IBM 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Other Information

Looking Forward

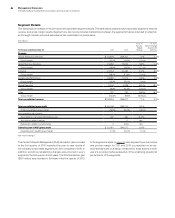

In 2012, the company delivered revenue of $104.5 billion, net income

of $16.6 billion, up 4.7 percent and earnings per share of $14.37, an

increase of 10.0 percent compared to 2011. Operating (non-GAAP)

earnings per share was $15.25, an increase of 13.5 percent versus

the prior year. The 2012 results put the company well on track to its

2015 operating earnings per share road map objective.

The company measures the success of its business model over

the long term, not any individual quarter or year. The company’s

strategies, investments and actions are all taken with an objective

of optimizing long-term performance.

In May 2010, the company met with investors and introduced

a road map for earnings per share in 2015. The objective of the

road map for growth is to achieve at least $20 of operating (non-

GAAP) earnings per diluted share in 2015. The company has

identified the major drivers of financial performance: revenue

growth, margin expansion and common stock share repurchase.

The revenue growth will come from a combination of base revenue

growth, a shift to faster growing businesses and from acquisitions

closed between 2010 and 2015. The contribution from margin

expansion will be driven by the mix of higher margin businesses

and enterprise productivity. The company will also continue to

return value to its shareholders, with approximately $50 billion of

gross share repurchases and $20 billion of dividends expected

during the road map period.

Looking forward, the company expects to continue its trans-

formation in 2013. The company will continue to acquire key

capabilities, divest of certain businesses, rebalance its workforce

and invest in innovation. The company continues to retool its skills

and offerings to shift to higher value content and meet its clients’

needs. The company’s expectation for 2013 includes all these fac-

tors. In January 2013, the company disclosed that it is expecting

GAAP earnings of at least $15.53 and operating (non-GAAP) earn-

ings of at least $16.70 per diluted share for the full year 2013. The

operating (non-GAAP) earnings per share expectation excludes

acquisition-related charges of $0.48 per share and non-operating

retirement-related costs of $0.69 per share. This expectation results

in an increase year to year of 8 percent in GAAP earnings per share

and an increase of 10 percent year to year in operating (non-GAAP)

earnings per share which keeps the company on track to its 2015

objective. On an operating (non-GAAP) basis, the company expects

the first half earnings per share growth rate to be slightly higher

than the growth rate in the second half primarily driven by the new

System z mainframe content and the resulting year-to-year product

cycle impacts.

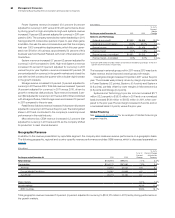

From a segment perspective, the Software business once again

delivered strong results in 2012 and continued market leadership.

The company expects the Software business to continue its momen-

tum in 2013 and deliver revenue growth in the mid single-digits on a

constant currency basis with strong profit contribution. Within Global

Services, entering 2013, the company will continue to drive its key

plays and shift toward higher value content. The company will

continue to invest in the growth markets—which represent over 20

percent of services revenue and where the company sees the most

opportunity for growth. The company will continue to transform the

services portfolio to higher value content, and away from the more

commoditizing labor-based content. Global Services profit and

margin performance will continue to benefit from the work being

done to infuse more IP content into its offerings. In addition, Global

Services will continue to be the prime beneficiary of the focus on

enterprise productivity. The company believes that Global Services

has a good set of opportunities to continue to drive profit growth and

margin expansion in 2013. As a result, the company expects the

Global Services business to deliver profit growth in 2013, consistent

with its business model expectations, with double-digit profit growth

in the first quarter. In addition, with its backlog growth and the mix

toward longer duration engagements, the company expects Global

Business Services to return to revenue growth at constant currency

in 2013. Within Systems and Technology, looking forward to 2013,

performance in the first half of the year will be defined by the momen-

tum related to the System z mainframe content. The company

expects that momentum to drive double-digit profit growth in Sys-

tems and Technology in the first half of 2013.

The economy could impact the credit quality of the company’s

receivables, and therefore the allowance for credit losses. The com-

pany will continue to apply its rigorous credit policies and analysis,

and will also continue to monitor the current economic environment,

particularly in Europe. Total receivables in Portugal, Italy, Ireland,

Greece and Spain were approximately $2.7 billion and $2.6 billion, net

of allowances, and represented approximately 7 percent of total net

trade and financing accounts receivables at December 31, 2012 and

2011, respectively. The company will continue to monitor potential

exposures in these countries in conjunction with the application of its

credit policies.

The company expects 2013 pre-tax retirement-related plan

cost to be approximately $3.1 billion, an increase of approximately

$700 million compared to 2012. This estimate reflects current

pension plan assumptions at December 31, 2012. Within total

retirement-related plan cost, operating retirement-related plan cost

is expected to be approximately $1.9 billion, an increase of approxi-

mately $100 million versus 2012. Non-operating retirement-related

plan cost is expected to be approximately $1.1 billion, an increase

of approximately $600 million, compared to 2012. See note S,

“Retirement-Related Benefits,” on pages 120 to 134 for additional

information.

The company expects in the normal course of business that

its effective tax rate and operating (non-GAAP) tax rate will be

approximately 25 percent in 2013. The rate will change year to year

based on non-recurring events, such as the settlement of income

tax audits and changes in tax laws, as well as recurring factors

including the geographic mix of income before taxes, the timing

and amount of foreign dividend repatriation, state and local taxes

and the effects of various global income tax strategies.