IBM 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5656 Management Discussion

International Business Machines Corporation and Subsidiary Companies

Liquidity and Capital Resources

The company has consistently generated strong cash flow from

operations, providing a source of funds ranging between $18.8 billion

and $20.8 billion per year over the past five years. The company

provides for additional liquidity through several sources: maintaining

an adequate cash balance, access to global funding sources, a

committed global credit facility and other committed and uncommit-

ted lines of credit worldwide. The following table provides a summary

of the major sources of liquidity for the years ended December 31,

2008 through 2012.

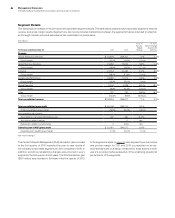

Cash Flow and Liquidity Trends

($ in billions)

2012 2011 2010 2009 2008

Net cash from

operating activities $19.6 $19.8 $19.5 $20.8 $18.8

Cash and short-term

marketable securities $11.1 $11.9 $11.7 $14.0 $12.9

Committed global

credit facility $10.0 $10.0 $10.0 $10.0 $10.0

The major rating agencies’ ratings on the company’s debt securities

at December 31, 2012 appear in the following table. The Standard

and Poor’s ratings reflect an upgrade on May 30, 2012. The other

agency ratings remain unchanged from December 31, 2011. The

company’s debt securities do not contain any acceleration clauses

which could change the scheduled maturities of the obligation. In

addition, the company does not have “ratings trigger” provisions in

its debt covenants or documentation, which would allow the holders

to declare an event of default and seek to accelerate payments

thereunder in the event of a change in credit rating. The company’s

contractual agreements governing derivative instruments contain

standard market clauses which can trigger the termination of the

agreement if the company’s credit rating were to fall below investment

grade. At December 31, 2012, the fair value of those instruments that

were in a liability position was $503 million, before any applicable

netting, and this position is subject to fluctuations in fair value period

to period based on the level of the company’s outstanding instru-

ments and market conditions. The company has no other contractual

arrangements that, in the event of a change in credit rating, would

result in a material adverse effect on its financial position or liquidity.

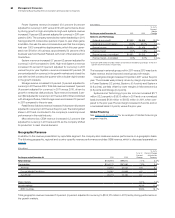

Standard

& Poor’s

Moody’s

Investors

Service

Fitch

Ratings

Senior long-term debt AA- Aa3 A+

Commercial paper A-1+ Prime-1 F1

The company prepares its Consolidated Statement of Cash Flows

in accordance with applicable accounting standards for cash flow

presentation on page 73 and highlights causes and events under-

lying sources and uses of cash in that format on page 36. For the

purpose of running its business, the company manages, monitors

and analyzes cash flows in a different format.

Management uses a free cash flow measure to evaluate the

company’s operating results, plan share repurchase levels, evaluate

strategic investments and assess the company’s ability and need

to incur and service debt. Free cash flow is not a defined term under

GAAP and it should not be inferred that the entire free cash flow

amount is available for discretionary expenditures. The company

defines free cash flow as net cash from operating activities less the

change in Global Financing receivables and net capital expenditures,

including the investment in software. As discussed on page 24, a

key objective of the Global Financing business is to generate strong

returns on equity. Increasing receivables is the basis for growth in a

financing business. Accordingly, management considers Global

Financing receivables as a profit-generating investment, not as work-

ing capital that should be minimized for efficiency. After considering

Global Financing receivables as an investment, the remaining net

operational cash flow less net capital expenditures is viewed by the

company as free cash flow.

Net cash from operating activities per GAAP was $19.6 billion in

2012, a decrease of $0.3 billion from the prior year. As discussed on

page 36, a key driver was a decrease in cash provided by receiv-

ables, primarily Global Financing receivables, which increased $3.2

billion year to year. The increase in Global Financing receivables

resulted from an increase in originations primarily driven by an

improved participation rate. From the perspective of how manage-

ment views cash flow, in 2012, free cash flow was $18.2 billion, an

increase of $1.6 billion compared to 2011. The increase was primarily

driven by the increase in net income and a reduction in income tax

payments as a result of audit settlements in 2011. Within its strong

free cash flow performance, the company increased its capital

expenditures by $0.2 billion versus the prior year.

In 2012, the company continued to focus its cash utilization on

returning value to shareholders including $3.8 billion in dividends

and $10.5 billion in net stock transactions, including the common

stock repurchase program. In addition, $3.7 billion was utilized to

acquire 11 companies. For the full year, the company generated $18.2

billion in free cash flow and utilized $18.0 billion on acquisitions, net

share repurchases and dividends.

Over the past five years, the company generated over $80 billion

in free cash flow. During that period, the company invested nearly

$19 billion in strategic acquisitions and returned over $61 billion to

shareholders through dividends and net share repurchases. The

amount of prospective returns to shareholders in the form of divi-

dends and share repurchases will vary based upon several factors

including each year’s operating results, capital expenditure require-

ments, research and development investments and acquisitions, as

well as the factors discussed on page 57.

The company’s Board of Directors meets quarterly to consider

the dividend payment. In the second quarter of 2012, the Board

of Directors increased the company’s quarterly common stock

dividend from $0.75 to $0.85 per share.