IBM 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

4

8

$20

16

12

0

00 12

18.2

6.7

10.1%

22.2%

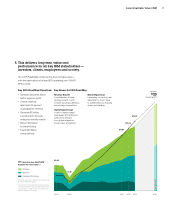

Our operating (non-GAAP) pre-tax income margin in 2012 was

22.2 percent, 12 points higher than in 2000. The primary driver

of this performance was gross profit margin expansion, as a result

of the shift in our business mix to more profitable, higher-value

segments and improved productivity.

At the same time, we’ve increased R&D investment. Since the

beginning of 2000, we’ve spent $75 billion in R&D, enabling

us to deliver key innovations and maintain U.S. patent leadership

for our 20th consecutive year in 2012.

Our solid business model performance has resulted in

consistently strong free cash flow. In 2012 our free cash flow

was $18.2 billion, $12 billion higher than a decade ago.

3. By aligning our business model

with our clients’ needs, we achieve

our financial goals.

4. This allows us to invest in future

sources of growth and provide strong

returns to our shareholders.

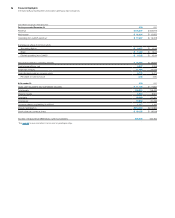

Primary Uses of Cash Since the Beginning of 2000

($ in billions)

Free Cash Flow and Operating Pre-tax Income Margin*

($ in billions)

Free Cash Flow

Operating Pre-tax Income Margin

$237

Acquisitions

Dividends

Capital expenditures

Share repurchases (gross)

Acquisitions: Since the beginning of 2000, we have acquired

more than 140 companies in strategic areas including analytics,

cloud, security and Smarter Commerce. We expect to spend

$20 billion in acquisitions over the 2015 Road Map period to

support growth initiatives.

Capital Expenditures: We have invested more than $55 billion

since 2000 to advance our capabilities.

Share Repurchase and Dividends: Since 2000, we have

returned almost $150 billion to shareholders—paying $26 billion

in dividends and reducing the outstanding share count by

over 35 percent. We expect to return $70 billion to shareholders

in our 2015 Road Map period—$50 billion through gross share

repurchases and $20 billion in dividends.

$123

$26

$55

$33

* Excludes acquisition-related and nonoperating retirement-related charges.

$

70 billion expected to be returned

to shareholders through 2015.