IBM 2012 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.I am pleased to report that in 2012, IBM

achieved record operating earnings per

share, record free cash flow and record profit

margins, with revenues that were flat at

constant currency. Operating earnings per

share were up 13 percent, putting us well

on track to our 2015 Road Map objective of

at least $20 of operating earnings per share.

Importantly, we continued to deliver value

to you, our owners.

This performance is a testament to our strategic position and

capabilities, the discipline of our management systems, and the

dedication and expertise of more than 430,000 IBMers around

the world. Importantly, it reflects the impact of a distinct choice

we have made about IBM’s business and technology model.

IBM is an innovation company. Both in what we do

and in how we do it, we pursue continuous transformation

—

always remixing to higher value in our portfolio and skills,

in the capabilities we deliver to our clients and in our own

operations and management practices.

This is not the only path to success in our industry,

and it is not the easiest one. But it is ours. In this letter, I will

report on our 2012 results, and then put them in context

of our model of continuous transformation.

Results in 2012

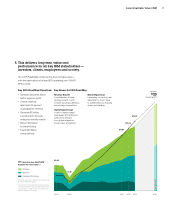

Earnings per share: Diluted operating earnings per share

in 2012 were $15.25, a new record. This marked 10 straight

years of double-digit EPS growth.

Margins: IBM’s operating pre-tax income margin rose

for the 10th consecutive year

—

to 22.2 percent, up 12 points

since 2000.

Cash flow: IBM has consistently generated strong cash

flow, a key indicator of real business performance. In 2012

our free cash flow was $18.2 billion, a record for IBM and

$12 billion higher than a decade ago. We ended 2012 with

$11.1 billion of cash and marketable securities.

Revenue and income: Our revenue in 2012 was

$104.5 billion, down 2 percent as reported and flat

at constant currency. We grew operating net income

by 8 percent, to $17.6 billion, our highest ever.

Investment and return to shareholders: In 2012 we invested

$3.7 billion for 11 acquisitions in key areas of software

and services; $4.3 billion in net capital expenditures; and

$6.3 billion in R&D. We were able to return $15.8 billion to

you

—

$12 billion through share repurchases and $3.8 billion

through dividends. Last year’s dividend increase was

13 percent, marking the 17th year in a row in which we

have raised our dividend, and the 97th consecutive year

in which we have paid one.

Since 2000, we have added $14.6 billion to IBM’s

operating pre-tax profit base, and increased our pre-tax

income 1.7 times, our operating earnings per share

3.6 times and our free cash flow 1.7 times. Cumulatively,

we have generated about $150 billion of free cash flow.

IBM’s Model: Continuous Transformation

In an industry characterized by a relentless cycle of

innovation and commoditization, one model for success

is that of the commodity player

—

winning through low

Dear IBM Investor:

1

A Letter from the Chairman