IBM 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

Management Discussion

International Business Machines Corporation and Subsidiary Companies

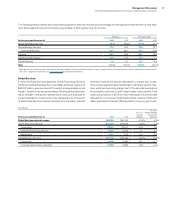

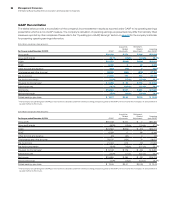

Noncurrent Assets and Liabilities

($ in millions)

At December 31: 2012 2011

Noncurrent assets $69,780 $65,505

Long-term debt $24,088 $22,857

Noncurrent liabilities (excluding debt) $32,516 $31,217

The increase in noncurrent assets of $4,276 million ($4,454 million

adjusted for currency) was driven by:

• An increase of $3,429 million ($3,236 million adjusted

for currency) in goodwill and intangible assets driven by

acquisitions;

• An increase of $470 million in deferred taxes ($580 million

adjusted for currency) driven by retirement-related

activity; and

• An increase of $2,036 million in financing receivables

($2,214 million adjusted for currency) driven by increased

volumes, partially offset by

• A decrease of $1,899 million in prepaid pension assets

($1,922 million adjusted for currency) primarily driven by plan

remeasurements.

Long-term debt increased by $1,231 million primarily driven by new

debt issuances of $7,700 million, partially offset by reclasses to

short-term debt of $5,638 million, and debt repurchased as a result

of the debt exchange of $665 million.

Other noncurrent liabilities, excluding debt, increased $1,299

million ($1,558 million adjusted for currency) primarily driven by:

• An increase in retirement and nonpension benefit obligations

of $2,044 million ($2,264 million adjusted for currency)

as a result of pension remeasurements; and

• An increase in deferred income of $644 million driven by

services and software arrangements; partially offset by

• A decrease of $1,389 million in other liabilities driven

by a reclass of tax-related liabilities to short term.

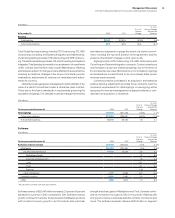

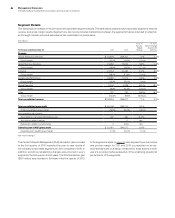

Debt

The company’s funding requirements are continually monitored and

strategies are executed to manage the overall asset and liability

profile. Additionally, the company maintains sufficient flexibility to

access global funding sources as needed.

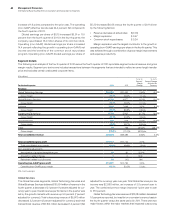

($ in millions)

At December 31: 2012 2011

Total company debt $33,269 $31,320

Total Global Financing segment debt $24,501 $23,332

Debt to support external clients 21,583 20,051

Debt to support internal clients 2,919 3,281

Global Financing provides financing predominantly for the com-

pany’s external client assets, as well as for assets under contract by

other IBM units. These assets, primarily for Global Services, gener-

ate long-term, stable revenue streams similar to the Global Financing

asset portfolio. Based on their attributes, these Global Services

assets are leveraged with the balance of the Global Financing asset

base. The debt analysis in the previous column is further detailed in

the Global Financing section on pages 66 and 67.

Given the significant leverage, the company presents a debt-to-

capitalization ratio which excludes Global Financing debt and equity

as management believes this is more representative of the com-

pany’s core business operations. This ratio can vary from period to

period as the company manages its global cash and debt positions.

“Core” debt-to-capitalization ratio (excluding Global Financing

debt and equity) was 36.1 percent at December 31, 2012 compared

to 32.0 percent at December 31, 2011. The increase was primarily

driven by an increase in non-Global Financing debt of $780 million

and a decrease in non-Global Financing equity of $1,497 million from

the December 31, 2011 balances.

Consolidated debt-to-capitalization ratio at December 31, 2012

was 63.7 percent versus 60.7 percent at December 31, 2011.

The increase in both the “core” debt-to-capitalization ratio and

the consolidated debt-to-capitalization ratio was impacted by the

$5.2 billion impact to equity as a result of retirement-related plan

remeasurements in December.

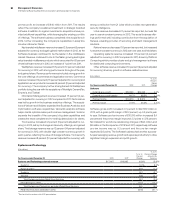

Debt Exchange

In the second quarter of 2012, the company completed an exchange

of approximately $6 million of principal of its 7.125 percent deben-

tures due in 2096, $104 million principal of its 8.00 percent notes

due in 2038 and $800 million of principal of its 5.60 percent senior

notes due in 2039 for approximately $1,107 million of 4.00 percent

senior notes due in 2042 and cash of approximately $121 million.

The exchange was completed to retire high coupon debt in the

current favorable interest rate environment.

The debt exchange was accounted for as a non-revolving debt

modification in accordance with accounting guidance, and therefore

it did not result in any gain or loss recorded in the Consolidated

Statement of Earnings. Cash payments will be amortized over the

life of the new debt. Administrative fees with third parties in relation

to the exchange were expensed as incurred.

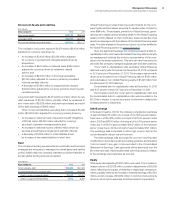

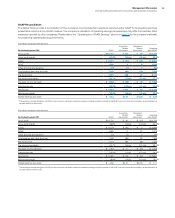

Equity

Total equity decreased by $1,252 million as a result of an increase in

treasury stock of $12,168 million; pension adjustments of $3,669

million reflecting the impact of retirement-related plan remeasure-

ments; partially offset by an increase in retained earnings of $12,783

million, and an increase of $1,980 million in common stock primarily

driven by stock option exercises and stock based compensation.