IBM 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

115

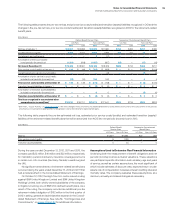

In April 2010, the company appealed the determination of a non-

U.S. taxing authority with respect to certain foreign tax losses. The

tax benefit of these losses, approximately $1,475 million, had been

included in unrecognized tax benefits within 2010 additions for tax

positions of prior years. The tax benefit of these losses total $1,386

million as of December 31, 2012. The 2012 decrease was driven by

currency and has been included in the 2012 reductions for tax posi-

tions of prior years. In April 2011, the company had received

notification that the appeal was denied. In June 2011, the company

filed a lawsuit challenging this decision. The next court hearing is

scheduled for March 2013. No final determination has been reached

on this matter.

The liability at December 31, 2012 of $5,672 million can be

reduced by $573 million of offsetting tax benefits associated with the

correlative effects of potential transfer pricing adjustments, state

income taxes and timing adjustments. The net amount of $5,099

million, if recognized, would favorably affect the company’s effective

tax rate. The net amounts at December 31, 2011 and 2010 were

$5,090 million and $4,849 million, respectively.

Interest and penalties related to income tax liabilities are included

in income tax expense. During the year ended December 31, 2012,

the company recognized $134 million in interest expense and penalties;

in 2011, the company recognized $129 million in interest expense and

penalties, and in 2010, the company recognized a $15 million ben-

efit in interest expense and penalties. The company has $533 million

for the payment of interest and penalties accrued at December 31,

2012, and had $461 million accrued at December 31, 2011.

Within the next 12 months, the company believes it is reasonably

possible that the total amount of unrecognized tax benefits associ-

ated with certain positions may be significantly reduced. The

potential decrease in the amount of unrecognized tax benefits is

primarily associated with the anticipated resolution of the com-

pany’s U.S. income tax audit for 2008 through 2010, as well as

various non-U.S. audits. Specific positions that may be resolved,

and may reduce the amount of unrecognized tax benefits, include

transfer pricing matters, tax incentives and credits as well as vari-

ous other foreign tax matters. The company estimates that the

unrecognized tax benefits at December 31, 2012 could be reduced

by approximately $1,700 million.

With limited exception, the company is no longer subject to U.S.

federal, state and local or non-U.S. income tax audits by taxing

authorities for years through 2007. The years subsequent to 2007

contain matters that could be subject to differing interpretations of

applicable tax laws and regulations related to the amount and/or

timing of income, deductions and tax credits. Although the outcome

of tax audits is always uncertain, the company believes that ade-

quate amounts of tax and interest have been provided for any

adjustments that are expected to result for these years.

The company has not provided deferred taxes on $44.4 billion

of undistributed earnings of non-U.S. subsidiaries at December 31,

2012, as it is the company’s policy to indefinitely reinvest these earn-

ings in non-U.S. operations. However, the company periodically

repatriates a portion of these earnings to the extent that it does not

incur an additional U.S. tax liability. Quantification of the deferred tax

liability, if any, associated with indefinitely reinvested earnings is not

practicable.

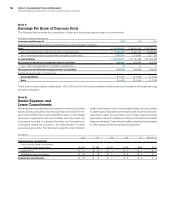

Note O.

Research, Development

and Engineering

RD&E expense was $6,302 million in 2012, $6,258 million in 2011

and $6,026 million in 2010.

The company incurred expense of $6,034 million, $5,990 million

and $5,720 million in 2012, 2011 and 2010, respectively, for scientific

research and the application of scientific advances to the develop-

ment of new and improved products and their uses, as well as

services and their application. Within these amounts, software-

related expense was $3,078 million, $3,097 million and $3,028

million in 2012, 2011 and 2010, respectively.

Expense for product-related engineering was $268 million,

$267 million and $306 million in 2012, 2011 and 2010, respectively.