IBM 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5252 Management Discussion

International Business Machines Corporation and Subsidiary Companies

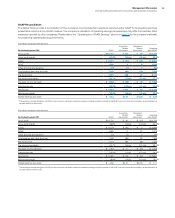

Other (Income) and Expense

($ in millions)

For the year ended December 31: 2011 2010

Yr.-to-Yr.

Percent

Change

Other (income) and expense

Foreign currency transaction

losses/(gains) $513 $ 303 69.2%

(Gains)/losses on

derivative instruments (113) (239)(52.9)

Interest income (136) (92)48.4

Net (gains)/losses from securities

and investment assets (227)31 NM

Other (58)(790)(92.7)

Total consolidated other

(income) and expense $ (20)$(787)(97.4)%

Non-operating adjustment

Acquisition-related charges (25)(4)NM

Operating (non-GAAP) other

(income) and expense $ (45)$(791)(94.3)%

NM—Not meaningful

Other (income) and expense was income of $20 million and

$787 million for 2011 and 2010, respectively. The decrease in income

in 2011 was primarily driven by the net gain ($591 million) from the

PLM transaction recorded in the first quarter of 2010 and a net gain

associated with the disposition of a joint venture in the third quarter

of 2010 ($57 million) reflected in Other in the table above. In addition,

foreign currency rate volatility drove higher foreign currency transac-

tion losses ($210 million) and lower gains on derivative instruments

($126 million). These decreases in income were partially offset by

higher net gains from securities and investment asset sales ($258

million), primarily in the first quarter of 2011.

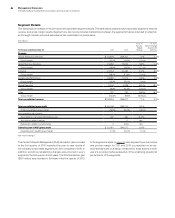

Research, Development and Engineering

($ in millions)

For the year ended December 31: 2011 2010

Yr.-to-Yr.

Percent

Change

Total consolidated research,

development and engineering $6,258 $6,026 3.8%

Non-operating adjustment

Non-operating retirement-related

(costs)/income 88 126 (30.4)

Operating (non-GAAP) research,

development and engineering $6,345 $6,152 3.1%

The company continues to invest in research and development,

focusing its investments on high-value, high-growth opportunities

and to extend its technology leadership. Total RD&E expense

increased 3.8 percent in 2011 versus 2010, primarily driven by acqui-

sitions (up 4 points) and currency impacts (up 2 points), partially

offset by base expense (down 2 points). Operating (non-GAAP)

RD&E expense increased 3.1 percent in 2011 compared to the

prior year primarily driven by the same factors. RD&E investments

represented 5.9 percent of revenue in 2011, compared to 6.0 percent

in 2010.

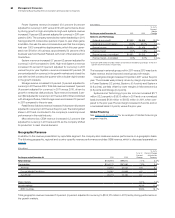

Selling, General and Administrative

($ in millions)

For the year ended December 31: 2011 2010

Yr.-to-Yr.

Percent

Change

Selling, general and

administrative expense

Selling, general and

administrative—other $20,287 $18,585 9.2%

Advertising and promotional expense 1,373 1,337 2.7

Workforce rebalancing charges 440 641 (31.3)

Retirement-related costs 603 494 22.1

Amortization of acquired

intangible assets 289 253 14.4

Stock-based compensation 514 488 5.4

Bad debt expense 88 40 116.6

Total consolidated selling, general

and administrative expense $23,594 $21,837 8.0%

Non-operating adjustments

Amortization of acquired

intangible assets (289)(253)14.4

Acquisition-related charges (20)(41)(52.3)

Non-operating retirement-related

(costs)/income (13)84 NM

Operating (non-GAAP)

selling, general and

administrative expense $23,272 $21,628 7.6%

NM—Not meaningful

Total SG&A expense increased 8.0 percent (5 percent adjusted for

currency) in 2011 versus 2010. Overall the increase was driven by

currency impacts (3 points), acquisition-related spending (3 points)

and base expense (2 points). Operating (non-GAAP) SG&A expense

increased 7.6 percent (5 percent adjusted for currency) primarily

driven by the same factors. Workforce rebalancing charges

decreased $201 million due primarily to actions taken in the first

quarter of 2010 ($558 million). Bad debt expense increased $47

million in 2011 primarily due to higher receivable balances and the

economic environment in Europe. The accounts receivable provision

coverage was 1.5 percent at December 31, 2011, a decrease of 30

basis points from year-end 2010.