IBM 2012 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88 Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

88

Each acquisition further complemented and enhanced the company’s

portfolio of product and services offerings. Green Hat helps custom-

ers improve the quality of software applications by enabling

developers to use cloud computing technologies to conduct testing

of a software application prior to its delivery. Emptoris expands the

company’s cloud-based analytics offerings that provide supply chain

intelligence leading to better inventory management and cost efficien-

cies. Worklight delivers mobile application management capabilities

to clients across a wide range of industries. The acquisition enhances

the company’s comprehensive mobile portfolio, which is designed to

help global corporations leverage the proliferation of all mobile

devices—from laptops and smartphones to tablets. DemandTec

delivers cloud-based analytics software to help organizations improve

their price, promotion and product mix within the broad context of

enterprise commerce. Varicent’s software automates and analyzes

data across sales, finance, human resources and IT departments to

uncover trends and optimize sales performance and operations. Vivi-

simo software automates the discovery of big data, regardless of its

format or where it resides, providing decision makers with a view of

key business information necessary to drive new initiatives. Tealeaf

provides a full suite of customer experience management software,

which analyzes interactions on websites and mobile devices. Butterfly

offers storage planning software and storage migration tools, helping

companies save storage space, operational time, IT budget and

power consumption. Platform Computing’s focused technical and

distributed computing management software helps clients create,

integrate and manage shared computing environments that are

used in compute-and-data intensive applications such as simulations,

computer modeling and analytics. TMS designs and sells high-

performance solid state storage solutions.

For the “Other Acquisitions,” the overall weighted-average life of

the identified amortizable intangible assets acquired is 6.6 years.

These identified intangible assets will be amortized on a straight-line

basis over their useful lives. Goodwill of $1,880 million has been

assigned to the Software ($1,412 million), Global Business Services

(GBS) ($5 million), GTS ($21 million) and STG ($443 million) seg-

ments. As of the acquisition dates, it is expected that approximately

15 percent of the goodwill will be deductible for tax purposes.

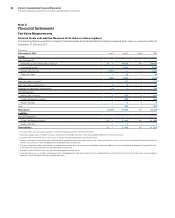

The table below reflects the purchase price related to these acquisitions and the resulting purchase price allocations as of December 31, 2012.

2012 Acquisitions

($ in millions)

Amortization

Life (in Years)

Kenexa

Other

Acquisitions

Current assets $ 133 $ 278

Fixed assets/noncurrent assets 98 217

Intangible assets

Goodwill N/A 1,014 1,880

Completed technology 3 to 7 169 403

Client relationships 4 to 7 179 194

In-process R&D N/A — 11

Patents/trademarks 1 to 7 39 37

Total assets acquired 1,632 3,020

Current liabilities (93) (143)

Noncurrent liabilities (188) (264)

Total liabilities assumed (281) (407)

Total purchase price $1,351 $2,613

N/A—Not applicable