IBM 2012 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134 Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

134

Other Plan Information

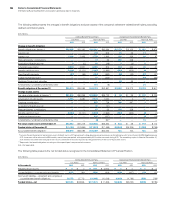

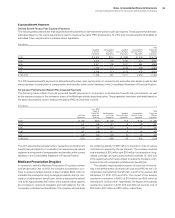

The following table presents information for defined benefit pension plans with accumulated benefit obligations (ABO) in excess of plan

assets. For a more detailed presentation of the funded status of the company’s defined benefit pension plans, see the table on page 124.

($ in millions)

2012 2011

At December 31:

Benefit

Obligation

Plan

Assets

Benefit

Obligation

Plan

Assets

Plans with PBO in excess of plan assets $99,184 $83,799 $83,777 $70,570

Plans with ABO in excess of plan assets 98,263 83,677 83,184 70,512

Plans with assets in excess of PBO 6,944 7,889 13,169 16,011

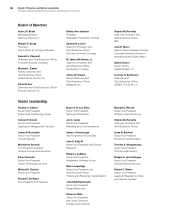

Note T.

Segment Information

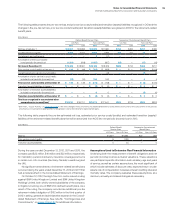

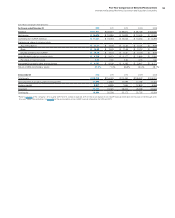

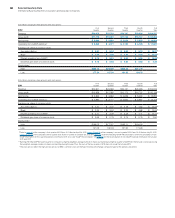

The company’s major operations consist of five business segments:

Global Tech nol ogy Services, Global Business Services, Software,

Systems and Technology and Global Financing. The segments

represent components of the company for which separate financial

information is available that is utilized on a regular basis by the chief

executive officer in determining how to allocate resources and evalu-

ate performance. The segments are determined based on several

factors, including client base, homogeneity of products, technology,

delivery channels and similar economic characteristics.

Information about each segment’s business and the products

and services that generate each segment’s revenue is located in

the “Description of Business” section on pages 23 and 24, and in

“Segment Details,” on pages 26 through 31 in the Management

Discussion.

Segment revenue and pre-tax income include transactions

between the segments that are intended to reflect an arm’s-length,

market-based transfer price. Systems and software that are used by

Global Technology Services in outsourcing engagements are pri-

marily sourced internally from Systems and Technology and

Software. For providing IT services that are used internally, Global

Technology Services and Global Business Services recover cost,

as well as a reasonable fee, that is intended to reflect the arm’s-

length value of providing the services. The Global Services

segments enter into arm’s-length loans at prices equivalent to

market rates with Global Financing to facilitate the acquisition of

equipment used in services engagements. All internal transaction

prices are reviewed annually, and reset if appropriate.

The company utilizes globally integrated support organizations

to realize economies of scale and efficient use of resources. As a

result, a considerable amount of expense is shared by all of the

segments. This shared expense includes sales coverage, certain

marketing functions and support functions such as Accounting,

Treasury, Procurement, Legal, Human Re sources, and Billing and

Collections. Where practical, shared expenses are allocated based

on measurable drivers of expense, e.g., head count. When a clear

and measurable driver cannot be identified, shared expenses are

allocated on a financial basis that is consistent with the company’s

management system, e.g., advertising expense is allocated based

on the gross profits of the segments. A portion of the shared

expenses, which are recorded in net income, are not allocated to the

segments. These expenses are associated with the elimination of

internal transactions and other miscellaneous items.