IBM 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Critical Accounting Estimates

The application of GAAP requires the company to make estimates

and assumptions about certain items and future events that directly

affect its reported financial condition. The accounting estimates and

assumptions discussed in this section are those that the company

considers to be the most critical to its financial statements. An

accounting estimate is considered critical if both (a) the nature of

the estimate or assumption is material due to the levels of subjectiv-

ity and judgment involved, and (b) the impact within a reasonable

range of outcomes of the estimate and assumption is material to the

company’s financial condition. Senior management has discussed

the development, selection and disclosure of these estimates with

the Audit Committee of the company’s Board of Directors. The

company’s significant accounting policies are described in note A,

“Significant Accounting Policies,” on pages 76 to 86.

A quantitative sensitivity analysis is provided where that informa-

tion is reasonably available, can be reliably estimated and provides

material information to investors. The amounts used to assess sen-

sitivity (e.g., 1 percent, 10 percent, etc.) are included to allow users

of the Annual Report to understand a general direction cause and

effect of changes in the estimates and do not represent manage-

ment’s predictions of variability. For all of these estimates, it should

be noted that future events rarely develop exactly as forecasted,

and estimates require regular review and adjustment.

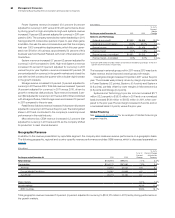

Pension Assumptions

For the company’s defined benefit pension plans, the measurement

of the company’s benefit obligation to employees and net periodic

pension (income)/cost requires the use of certain assumptions,

including, among others, estimates of discount rates and expected

return on plan assets.

Changes in the discount rate assumptions will impact the (gain)/

loss amortization and interest cost components of the net periodic

pension (income)/cost calculation (see page 126 for information

regarding the discount rate assumptions) and the projected benefit

obligation (PBO). The company decreased the discount rate

assumption for the IBM Personal Pension Plan (PPP), a U.S.-based

defined benefit plan, by 60 basis points to 3.60 percent on Decem-

ber 31, 2012. This change will increase pre-tax cost and expense

recognized in 2013 by an estimated $156 million. If the discount rate

assumption for the PPP increased by 60 basis points on December

31, 2012, pre-tax cost and expense recognized in 2013 would have

decreased by an estimated $200 million. Changes in the discount

rate assumptions will impact the PBO which, in turn, may impact the

company’s funding decisions if the PBO exceeds plan assets. Each

25 basis point increase or decrease in the discount rate will cause

a corresponding decrease or increase, respectively, in the PPP’s

PBO of an estimated $1.4 billion based upon December 31, 2012 data.

The expected long-term return on plan assets assumption is

used in calculating the net periodic pension (income)/cost (see page

126 for information regarding the expected long-term return on plan

assets assumption). Expected returns on plan assets are calculated

based on the market-related value of plan assets, which recognizes

changes in the fair value of plan assets systematically over a five-

year period in the expected return on plan assets line in net periodic

pension (income)/cost. The differences between the actual return

on plan assets and the expected long-term return on plan assets

are recognized over five years in the expected return on plan assets

line in net periodic pension (income)/cost and also as a component

of actuarial gains/losses, which are recognized over the service lives

of the employees in the plan, provided such amounts exceed thresh-

olds which are based upon the obligation or the value of plan assets,

as provided by accounting standards.

To the extent the outlook for long-term returns changes such

that management changes its expected long-term return on plan

assets assumption, each 50 basis point increase or decrease in the

expected long-term return on PPP plan assets assumption will have

an estimated increase or decrease, respectively, of $249 million on

the following year’s pre-tax net periodic pension (income)/cost

(based upon the PPP’s plan assets at December 31, 2012 and

assuming no contributions are made in 2013).

The company may voluntarily make contributions or be required,

by law, to make contributions to its pension plans. Actual results that

differ from the estimates may result in more or less future company

funding into the pension plans than is planned by management.

Impacts of these types of changes on the company’s pension plans

in other countries worldwide will vary depending upon the status of

each respective plan.

Revenue Recognition

Application of the various accounting principles in GAAP related to

the measurement and recognition of revenue requires the company

to make judgments and estimates. Specifically, complex arrange-

ments with nonstandard terms and conditions may require

significant contract interpretation to determine the appropriate

accounting, including whether the deliverables specified in a multiple

element arrangement should be treated as separate units of

accounting. Other significant judgments include determining whether

IBM or a reseller is acting as the principal in a transaction and

whether separate contracts are considered part of one arrangement.

Revenue recognition is also impacted by the company’s ability

to estimate sales incentives, expected returns and collectibility. The

company considers various factors, including a review of specific

transactions, the creditworthiness of the customers, historical experi-

ence and market and economic conditions when calculating these

provisions and allowances. Evaluations are conducted each quarter

to assess the adequacy of the estimates. If these estimates were

changed by 10 percent in 2012, net income would have been

impacted by $79 million (excluding Global Financing receivables

discussed on page 65).