IBM 2012 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5454 Management Discussion

International Business Machines Corporation and Subsidiary Companies

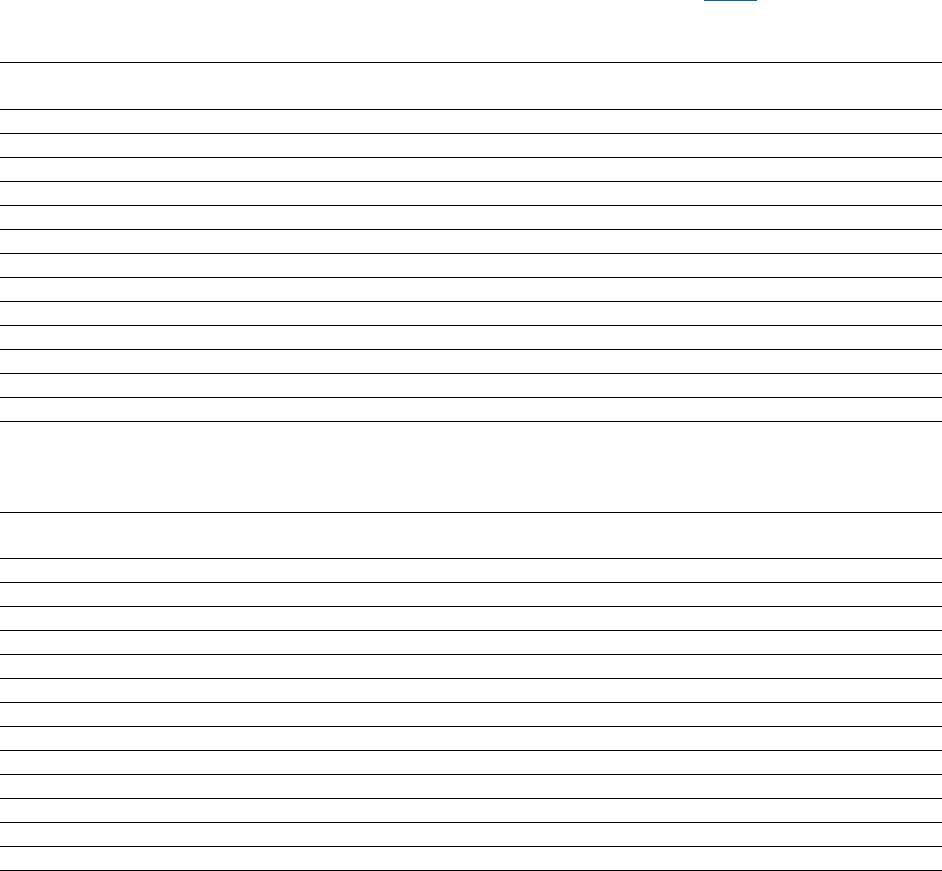

GAAP Reconciliation

The tables below provide a reconciliation of the company’s income statement results as reported under GAAP to its operating earnings

presentation which is a non-GAAP measure. The company’s calculation of operating earnings, as presented, may differ from similarly titled

measures reported by other companies. Please refer to the “Operating (non-GAAP) Earnings” section on page 18 for the company’s rationale

for presenting operating earnings information.

($ in millions except per share amounts)

For the year ended December 31, 2011: GAAP

Acquisition-

Related

Adjustments

Retirement-

Related

Adjustments

Operating

(non-GAAP)

Gross profit $50,138 $ 341 $ 2 $50,481

Gross profit margin 46.9% 0.3 pts. 0.0 pts. 47.2%

SG&A $23,594 $(309) $ (13) $23,272

RD&E 6,258 0 88 6,345

Other (income) and expense (20) (25) 0 (45)

Total expense and other (income) 29,135 (334) 74 28,875

Pre-tax income 21,003 675 (72)21,605

Pre-tax income margin 19.6% 0.6 pts. (0.1) pts. 20.2%

Provision for income taxes* $ 5,148 $ 179 $ (40)$ 5,287

Effective tax rate 24.5% 0.1 pts. (0.1) pts. 24.5%

Net income $15,855 $ 495 $ (32)$16,318

Net income margin 14.8% 0.5 pts. (0.0) pts. 15.3%

Diluted earnings per share $ 13.06 $0.41 $(0.03)$ 13.44

*

The tax impact on operating (non-GAAP) pre-tax income is calculated under the same accounting principles applied to the GAAP pre-tax income which employs an annual

effective tax rate method to the results.

($ in millions except per share amounts)

For the year ended December 31, 2010: GAAP

Acquisition-

Related

Adjustments

Retirement-

Related

Adjustments

Operating

(non-GAAP)

Gross profit $46,014 $ 260 $ (204)$46,070

Gross profit margin 46.1% 0.3 pts. (0.2) pts. 46.1%

SG&A $21,837 $(294) $ 84 $21,628

RD&E 6,026 0 126 6,152

Other (income) and expense (787) (4) 0 (791)

Total expense and other (income) 26,291 (298) 210 26,202

Pre-tax income 19,723 558 (414)19,867

Pre-tax income margin 19.7% 0.6 pts. (0.4) pts. 19.9%

Provision for income taxes* $ 4,890 $ 116 $ (162)$ 4,844

Effective tax rate 24.8% (0.1)pts. (0.3) pts. 24.4%

Net income $14,833 $ 443 $ (253)$15,023

Net income margin 14.9% 0.4 pts. (0.3) pts. 15.0%

Diluted earnings per share $ 11.52 $0.34 $(0.20)$ 11.67

*

The tax impact on operating (non-GAAP) pre-tax income is calculated under the same accounting principles applied to the GAAP pre-tax income which employs an annual

effective tax rate method to the results.