IBM 2005 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

_97

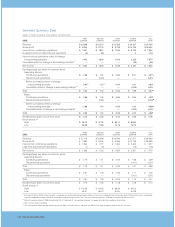

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_97

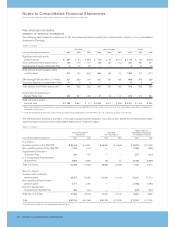

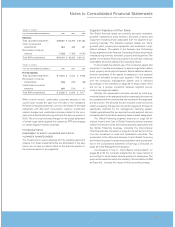

(Dollarsinmillions)

FORTHEYEARENDEDDECEMBER31: 2005 2004 2003

Revenue:

Totalreportablesegments $«98,097 $«103,259 $«95,485

Otherrevenueand

adjustments 563 489 437

Eliminationofinternal

revenue (7,526) (7,455) (6,791)

TotalIBMconsolidated $«91,134 $«««96,293 $«89,131

(Dollarsinmillions)

FOR THE YEARENDEDDECEMBER31: 2005 2004 2003

Pre-TaxIncome:

Totalreportablesegments $«11,503 $«««11,545 $«««9,459

Eliminationofinternal

transactions (166) (152) (89)

Unallocatedcorporate

amounts 889 (724) 47

TotalIBMconsolidated $«12,226 $«««10,669 $«««9,417

Within pre-tax income, unallocated corporate amounts in the

current year include the gain from the sale of the company’s

PersonalComputingbusinesstoLenovo,theimpactofthelegal

settlement with Microsoft Corporation, pension curtailment

related charges and unallocated charges related to the com-

pany’sincrementalrestructuringactionsinthesecondquarterof

2005.Theprioryearincludeschargesforthepartialsettlement

ofcertainlegalclaimsagainstthecompany’s PPP andcharges

forcertainlitigation-relatedexpenses.

Immaterial Items

INVESTMENT IN EQUITY ALLIANCES AND EQUITY

ALLIANCES GAINS/(LOSSES)

Theinvestmentsinequityalliancesandtheresultinggainsand

(losses)fromtheseinvestmentsthatareattributabletotheseg-

mentsdonothaveamaterialeffectonthefinancialpositionor

thefinancialresultsofthesegments.

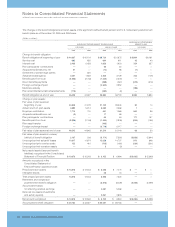

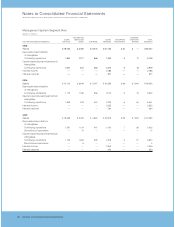

SegmentAssetsandOtherItems

The Global Services assets are primarily accounts receivable,

goodwill,maintenance parts inventory, andplant, property and

equipment including those associated with the segment’s out-

sourcing business. The Software segment assets are mainly

goodwill,plant,propertyandequipment,andinvestmentincap-

italized software. The assets of the Systems and Technology

GroupsegmentandthePersonalComputingDivision areprimarily

manufacturing inventoryandplant,propertyandequipment.The

assetsoftheGlobalFinancing segment areprimarilyfinancing

receivablesandfixedassetsunderoperatingleases.

Toaccomplishtheefficientuseofthecompany’sspaceand

equipment,itusuallyisnecessaryforseveralsegmentstoshare

plant,propertyandequipmentassets.Whereassetsareshared,

landlord ownership of the assets is assigned to one segment

and is not allocated to each user segment. This is consistent

with the company’s management system and is reflected

accordinglyinthescheduleonpage 98.Inthosecases,there

will not be a precise correlation between segment pre-tax

incomeandsegmentassets.

Similarly, the depreciation amounts reported by each seg-

mentarebasedontheassignedlandlordownershipandmaynot

beconsistentwiththeamountsthatareincludedinthesegments’

pre-taxincome.Theamountsthatareincludedinpre-taxincome

reflectoccupancychargesfromthelandlordsegmentandarenot

specifically identified by the management reporting system.

Capitalexpendituresthatarereportedbyeachsegmentalsoare

consistent withthelandlordownershipbasisofassetassignment.

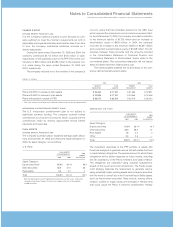

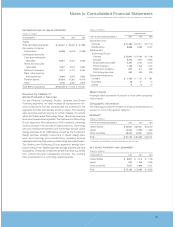

The Global Financing segment amounts on page 98 for

InterestincomeandCostofGlobalFinancinginterestexpense

reflecttheinterestincomeandinterestexpenseassociatedwith

the Global Financing business, including the intercompany

financingactivitiesdiscussedonpage 43, aswellastheincome

from the investment in cash and marketable securities. The

explanationofthedifferencebetweenCostofGlobalFinancing

andInterestexpenseforsegmentpresentationversuspresenta-

tion in the Consolidated Statement of Earnings is included on

page 46 oftheManagementDiscussion.

As discussed in note U, “Stock-Based Compensation” on

pages83to85,thecompanyadoptedthefairvaluemethodof

accountingforstock-basedawardsgrantedtoemployees.The

deferredtaxassetlinewithinthefollowing“ReconciliationtoIBM

asReported,” includestheimpactofthisaccountingchange.