IBM 2012 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

Management Discussion

International Business Machines Corporation and Subsidiary Companies

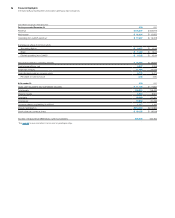

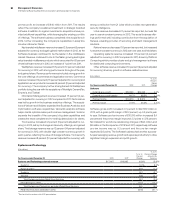

and other investments, increased cash used for acquisitions ($1,911

million) and increased net capital investments ($248 million), partially

offset by increased cash from divestitures ($585 million). Net cash

used in financing activities of $11,976 million was $1,719 million lower,

compared to 2011, primarily due to lower cash used for common

stock repurchases ($3,051 million), partially offset by lower cash

provided by common stock transactions ($914 million) and increased

dividend payments ($300 million).

In January 2013, the company disclosed that it is expecting

GAAP earnings of at least $15.53 and operating (non-GAAP) earn-

ings of at least $16.70 per diluted share for the full year 2013.

For additional information and details, see the “Year in Review”

section on pages 26 through 43. For additional information regard-

ing 2002 free cash flow, see the company’s Form 8-K filed with the

SEC on January 22, 2013.

Description of Business

Please refer to IBM’s Annual Report on Form 10-K filed with

the SEC on February 26, 2013 for a more detailed version of this

Des cription of Business, especially Item 1A. entitled “Risk Factors.”

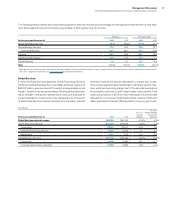

The company creates business value for clients and solves

business problems through integrated solutions that leverage

information technology and deep knowledge of business processes.

IBM solutions typically create value by reducing a client’s operational

costs or by enabling new capabilities that generate revenue. These

solutions draw from an industry-leading portfolio of consulting,

delivery and implementation services, enterprise software, systems

and financing.

Strategy

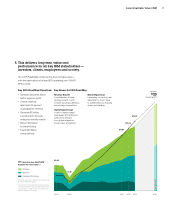

Despite the volatility of the information technology (IT) industry over

the past decade, IBM has consistently delivered strong perfor-

mance, with a steady track record of sustained earnings per share

growth and cash generation. The company has shifted its business

mix, exiting certain segments while increasing its presence in

higher-value areas such as services, software and integrated

solutions. As part of this shift, the company has acquired more

than 140 companies since 2000, complementing and scaling its

portfolio of products and offerings.

IBM’s strategy of delivering high value solutions to enterprise

clients has yielded consistent business results. Working with enter-

prise clients across the full spectrum of their business and

technical opportunities, IBM delivers leadership innovation in tech-

nology, high value solutions and insights that improve client and

industry outcomes. A highly engaged, global workforce with deep

technical and business skills, teamed with an unmatched eco-

system of partners provides a world-class client experience.

These priorities reflect a broad shift in client spending toward

innovation and efficiency, as companies seek higher levels of busi-

ness value from their IT investments. IBM has been able to deliver

this enhanced client value thanks to its industry expertise, under-

standing of clients’ businesses, sustained investment in core and

applied research and development (R&D), global reach and the

breadth and depth of the company’s capabilities.

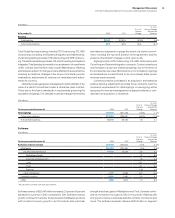

New types of solutions, new market opportunities and new deci-

sion makers are emerging as clients look to make use of technology

to generate innovation and competitive advantage. These opportuni-

ties are driven by a new era of computing that is enabled by

analytics, cloud computing, Big Data, mobility, social computing

and supported by enterprise grade security solutions. The com-

pany’s strategy is to establish leadership in this new era of smarter

computing—computing that is designed for Big Data, built on soft-

ware-defined environments and open—in order to enhance the

value we deliver, create new markets and engage new clients.

To capture the opportunities arising from these market trends,

IBM is focused on four key growth initiatives: Smarter Planet, Growth

Markets, Business Analytics and Optimization and Cloud Comput-

ing. Each initiative represents a significant growth opportunity with

attractive profit margins for IBM.

Smarter Planet

Smarter Planet is IBM’s vision of a technology-enabled world that

is more instrumented, interconnected and intelligent than ever

before, enabling people and organizations to tackle significant busi-

ness and societal challenges. At the heart of this vision is the

opportunity for meaningful innovation—exploring and extending the

boundaries of businesses, industries and communities. It’s about

helping the company’s clients become better at what they do for

their clients. IBM’s strategy is to accelerate progress toward a

“smarter planet” by equipping clients with the advanced, integrated

capabilities they need to thrive in this exciting new world that is

unfolding before us—capabilities such as analytics for business and

physical systems, business process management, social business,

mobile computing and cloud computing.

IBM has continued to deepen its commitment to understanding

and delivering on the promise of Smarter Planet for both line of

business and IT executives across a broad range of industries. An

industry-based approach is central to the strategy, since every

industry confronts a distinct set of challenges and opportunities in

today’s constantly transforming world. Whether “smarter” means

helping a hospital group to deliver improved healthcare, a local gov-

ernment to ease traffic congestion, or a retail chain to execute a

successful cross-channel campaign, IBM is aggressively developing

and investing in a portfolio of industry solutions that helps these

clients achieve their goals.

Three initiatives that drive significant value illustrate IBM’s deep

commitment to building a smarter planet: Smarter Commerce,

Smarter Cities and Social Business. IBM’s Smarter Commerce model

integrates and transforms how companies manage and adapt their

buy, market, sell and service processes, placing the customer

squarely at the center of their business. IBM’s Smarter Cities initiative

enables federal, state and local governments to make smarter deci-

sions, anticipate issues and coordinate resources more effectively,

while delivering citizen-centric services that underpin sustainable

economic growth. IBM’s Social Business initiative helps clients inte-

grate social technologies and practices into their front-end processes

to more effectively create and share knowledge to accelerate innova-

tion, improve customer service, and build a smarter workforce. Each

of these initiatives is powered by market-leading IBM innovations and

software, developed both by IBM and through acquisitions.