IBM 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

131

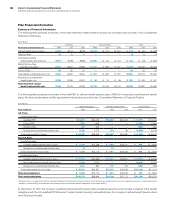

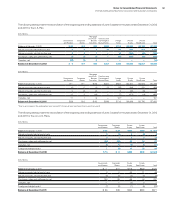

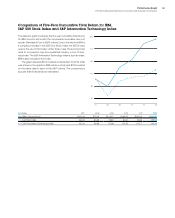

The following tables present the reconciliation of the beginning and ending balances of Level 3 assets for the years ended December 31, 2012

and 2011 for the U.S. Plan.

($ in millions)

Government

and Related

Corporate

Bonds

Mortgage

and Asset-

Backed

Securities

Fixed Income

Commingled/

Mutual Funds

Hedge

Funds

Private

Equity

Private

Real Estate To ta l

Balance at January 1, 2012 $ 29 $12 $45 $246 $713 $4,098 $2,790 $7,932

Return on assets held at end of year 0 0 1 21 56 855 202 1,135

Return on assets sold during the year 0 2 1 — 14 (334) (41) (359)

Purchases, sales and settlements, net (1) (2) (9) — (26) (533) (90) (660)

Transfers, net (22) (1) 8 — — — — (15)

Balance at December 31, 2012 $ 6 $11 $45 $267 $756 $4,085 $2,861 $8,032

($ in millions)

Government

and Related

Corporate

Bonds

Mortgage

and Asset-

Backed

Securities

Fixed Income

Commingled/

Mutual Funds

Hedge

Funds

Private

Equity

Private

Real Estate To ta l

Balance at January 1, 2011 $ — $ — $ 56 $221 $624 $4,251 $2,634 $7,786

Return on assets held at end of year (0) 0 (1) 25 (35) 348 131 468

Return on assets sold during the year 0 (0) (0) — 5 (30) 39 14

Purchases, sales and settlements, net 12 5 (16) — (7) (471) (14) (492)

Transfers, net 17 7 6 — 127* — — 157

Balance at December 31, 2011 $29 $12 $ 45 $246 $713 $4,098 $2,790 $7,932

* Due to an increase in the redemption term during 2011, the asset was transferred from Level 2 to Level 3.

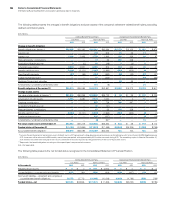

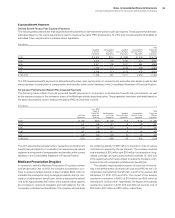

The following tables present the reconciliation of the beginning and ending balances of Level 3 assets for the years ended December 31, 2012

and 2011 for the non-U.S. Plans.

($ in millions)

Government

and Related

Corporate

Bonds

Private

Equity

Private

Real Estate To ta l

Balance at January 1, 2012 $ 96 $ 39 $262 $580 $ 977

Return on assets held at end of year 3 (1) 9 (5) 6

Return on assets sold during the year 3 1 9 0 14

Purchases, sales and settlements, net (26) (29) 62 14 21

Transfers, net (2) (5) (0) (3) (10)

Foreign exchange impact 1 (0) 11 23 34

Balance at December 31, 2012 $ 76 $ 5 $353 $609 $1,042

($ in millions)

Government

and Related

Corporate

Bonds

Private

Equity

Private

Real Estate To ta l

Balance at January 1, 2011 $ — $11 $176 $533 $720

Return on assets held at end of year 3 2 30 11 46

Return on assets sold during the year (0) (0) (2) (3) (5)

Purchases, sales and settlements, net 100 28 65 44 237

Transfers, net — — (0) 0 0

Foreign exchange impact (7) (2) (7) (6) (22)

Balance at December 31, 2011 $ 96 $39 $262 $580 $977