IBM 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

Management Discussion

International Business Machines Corporation and Subsidiary Companies

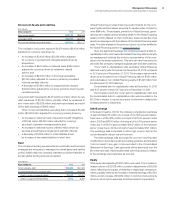

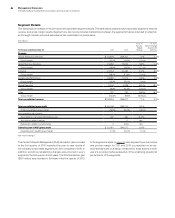

revenue growth in the quarter. First, GTS did a tremendous amount

of work to address a number of low margin contracts to improve the

profitability of the outsourcing portfolio. The benefits of that work were

realized in profit and margin performance, though it did have some

impact on revenue. In the fourth quarter, the impact was 1 point of

year-to-year revenue growth to GTS, and to Global Services in total.

Second, revenue from sales and volumes into existing base accounts

declined year to year in the fourth quarter. This activity tends to be

more transactional in nature and economically sensitive. The impact

of these factors are reflected in GTS Outsourcing revenue, which

decreased 3.1 percent (2 percent adjusted for currency) in the fourth

quarter. Outsourcing revenue in the growth markets increased 6.1

percent, 8 percent at constant currency, and the outsourcing backlog

in these markets was up 9 percent at constant currency. The backlog

growth reflects an ongoing trend as clients are building out their infra-

structures and scaling to meet the growth objectives of their

businesses. ITS revenue of $2,542 million increased 2.1 percent (3

percent adjusted for currency) in the fourth quarter with the growth

markets up 10.1 percent (10 percent at constant currency). GTS gross

profit increased 1.3 percent and the gross profit margin improved 1.1

points to 37.6 percent with margin improvement across all lines of

business. GTS fourth-quarter 2012 pre-tax income increased 5.0

percent to $2,027 million with the pre-tax margin expanding 1.2 points

to 19.2 percent, versus the fourth quarter of 2011. Margin expansion

resulted from increased efficiency and productivity from the focus on

automation and process, primarily through the company’s enterprise

productivity initiatives.

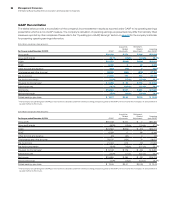

Global Business Services revenue of $4,720 million decreased

3.2 percent (2 percent adjusted for currency) in the fourth quarter

of 2012. From a geographic perspective, the growth markets

increased 2.0 percent (3 percent at constant currency) and Japan

improved 0.3 percent (6 percent at constant currency)—the second

consecutive quarter of revenue growth in Japan. The growth initia-

tives continued to drive strong performance with double-digit

revenue growth in business analytics, Smarter Planet and cloud

offerings in the quarter. Application Outsourcing revenue decreased

3.8 percent (2 percent adjusted for currency) and C&SI revenue

decreased 3.0 percent (2 percent adjusted for currency). GBS has

been taking actions to address the more traditional customized

packaged application work including: adding partners, increasing

sales capability and targeting and closing large transformational

opportunities in the growth markets. GBS gross profit decreased

1.0 percent in the fourth quarter with the gross profit margin expanding

0.7 points versus the prior year. GBS pre-tax income of $841 million

was essentially flat year to year with a pre-tax margin of 17.2 percent,

an improvement of 0.6 points. Improved utilization and improved

services delivery more than offset the impact from revenue.

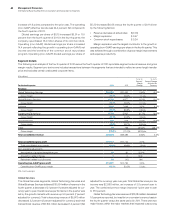

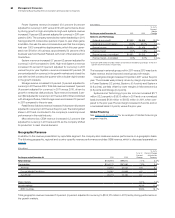

Software

Software revenue of $7,915 million increased 3.5 percent (4 percent

adjusted for currency) in the fourth quarter with growth in all the key

brands, and particular strength and share gains in WebSphere,

Lotus and Rational. Key branded middleware revenue increased

5.4 percent (6 percent adjusted for currency) year to year and gained

share as the software business continued to be the leader in

the middleware market. The software business had continued

momentum across its brands in the growth initiatives in the fourth

quarter with strong performance in business analytics, Smarter

Commerce and cloud. WebSphere revenue increased 10.6 percent

(11 percent adjusted for currency) in the fourth quarter year to year

and gained share. The company continued to expand its portfolio

to capture the emerging opportunity around mobile computing and

had solid revenue growth in several of its core WebSphere offerings,

such as application servers and commerce in the fourth quarter.

Information Management revenue increased 2.2 percent (3 percent

adjusted for currency) and held share with strong performance in

Information Integration and predictive analytics, both driven by big

data. Tivoli revenue increased 4.3 percent (5 percent adjusted for

currency) and held share, led by its storage and security offerings.

Revenue from the storage portfolio increased 12 percent (13 percent

adjusted for currency), reflecting the continued value of storage

software. Tivoli security increased 16 percent (16 percent adjusted

for currency) driven by Q1 Labs. Lotus revenue increased 8.6 per-

cent (9 percent adjusted for currency) and gained share as the Lotus

portfolio continues to transform to the faster-growing social busi-

ness offerings. Revenue growth was driven by strong performance

from the existing social business offerings and the recent acquisition

of Kenexa, which closed in December 2012. Kenexa helps clients

create a more efficient and effective workforce, and brings a unique

combination of cloud-based technology and consulting services to

an already extensive portfolio of social business solutions. Rational

revenue increased 11.6 percent (12 percent adjusted for currency) in

the fourth quarter and gained share. Growth was driven by double-

digit growth in both analysis, modeling and design software and the

Automated Software Quality business. Software gross profit

increased 4.5 percent and the gross profit margin expanded 0.8

points to 90.6 percent. Software delivered pre-tax income of $4,017

million in the fourth quarter, a growth of 8.3 percent compared to

the fourth quarter of 2011, with a pre-tax margin of 46.0 percent, up

2.4 points.

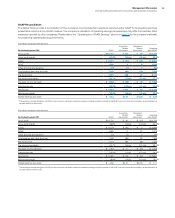

Systems and Technology

Systems and Technology revenue of $5,763 million decreased 0.7

percent (1 percent adjusted for currency); adjusted for the RSS

divestiture, revenue increased 3.6 percent (4 percent adjusted for

currency). Performance was driven by the company’s new main-

frame and momentum in PureSystems—the company’s new

expert integrated systems. System z revenue increased 55.6 per-

cent (56 percent adjusted for currency) driven by the first full

quarter of the new mainframe product. MIPS shipments increased

66 percent year to year; the largest quarter of MIPS shipments in

history. Approximately half of these MIPS were specialty engines,

which were up over 80 percent year to year driven by Linux work-

loads. Revenue growth in System z was over 50 percent in the

major markets and over 65 percent in the growth markets. In the

growth markets, the company had strong sales to established as

well as new mainframe customers. Power Systems revenue

decreased 18.9 percent (19 percent adjusted for currency),

although both the new POWER7+ midrange and high-end Power

servers performed well in the quarter. In the fourth quarter, the

company had over 350 competitive displacements resulting in over

$335 million of business; approximately half of which came from