IBM 2012 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2828 Management Discussion

International Business Machines Corporation and Subsidiary Companies

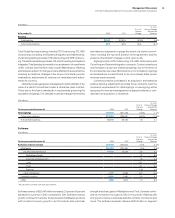

Global Technology Services revenue of $40,236 million in 2012

decreased 1.6 percent as reported, but increased 1 percent adjusted

for currency year to year. Revenue growth from the backlog was

partially offset by a decline in revenue from new signings and a

decrease in sales in existing accounts. Revenue performance was

led by the growth markets which were up 5.0 percent (9 percent

adjusted for currency). GTS Outsourcing revenue decreased 2.4

percent as reported, but increased 1 percent adjusted for currency

in 2012. Outsourcing revenue from the growth markets increased

2.4 percent (7 percent adjusted for currency), as the outsourcing

offerings help clients build out their IT infrastructures. Integrated

Technology Services (ITS) revenue increased 1.0 percent (4 percent

adjusted for currency) in 2012 compared to 2011, and continued

to be led by strength in the growth markets which increased 10.3

percent (13 percent adjusted for currency).

Global Business Services revenue of $18,566 million decreased

3.7 percent (2 percent adjusted for currency) in 2012. On a geographic

basis, solid performance in the growth markets, with revenue up

4.3 percent (8 percent adjusted for currency), was offset by a

5.1 percent decline (3 percent adjusted for currency) in the major

markets. The growth initiatives—business analytics, Smarter Planet

and cloud had solid double-digit revenue growth, and represented

over one-third of total GBS revenue in 2012. As GBS shifts more of

its business to higher value content, these larger, more complex

engagements are having a positive effect on the GBS backlog.

The GBS backlog grew for the fourth consecutive year at constant

currency—although the backlog is mixing to longer duration engage-

ments. Application Outsourcing revenue decreased 4.1 percent

(2 percent adjusted for currency) in 2012 year to year, and Consulting

and Systems Integration (C&SI) revenue decreased 3.6 percent

(2 percent adjusted for currency). Both GBS lines of business had

solid revenue performance year to year in the growth markets with

Application Outsourcing and C&SI up 1.5 percent and 5.3 percent,

respectively, as reported, and up 6 percent and 8 percent, respec-

tively, at constant currency.

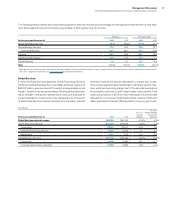

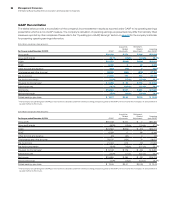

($ in millions)

For the year ended December 31: 2012 2011

Yr.-to-Yr.

Percent/

Margin

Change

Global Services

Global Technology Services

External gross profit $14,740 $14,320 2.9%

External gross profit margin 36.6% 35.0% 1.6 pts.

Pre-tax income $ 6,961 $ 6,284 10.8%

Pre-tax margin 16.8% 14.9% 1.9 pts.

Global Business Services

External gross profit $ 5,564 $ 5,545 0.3%

External gross profit margin 30.0% 28.8% 1.2 pts.

Pre-tax income $ 2,983 $ 3,006 (0.8)%

Pre-tax margin 15.5% 15.0% 0.5 pts.

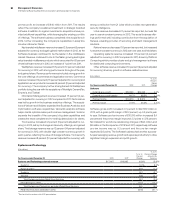

GTS gross profit increased 2.9 percent in 2012 and the gross profit

margin improved 1.6 points year to year with margin expansion

in each line of business, led by Outsourcing. Pre-tax income of

$6,961 million in 2012 increased 10.8 percent year to year and the

pre-tax margin expanded 1.9 points to 16.8 percent. Normalized for

workforce rebalancing charges of $151 million and $5 million in the

third quarter of 2012 and 2011, respectively, GTS pre-tax income was

up 13.1 percent and pre-tax margin expanded 2.2 points. The year-

over-year gross and pre-tax margin expansion was driven by several

factors: the work done to improve the profitability of a number of low

margin contracts in the outsourcing portfolio, increased contribution

from the higher margin growth markets, and increased efficiency

and productivity from the focus on automation and process primarily

through the company’s enterprise productivity initiatives.

The GBS gross profit margin expanded 1.2 points, led primarily

by improved profit performance in Application Outsourcing. GBS

pre-tax income of $2,983 million declined 0.8 percent in 2012 with

a pre-tax margin of 15.5 percent, an improvement of 0.5 points year

to year. Normalized for workforce rebalancing charges of $113 million

and $5 million in the third quarter of 2012 and 2011, respectively,

GBS pre-tax income was up 2.8 percent and the pre-tax margin

expanded 1.1 points. The gross and pre-tax margins benefitted from

improved service delivery and yield from the company’s enterprise

productivity initiatives.

The total Global Services business delivered strong profit and

margin expansion throughout 2012. Pre-tax income of $9,944 million

in 2012 increased 7.0 percent year to year. Normalized for the higher

level of workforce rebalancing charges in 2012, pre-tax income was

up 9.8 percent and the pre-tax margin expanded 1.9 points com-

pared to the prior year.

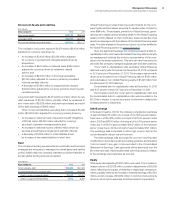

Global Services Backlog

The estimated Global Services backlog at December 31, 2012 was

$140 billion, a decrease of 0.3 percent as reported, but an increase

of 1 percent adjusted for currency compared to the December 31,

2011 balance, and an increase of 1.9 percent (3 percent adjusted for

currency) compared to the September 30, 2012 balance. Revenue

generated from the backlog is approximately 70 percent of total

services annual revenue in any year, with the remainder coming from

transactional signings in the year, and sales and volumes into the

existing client base. In 2013, the projected total services revenue

from the backlog is expected to be up 1 percent year to year at

consistent foreign currency exchange rates. This includes 2 percent

growth from the run out of the opening backlog and a 1 percent

impact from the work done to restructure a number of lower margin

contracts in the outsourcing business. Despite the impact to revenue

growth, these restructured contracts have improved the profitability

of the backlog. These contracts provided year-to-year profit

improvement in 2012. This impact, which will carryforward to 2013,

will contribute modest profit growth in 2013 off this higher profit

base, with the gross profit coming from the backlog more represen-

tative of a 2 percent backlog growth versus a 1 percent growth.

The total estimated growth markets backlog at December 31,

2012 increased 13.6 percent (15 percent adjusted for currency) year

to year. The estimated transactional backlog at December 31, 2012

increased 8.7 percent (9 percent adjusted for currency) and the

estimated outsourcing backlog decreased 3.3 percent (2 percent

adjusted for currency), respectively, from the December 31, 2011 levels.