2011

Prepaid pension assets $ 0 $ 0 $ 944 $ 2,843 $ 0 $ 0 $ 0 $ 0

Current liabilities—compensation and benefits (102) (96)(356) (304)(239) (437)(20) (22)

Noncurrent liabilities—retirement and nonpension

postretirement benefit obligations (3,078) (2,770) (11,849) (10,038)(4,610) (4,798)(880) (768)

Funded status—net $(3,180) $(2,866) $(11,261) $ (7,499)$(4,849) $(5,235)$(900) $(789)