IBM 2012 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

136 Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

136

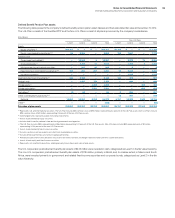

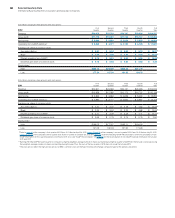

Reconciliations of IBM as Reported

($ in millions)

For the year ended December 31: 2012 2011 2010

Revenue

Total reportable segments $111,826 $114,440 $106,827

Other revenue and adjustments 577 722 750

Elimination of internal transactions (7,896) (8,246)(7,707)

Total IBM consolidated revenue $104,507 $106,916 $ 99,870

($ in millions)

For the year ended December 31: 2012 2011 2010

Pre-tax income

Total reportable segments $24,015 $22,904 $20,923

Amortization of acquired

intangible assets (703) (629)(512)

Acquisition-related charges (36) (46)(46)

Non-operating retirement-

related (costs)/income (538) 72 414

Elimination of internal transactions (1,197) (1,243)(957)

Unallocated corporate amounts* 361 (56)(98)

Total IBM consolidated

pre-tax income $21,902 $21,003 $19,723

* The 2012 amount includes the gain related to the Retail Store Solutions divestiture.

The 2011 amount includes gains related to the sale of Lenovo common stock.

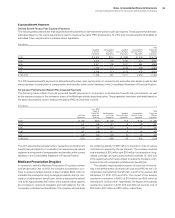

Immaterial Items

Investment in Equity Alliances

and Equity Alliances Gains/(Losses)

The investments in equity alliances and the resulting gains and

(losses) from these investments that are attributable to the segments

did not have a material effect on the financial position or the financial

results of the segments.

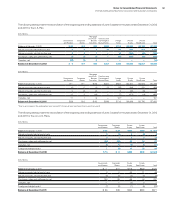

Segment Assets and Other Items

Global Technology Services assets are primarily plant, property and

equipment including the assets associated with the outsourcing

business, accounts receivable, goodwill, acquired intangible assets,

deferred services arrangement transition costs and maintenance parts

inventory. Global Business Services assets are primarily goodwill

and accounts receivable. Software assets are mainly goodwill,

acquired intangible assets and accounts receivable. Systems and

Technology assets are primarily plant, property and equipment,

goodwill, manufacturing inventory and accounts receivable. Global

Financing assets are primarily financing receivables and fixed assets

under operating leases.

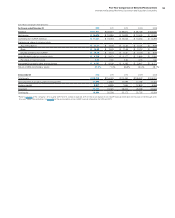

To ensure the efficient use of the company’s space and equip-

ment, several segments may share plant, property and equipment

assets. Where assets are shared, landlord ownership of the assets

is assigned to one segment and is not allocated to each user seg-

ment. This is consistent with the company’s management system

and is reflected accordingly in the table on page 137. In those cases,

there will not be a precise correlation between segment pre-tax

income and segment assets.

Similarly, the depreciation amounts reported by each segment

are based on the assigned landlord ownership and may not be con-

sistent with the amounts that are included in the segments’ pre-tax

income. The amounts that are included in pre-tax income reflect

occupancy charges from the landlord segment and are not specifi-

cally identified by the management reporting system. Capital

expenditures that are reported by each segment also are consistent

with the landlord ownership basis of asset assignment.

Global Financing amounts for interest income and interest

expense reflect the interest income and interest expense associated

with the Global Financing business, including the intercompany

financing activities discussed on page 24, as well as the income

from investment in cash and marketable securities. The explanation

of the difference between cost of financing and interest expense for

segment presentation versus presentation in the Consolidated

Statement of Earnings is included on page 66 of the Management

Discussion.