IBM 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

114 Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

114

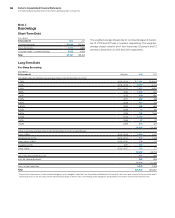

Deferred Tax Liabilities

($ in millions)

At December 31: 2012 2011

Leases $2,216 $2,149

Depreciation 1,378 1,421

Goodwill and intangible assets 957 796

Software development costs 542 466

Retirement benefits 257 551

Other 1,158 1,121

Gross deferred tax liabilities $6,508 $6,504

For income tax return purposes, the company has foreign and

domestic loss carryforwards, the tax effect of which is $706 million,

as well as domestic and foreign credit carryforwards of $929 million.

Substantially all of these carryforwards are available for at least two

years or are available for 10 years or more.

The valuation allowance at December 31, 2012 principally applies

to certain foreign, state and local loss carryforwards that, in the

opinion of management, are more likely than not to expire unutilized.

However, to the extent that tax benefits related to these carry-

forwards are realized in the future, the reduction in the valuation

allowance will reduce income tax expense.

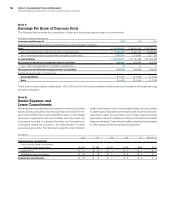

The amount of unrecognized tax benefits at December 31, 2012

increased by $97 million in 2012 to $5,672 million. A reconciliation of

the beginning and ending amount of unrecognized tax benefits is

as follows:

($ in millions)

2012 2011 2010

Balance at January 1 $5,575 $5,293 $ 4,790

Additions based on tax positions

related to the current year 401 672 1,054

Additions for tax positions

of prior years 215 379 1,768

Reductions for tax positions

of prior years (including impacts

due to a lapse in statute) (425) (538) (1,659)

Settlements (94) (231) (660)

Balance at December 31 $5,672 $5,575 $ 5,293

The additions to unrecognized tax benefits related to the current

and prior years are primarily attributable to non-U.S. issues, certain

tax incentives and credits, acquisition-related matters and state

issues. The settlements and reductions to unrecognized tax benefits

for tax positions of prior years are primarily attributable to the con-

clusion of the company’s various U.S., state and non-U.S. income

tax examinations and various non-U.S. matters, as well as impacts

due to lapses in statutes of limitation.

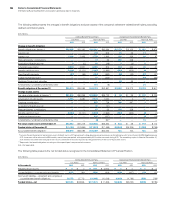

A reconciliation of the statutory U.S. federal tax rate to the company’s

effective tax rate is as follows:

For the year ended December 31: 2012 2011 2010

Statutory rate 35% 35% 35%

Foreign tax differential (11) (10) (10)

State and local 12 2

Other (1) (2) (2)

Effective rate 24% 25% 25%

The significant components reflected within the tax rate reconcili-

ation above labeled “Foreign tax differential” include the effects of

foreign subsidiaries’ earnings taxed at rates other than the U.S.

statutory rate, foreign export incentives, the U.S. tax impacts of

non-U.S. earnings repatriation and any net impacts of intercom-

pany transactions. These items also reflect audit settlements or

changes in the amount of unrecognized tax benefits associated

with each of these items.

In the fourth quarter of 2011, the IRS commenced its audit of the

company’s U.S. tax returns for the years 2008 through 2010. The

company anticipates that this audit will be completed by the end

of 2013.

The effect of tax law changes on deferred tax assets and liabilities

did not have a material impact on the company’s effective tax rate.

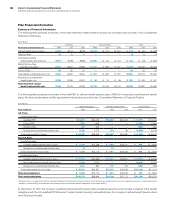

The significant components of deferred tax assets and liabilities

that are recorded in the Consolidated Statement of Financial Position

were as follows:

Deferred Tax Assets

($ in millions)

At December 31: 2012 2011*

Retirement benefits $ 5,870 $ 5,169

Share-based and other compensation 1,666 1,598

Deferred income 1,018 834

Domestic tax loss/credit carryforwards 954 914

Foreign tax loss/credit carryforwards 681 752

Bad debt, inventory and warranty reserves 586 608

Depreciation 456 474

Other 1,384 1,479

Gross deferred tax assets 12,615 11,828

Less: valuation allowance 1,187 912

Net deferred tax assets $11,428 $10,916

* Reclassed to conform with 2012 presentation.