IBM 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

90

2010

In 2010, the company completed 17 acquisitions at an aggregate

cost of $6,538 million.

Netezza Corporation (Netezza)—On November 10, 2010, the com-

pany completed the acquisition of 100 percent of Netezza, for cash

consideration of $1,847 million. Netezza expanded the company’s

business analytics initiatives to help clients gain faster insights into

their business information, with increased performance at a lower

cost of ownership. Netezza was integrated into the Software seg-

ment upon acquisition, and goodwill, as reflected in the table below,

was entirely assigned to the Software segment. As of the acquisition

date, it was expected that none of the goodwill would be deductible

for tax purposes. The overall weighted-average useful life of the

identified intangible assets acquired was 6.9 years.

Sterling Commerce—

On August 27, 2010, the company completed

the acquisition of 100 percent of Sterling Commerce, a wholly owned

subsidiary of AT&T, Inc., for cash consideration of $1,415 million.

Sterling Commerce expanded the company’s ability to help clients

accelerate their interactions with customers, partners and suppliers

through dynamic business networks using either on-premise or

cloud delivery models. Sterling Commerce was integrated into the

Software segment upon acquisition, and goodwill, as reflected in

the table below, was entirely assigned to the Software segment. As

of the acquisition date, it was expected that none of the goodwill

would be deductible for tax purposes. The overall weighted-average

useful life of the identified intangible assets acquired was 6.9 years.

Other Acquisitions—

The Software segment also completed acqui-

sitions of 10 privately held companies and one publicly held

company: in the first quarter, Lombardi Software, Inc. (Lombardi),

Intelliden Inc. and Initiate Systems, Inc. (Initiate); in the second quar-

ter, Cast Iron Systems; in the third quarter, BigFix, Inc., Coremetrics

and Datacap; and in the fourth quarter, Unica Corporation (Unica),

a publicly held company, PSS Systems, OpenPages, Inc. (Open-

Pages) and Clarity Systems. GTS completed an acquisition in the

first quarter: the core operating assets of Wilshire Credit Corporation

(Wilshire). GBS also completed an acquisition in the first quarter:

National Interest Security Company, LLC, a privately held company.

STG completed acquisitions of two privately held companies: in the

third quarter, Storwize; and in the fourth quarter, BLADE Network

Technologies (BLADE). All acquisitions were for 100 percent of the

acquired companies.

Lombardi is a leading provider of business process manage-

ment software and services, and became part of the company’s

application integration software portfolio. Intelliden Inc. is a leading

provider of intelligent network automation software and extended

the company’s network management offerings. Initiate is a market

leader in data integrity software for information sharing among

healthcare and government organizations. Cast Iron Systems, a

leading Software as a Service (SaaS) and cloud application integra-

tion provider, enhances the WebSphere business integration

portfolio. BigFix, Inc. is a leading provider of high-performance

enterprise systems and security management solutions that revo-

lutionizes the way IT organizations manage and secure their

computing infrastructure. Coremetrics, a leader in Web analytics

software, expanded the company’s business analytics capabilities

by enabling organizations to use cloud computing services to

develop faster, more targeted marketing campaigns. Datacap

strengthens the company’s ability to help organizations digitize,

manage and automate their information assets.

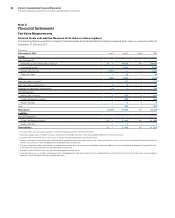

2010 Acquisitions

($ in millions)

Amortization

Life (in Years) Netezza

Sterling

Commerce

Other

Acquisitions

Current assets $ 218 $ 196 $ 377

Fixed assets/noncurrent assets 73 106 209

Intangible assets

Goodwill N/A 1,410 1,032 2,312

Completed technology 3 to 7 202 218 497

Client relationships 2 to 7 52 244 293

In-process R&D N/A 4 — 13

Patents/trademarks 1 to 7 16 14 27

Total assets acquired 1,975 1,810 3,728

Current liabilities (9) (129) (161)

Noncurrent liabilities (120) (266) (291)

Total liabilities assumed (128) (395) (452)

Total purchase price $1,847 $1,415 $3,277

N/A—Not applicable