IBM 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

Management Discussion

International Business Machines Corporation and Subsidiary Companies

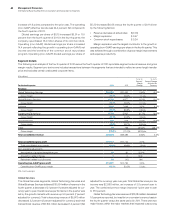

Consolidated Fourth-Quarter Results

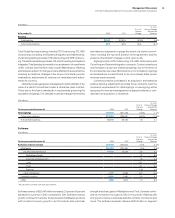

($ and shares in millions except per share amounts)

For the fourth quarter: 2012 2011

Yr.-to-Yr.

Percent/

Margin

Change

Revenue $29,304 $29,486 (0.6)%*

Gross profit margin 51.8% 49.9% 1.8 pts.

Total expense and other income $ 7,336 $ 7,448 (1.5)%

Total expense and other

income-to-revenue ratio 25.0% 25.3% (0.2 ) pts.

Income before income taxes $ 7,831 $ 7,274 7.7%

Provision for income taxes 1,998 1,784 12.0%

Net income $ 5,833 $ 5,490 6.3%

Net income margin 19.9% 18.6%1.3 pts.

Earnings per share of common stock

Assuming dilution $ 5.13 $ 4.62 11.0%

Weighted-average shares outstanding

Assuming dilution 1,136.4 1,188.7 (4.4)%

* 0.3 percent adjusted for currency.

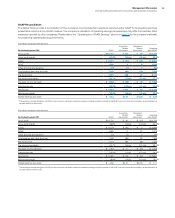

The following table provides the company’s operating (non-GAAP)

earnings for the fourth quarter of 2012 and 2011.

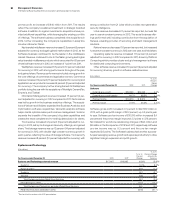

($ in millions except per share amounts)

For the fourth quarter: 2012 2011

Yr.-to-Yr.

Percent

Change

Net income as reported $5,833 $5,490 6.3%

Non-operating adjustments (net of tax)

Acquisition-related charges 243 119 103.4

Non-operating retirement-related

costs/(income) 53 (12)NM

Operating (non-GAAP) earnings* $6,129 $ 5,597 9.5%

Diluted operating (non-GAAP)

earnings per share $ 5.39 $ 4.71 14.4%

* See page 43 for a more detailed reconciliation of net income to operating earnings.

NM—Not meaningful

Snapshot

In the fourth quarter of 2012, the company improved its year-to-year

revenue growth rate, primarily in higher margin areas, while driving

significant margin expansion and profit growth. The company deliv-

ered diluted earning per share of $5.13, a growth of 11.0 percent, and

$5.39, an increase of 14.4 percent on an operating (non-GAAP)

basis. The company generated $6.3 billion in cash from operations

in the fourth quarter driving shareholder returns of $4.0 billion in

gross common stock repurchases and dividends.

Revenue in the fourth quarter declined 0.6 percent as reported,

but was flat at constant currency. Normalized for the RSS divestiture,

revenue increased 1 point at constant currency in the quarter, a

2 point improvement from the third quarter of 2012 constant cur-

rency growth rate. Consistent with the company’s business model

to move to higher value areas, revenue continued to grow in the

higher margin businesses which contributed to the overall margin

expansion and profit growth in the fourth quarter.

On a geographic basis, revenue performance was led by the

growth markets which increased 6.8 percent as reported and 7 per-

cent at constant currency. The BRIC countries delivered combined

growth of 11.4 percent (14 percent adjusted for currency). In the

fourth quarter, over 30 growth market countries grew constant

currency revenue at a double-digit rate reflecting ongoing broad-

based strength.

Within the company’s segments, performance was led by con-

tinued momentum in the growth initiatives and successful product

launches in high-end systems—both of which drove a more profit-

able mix. Software revenue increased 3.5 percent (4 percent

adjusted for currency), driven by business analytics, Smarter Com-

merce and cloud with strength in several emerging areas where the

company has been targeting its investments—Social Business,

mobile and security. Systems and Technology revenue declined 0.7

percent (1 percent adjusted for currency); adjusted for the RSS

divestiture, revenue increased 3.6 percent (4 percent adjusted for

currency) versus the prior year. New product introductions per-

formed well in the quarter. System z revenue increased 55.6 percent

(56 percent adjusted for currency) reflecting strong acceptance of

the new mainframe. System z revenue increased over 50 percent

in the major markets and over 65 percent in the growth markets.

Global Services revenue decreased 2.1 percent (1 percent adjusted

for currency) with the constant currency growth rate consistent with

the third quarter of 2012. Global Services continued to have strong

performance in all of the key growth initiatives which are becoming

a larger part of the services business.

The consolidated gross profit margin increased 1.8 points versus

the fourth quarter of 2011 to 51.8 percent. The operating (non-GAAP)

gross margin increased 2.1 points to 52.3 percent. The improvement

was driven by a combination of strong mainframe growth, good

margin expansion in both services segments and an improving seg-

ment mix due to the relative strength of software.

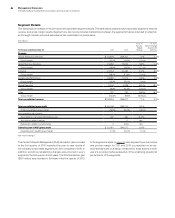

Total expense and other income decreased 1.5 percent in the

fourth quarter compared to the prior year. Total operating (non-

GAAP) expense and other income decreased 2.3 percent. The

year-to-year drivers for both categories were approximately:

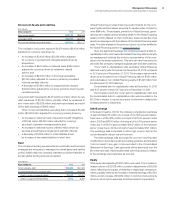

Total Operating

Consolidated (non-GAAP)

• Currency* (1) point (1) point

• Acquisitions** 2 points 2 points

•

Base expense (3) points (3) points

* Reflects impacts of translation and hedging programs.

** Includes acquisitions completed in prior 12-month period.

Pre-tax income grew 7.7 percent and the pre-tax margin was 26.7

percent, an increase of 2.1 points versus the fourth quarter of

2011. Net income increased 6.3 percent and the net income

margin increased 1.3 points to 19.9 percent. The effective tax rate

for the fourth quarter was 25.5 percent, an increase of 1 point

versus the prior year. Operating (non-GAAP) pre-tax income grew

9.5 percent and the operating (non-GAAP) pre-tax margin was

27.7 percent, an increase of 2.6 points versus the prior year. Oper-

ating (non-GAAP) net income increased 9.5 percent and the

operating (non-GAAP) net income margin was 20.9 percent, an