IBM 2012 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

110 Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

110

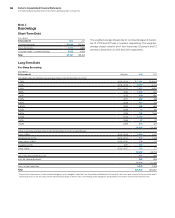

Accumulated Other Comprehensive Income/(Loss) (net of tax)

($ in millions)

Net Unrealized

Gains/(Losses)

on Cash Flow

Hedges

Foreign

Currency

Translation

Adjustments*

Net Change

Retirement-

Related

Benefit

Plans

Net Unrealized

Gains/(Losses)

on Available-

For-Sale

Securities

Accumulated

Other

Comprehensive

Income/(Loss)

December 31, 2009 $(481) $1,836 $(20,297) $ 113 $(18,830)

Other comprehensive income before reclassifications 251 643 (1,684) 51 (739)

Amount reclassified from accumulated other comprehensive income 134 0 692 0 826

Total change for the period 385 643 (992) 51 87

December 31, 2010 (96) 2,478 (21,289) 164 (18,743)

Other comprehensive income before reclassifications (162) (711) (3,581) (7) (4,461)

Amount reclassified from accumulated other comprehensive income 329 0 1,133 (143) 1,319

Total change for the period 167 (711) (2,448) (150) (3,142)

December 31, 2011 71 1,767 (23,737) 13 (21,885)

Other comprehensive income before reclassifications 5 (34) (5,164) 16 (5,177)

Amount reclassified from accumulated other comprehensive income (167) 0 1,495 (25) 1,303

Total change for the period (161) (34) (3,669) (9) (3,874)

December 31, 2012 $ (90) $1,733 $(27,406) $ 4 $(25,759)

* Foreign currency translation adjustments are presented gross except for any associated hedges which are presented net of tax.

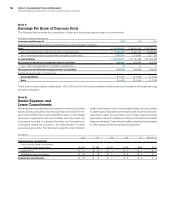

Note M.

Contingencies and Commitments

Contingencies

As a company with a substantial employee population and with

clients in more than 170 countries, IBM is involved, either as plaintiff

or defendant, in a variety of ongoing claims, demands, suits, inves-

tigations, tax matters and proceedings that arise from time to time

in the ordinary course of its business. The company is a leader in

the information technology industry and, as such, has been and will

continue to be subject to claims challenging its IP rights and associ-

ated products and offerings, including claims of copyright and patent

infringement and violations of trade secrets and other IP rights. In

addition, the company enforces its own IP against infringement,

through license negotiations, lawsuits or otherwise. Also, as is typical

for companies of IBM’s scope and scale, the company is party to

actions and proceedings in various jurisdictions involving a wide

range of labor and employment issues (including matters related to

contested employment decisions, country-specific labor and

employment laws, and the company’s pension, retirement and other

benefit plans), as well as actions with respect to contracts, product

liability, securities, foreign operations, competition law and environ-

mental matters. These actions may be commenced by a number of

different parties, including competitors, clients, current or former

employees, government and regulatory agencies, stockholders and

representatives of the locations in which the company does busi-

ness. Some of the actions to which the company is party may involve

particularly complex technical issues, and some actions may raise

novel questions under the laws of the various jurisdictions in which

these matters arise.

The company records a provision with respect to a claim, suit,

investigation or proceeding when it is probable that a liability has

been incurred and the amount of the loss can be reasonably esti-

mated. Any recorded liabilities, including any changes to such

liabilities for the years ended December 31, 2012, 2011 and 2010

were not material to the Consolidated Financial Statements.

In accordance with the relevant accounting guidance, the com-

pany provides disclosures of matters for which the likelihood of

material loss is at least reasonably possible. In addition, the com-

pany also discloses matters based on its consideration of other

matters and qualitative factors, including the experience of other

companies in the industry, and investor, customer and employee

relations considerations.

With respect to certain of the claims, suits, investigations and

proceedings discussed herein, the company believes at this time

that the likelihood of any material loss is remote, given, for example,

the procedural status, court rulings, and/or the strength of the com-

pany’s defenses in those matters. With respect to the remaining

claims, suits, investigations and proceedings discussed in this note,

the company is unable to provide estimates of reasonably possible

losses or range of losses, including losses in excess of amounts

accrued, if any, for the following reasons. Claims, suits, investigations

and proceedings are inherently uncertain, and it is not possible to

predict the ultimate outcome of these matters. It is the company’s

experience that damage amounts claimed in litigation against it are

unreliable and unrelated to possible outcomes, and as such are not

meaningful indicators of the company’s potential liability. Further, the

company is unable to provide such an estimate due to a number of

other factors with respect to these claims, suits, investigations and

proceedings, including considerations of the procedural status of