IBM 2012 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

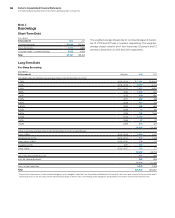

104 Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

104

Long-Term Debt

Pre-Swap Borrowing

($ in millions)

At December 31: Maturities 2012 2011

U.S. dollar notes and debentures (average interest rate at December 31, 2012):

2.79% 2013 – 2014 $ 7,131 $ 8,615

1.46% 2015 – 2016 5,807 2,414

5.29% 2017 –2021 7,457 8,600

1.88% 2022 1,000 500

7.00% 2025 600 600

6.22% 2027 469 469

6.50% 2028 313 313

5.875% 2032 600 600

8.00% 2038 83 187

5.60% 2039 745 1,545

4.00% 2042 1,107 —

7.00% 2045 27 27

7.125% 2096 316 322

25,656 24,192

Other currencies (average interest rate at December 31, 2012, in parentheses):

Euros (3.6%) 2013 – 2019 2,338 1,037

Japanese yen (0.7%) 2013 – 2014 878 1,123

Swiss francs (3.8%) 2015 – 2020 178 173

Canadian (2.2%) 2017 502 —

Other (4.6%) 2013 – 2017 107 177

29,660 26,702

Less: net unamortized discount 865 533

Add: fair value adjustment* 886 994

29,680 27,161

Less: current maturities 5,593 4,306

To t a l $24,088 $22,857

* The portion of the company’s fixed-rate debt obligations that is hedged is reflected in the Consolidated Statement of Financial Position as an amount equal to the sum of the debt’s

carrying value plus a fair value adjustment representing changes in the fair value of the hedged debt obligations attributable to movements in benchmark interest rates.

Note J.

Borrowings

Short-Term Debt

($ in millions)

At December 31: 2012 2011

Commercial paper $1,800 $2,300

Short-term loans 1,789 1,859

Long-term debt—current maturities 5,593 4,306

To t a l $9,181 $8,463

The weighted-average interest rate for commercial paper at Decem-

ber 31, 2012 and 2011 was 0.1 percent, respectively. The weighted-

average interest rates for short-term loans was 1.8 percent and 1.2

percent at December 31, 2012 and 2011, respectively.