IBM 2012 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

Management Discussion

International Business Machines Corporation and Subsidiary Companies

Management Discussion Snapshot

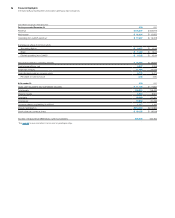

($ and shares in millions except per share amounts)

For the year ended December 31: 2012 2011

Yr.-to-Yr.

Percent/

Margin

Change

Revenue $104,507 $106,916 (2.3)%*

Gross profit margin 48.1% 46.9% 1.2 pts.

Total expense and other income $ 28,396 $ 29,135 (2.5)%

Total expense and other

income-to-revenue ratio 27.2% 27.3% (0.1)pts.

Income before income taxes $ 21,902 $ 21,003 4.3%

Provision for income taxes 5,298 5,148 2.9%

Net income $ 16,604 $ 15,855 4.7%

Net income margin 15.9% 14.8% 1.1 pts.

Earnings per share

of common stock

Assuming dilution $ 14.37 $ 13.06 10.0%

Weighted-average shares

outstanding

Assuming dilution 1,155.4 1,213.8 (4.8)%

Assets** $119,213 $116,433 2.4%

Liabilities** $100,229 $ 96,197 4.2%

Equity** $ 18,984 $ 20,236 (6.2)%

* 0.0 percent adjusted for currency.

** At December 31.

The following table provides the company’s operating (non-GAAP)

earnings for 2012 and 2011.

($ in millions except per share amounts)

For the year ended December 31: 2012 2011

Yr.-to-Yr.

Percent

Change

Net income as reported $16,604 $15,855 4.7%

Non-operating adjustments

(net of tax)

Acquisition-related charges 641 495 29.5

Non-operating retirement-related

costs/(income) 381 (32)NM

Operating (non-GAAP) earnings* $17,627 $16,318 8.0%

Diluted operating (non-GAAP)

earnings per share $ 15.25 $ 13.44 13.5%

NM—Not meaningful

* See page 38 for a more detailed reconciliation of net income to operating earnings.

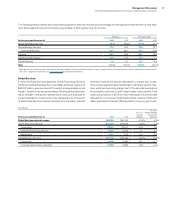

In 2012, the company reported revenue of $104.5 billion, expanded

gross, pre-tax and net income margins, and delivered diluted

earnings per share growth of 10.0 percent as reported and 13.5

percent on an operating (non-GAAP) basis. This was the 10th

consecutive year of double-digit earnings per share growth for

the company. The company generated $19.6 billion in cash from

operations, and $18.2 billion in free cash flow driving shareholder

returns of $15.8 billion in gross common stock repurchases and

dividends. The free cash flow performance in 2012 was $12.3

billion greater than the company generated in 2002. The financial

results demonstrate the strength and flexibility of the company’s

business model, which is designed to deliver profit and cash on

a sustained basis.

The company continued to deliver value to its clients and capitalize

on key trends in 2012. The company had strong performance in busi-

ness analytics, cloud and Smarter Planet—key growth initiatives that

leverage the software portfolio and contribute to margin expansion.

Within the growth markets, the company continued to expand its capa-

bilities and build out IT infrastructures in emerging markets. In 2012, the

growth markets revenue growth rate at constant currency outpaced

the major markets by 8 points. The company continues to invest

for innovation and technological leadership. These investments

supported the introduction of the new System z mainframe, stor-

age and POWER7+ products in hardware, as well as a series of

major launches across software that included more than 400 new or

upgraded product announcements. The introduction of PureSystems,

a new category of expert integrated systems, brings together hardware

and software and provides built-in expertise to deliver a more efficient

and effective solution to the company’s clients. In addition, the company

was awarded more U.S. patents in 2012 than any other company for

the 20th consecutive year, with many of the patents this year in key

areas such as business analytics, Big Data, cybersecurity, cloud, mobile,

social networking and software-defined environments. The company

also continued to add to its capabilities to support the growth initiatives

by acquiring 11 companies in 2012—investing approximately $4 billion.

At the same time, the company divested its Retail Store Solutions

(RSS) business as it focused the Smarter Commerce portfolio on higher

value, intellectual property-based opportunities. Throughout the

year, the company continued the transformation of the business—

shifting to higher value areas and improving its structure—resulting

in a higher quality revenue stream and margin expansion.

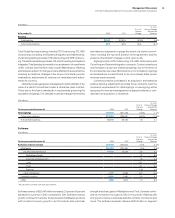

Segment performance was led by Software which increased

revenue 2.0 percent (4 percent adjusted for currency) driven by key

branded middleware which increased 2.9 percent (5 percent adjusted

for currency). Global Services revenue decreased 2.3 percent as

reported, but was up 0.4 percent on a constant currency basis.

Global Services revenue performance was led by the growth markets

which were up 4.8 percent (9 percent adjusted for currency) and now

represents more than 20 percent of total Global Services revenue.

Systems and Technology revenue decreased 6.9 percent; adjusting

for the divested RSS business, revenue declined 5.1 percent (4 percent

adjusted for currency). The company’s new mainframe was well

received in the market, with System z revenue increasing 5.4 percent

(6 percent adjusted for currency) versus the prior year. Global

Financing revenue decreased 4.2 percent as reported, 1 percent

on a constant currency basis, compared to the prior year.

Across all of the segments, the company continued to have

strong performance in its key growth initiatives. These are not stand-

alone offerings; they are integrated into the overall client offerings

and are included in the financial results of the segments. In the

growth markets, revenue increased 4.2 percent (7 percent adjusted

for currency) year to year and represented 24 percent of total geo-

graphic revenue, an increase of 8 points since 2006. The company

has been successful in capturing the opportunity in these faster

growing markets. The company’s business analytics initiative

continues to expand. The company has made significant strides

and expanded its leadership in a number of strategic areas