IBM 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102 Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

102

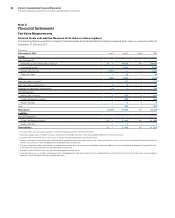

($ in millions)

At December 31, 2011:

Tota l

Past Due

> 90 Days* Current

Tota l

Financing

Receivables

Recorded

Investment

> 90 Days

and Accruing

Major markets $ 6 $ 6,504 $ 6,510 $ 6

Growth markets 9 1,911 1,921 6

Total lease receivables $16 $ 8,415 $ 8,430 $12

Major markets $23 $ 9,054 $ 9,077 $ 7

Growth markets 22 2,530 2,552 19

Total loan receivables $46 $11,584 $11,629 $26

To t a l $62 $19,998 $20,060 $38

* Does not include accounts that are fully reserved.

Troubled Debt Restructurings

The company assessed all restructurings that occurred on or after

January 1, 2011 and determined that there were no troubled debt

restructurings for the years ended December 31, 2011 and 2012.

Note G.

Property, Plant and Equipment

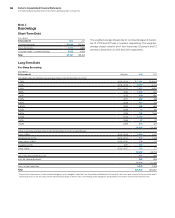

($ in millions)

At December 31: 2012 2011

Land and land improvements $ 747 $ 786

Buildings and building improvements 9,610 9,531

Plant, laboratory and office equipment 27,731 26,843

Plant and other property—gross 38,088 37,160

Less: Accumulated depreciation 25,234 24,703

Plant and other property—net 12,854 12,457

Rental machines 2,414 2,964

Less: Accumulated depreciation 1,271 1,538

Rental machines—net 1,142 1,426

Total—net $13,996 $13,883

Note H.

Investments and Sundry Assets

($ in millions)

At December 31: 2012 2011

Deferred transition and setup costs

and other deferred arrangements* $1,630 $1,784

Derivatives—noncurrent ** 585 753

Alliance investments

Equity method 120 131

Non-equity method 226 127

Prepaid software 306 233

Long-term deposits 318 307

Other receivables 204 208

Employee benefit-related 439 493

Prepaid income taxes 459 261

Other assets 735 598

To t a l $5,021 $4,895

* Deferred transition and setup costs and other deferred arrangements are related to

Global Services client arrangements. See note A, “Significant Accounting Policies,”

on page 79 for additional information.

**

See note D, “Financial Instruments,” on pages 94 through 98 for the fair value of all

derivatives reported in the Consolidated Statement of Financial Position.

Note I.

Intangible Assets Including Goodwill

Intangible Assets

The following table details the company’s intangible asset balances

by major asset class.

($ in millions)

At December 31, 2012:

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Intangible asset class

Capitalized software $1,527 $ (665) $ 861

Client relationships 2,103 (961) 1,142

Completed technology 2,709 (1,112) 1,597

In-process R&D 28 — 28

Patents/trademarks 281 (127) 154

Other* 31 (27) 3

To t a l $6,679 $(2,892) $3,787