IBM 2012 Annual Report Download - page 97

Download and view the complete annual report

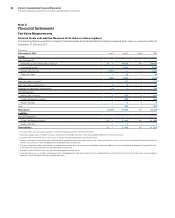

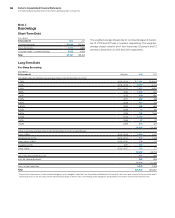

Please find page 97 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.96 Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

96

Anticipated Royalties and Cost Transactions

The company’s operations generate significant nonfunctional cur-

rency, third-party vendor payments and intercompany payments for

royalties and goods and services among the company’s non-U.S.

subsidiaries and with the parent company. In anticipation of these

foreign currency cash flows and in view of the volatility of the cur-

rency markets, the company selectively employs foreign exchange

forward contracts to manage its currency risk. These forward con-

tracts are accounted for as cash flow hedges. The maximum length

of time over which the company is hedging its exposure to the vari-

ability in future cash flows is four years. At December 31, 2012 and

2011, the total notional amount of forward contracts designated as

cash flow hedges of forecasted royalty and cost transactions was

$10.7 billion and $10.9 billion, respectively, with a weighted-average

remaining maturity of 0.7 years at both year-end dates.

At December 31, 2012 and December 31, 2011, in connection

with cash flow hedges of anticipated royalties and cost transactions,

the company recorded net losses of $138 million and net gains of

$88 million (before taxes), respectively, in AOCI. Within these

amounts $79 million of losses and $191 million of gains, respectively,

are expected to be reclassified to net income within the next 12

months, providing an offsetting economic impact against the under-

lying anticipated transactions.

Foreign Currency Denominated Borrowings

The company is exposed to exchange rate volatility on foreign cur-

rency denominated debt. To manage this risk, the company employs

cross-currency swaps to convert fixed-rate foreign currency denom-

inated debt to fixed-rate debt denominated in the functional currency

of the borrowing entity. These swaps are accounted for as cash flow

hedges. The maximum length of time over which the company

hedges its exposure to the variability in future cash flows is approxi-

mately three years. At December 31, 2012 and December 31, 2011,

no instruments relating to this program were outstanding.

Subsidiary Cash and Foreign Currency

Asset/Liability Management

The company uses its Global Treasury Centers to manage the cash

of its subsidiaries. These centers principally use currency swaps to

convert cash flows in a cost-effective manner. In addition, the com-

pany uses foreign exchange forward contracts to economically

hedge, on a net basis, the foreign currency exposure of a portion of

the company’s nonfunctional currency assets and liabilities. The

terms of these forward and swap contracts are generally less than

one year. The changes in the fair values of these contracts and of

the underlying hedged exposures are generally offsetting and are

recorded in other (income) and expense in the Consolidated State-

ment of Earnings. At December 31, 2012 and 2011, the total notional

amount of derivative instruments in economic hedges of foreign

currency exposure was $12.9 billion and $13.6 billion, respectively.

Equity Risk Management

The company is exposed to market price changes in certain broad

market indices and in the company’s own stock primarily related to

certain obligations to employees. Changes in the overall value of

these employee compensation obligations are recorded in SG&A

expense in the Consolidated Statement of Earnings. Although not

designated as accounting hedges, the company utilizes derivatives,

including equity swaps and futures, to economically hedge the

exposures related to its employee compensation obligations. The

derivatives are linked to the total return on certain broad market

indices or the total return on the company’s common stock. They

are recorded at fair value with gains or losses also reported

in SG&A expense in the Consolidated Statement of Earnings.

At December 31, 2012 and 2011, the total notional amount of deriva-

tive instruments in economic hedges of these compensation

obligations was $1.2 billion and $1.0 billion, respectively.

Other Risks

The company may hold warrants to purchase shares of common

stock in connection with various investments that are deemed

derivatives because they contain net share or net cash settlement

provisions. The company records the changes in the fair value of

these warrants in other (income) and expense in the Consolidated

Statement of Earnings. The company did not have any warrants

qualifying as derivatives outstanding at December 31, 2012 and 2011.

The company is exposed to a potential loss if a client fails to pay

amounts due under contractual terms. The company utilizes credit

default swaps to economically hedge its credit exposures. These

derivatives have terms of one year or less. The swaps are recorded

at fair value with gains and losses reported in other (income) and

expense in the Consolidated Statement of Earnings. The company

did not have any derivative instruments relating to this program out-

standing at December 31, 2012 and 2011.