IBM 2005 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

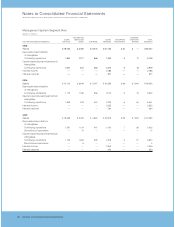

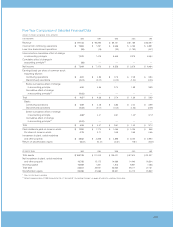

102_ SelectedQuarterlyData

SelectedQuarterlyData

(Dollarsinmillionsexceptpershareamountsandstockprices)

FIRST SECOND THIRD FOURTH FULL

2005: QUARTER QUARTER QUARTER QUARTER YEAR

Revenue $«22,908 $«22,270 $«21,529 $«24,427 $«91,134

Grossprofit $«««8,254 $«««8,775 $«««8,738 $«10,765 $«36,532

Incomefromcontinuingoperations $«««1,407 $«««1,851 $«««1,516 $«««3,220 $«««7,994

(Loss)/income fromdiscontinuedoperations (5) (22) — 3 (24)

Incomebeforecumulativeeffectofchange

inaccountingprinciple 1,402 1,829 1,516 3,223 7,970

Cumulativeeffectofchangeinaccountingprinciple** — — — (36) (36)

Netincome $«««1,402 $«««1,829 $«««1,516 $«««3,187 $«««7,934

Earnings/(loss)pershareofcommonstock:

Assumingdilution:

Continuingoperations $«««««0.85 $«««««1.14 $«««««0.94 $«««««2.01 $«««««4.91* +

Discontinuedoperations — (0.01) — — (0.01)

Beforecumulativeeffectofchange

inaccountingprinciple 0.84+1.12+0.94 2.01 4.90**

Cumulativeeffectofchangeinaccountingprinciple** — — — (0.02) (0.02)

Total $«««««0.84 $«««««1.12 $«««««0.94 $«««««1.99 $«««««4.87** +

Basic:

Continuingoperations $«««««0.86 $«««««1.15 $«««««0.95 $«««««2.04 $«««««4.99*

Discontinuedoperations — (0.01) — — (0.02) *****

Beforecumulativeeffectofchange

inaccountingprinciple 0.86 1.14 0.95 2.04 4.98** +

Cumulativeeffectofchangeinaccountingprinciple** — — — (0.02) (0.02)

Total $«««««0.86 $«««««1.14 $«««««0.95 $«««««2.02 $«««««4.96***

Dividendspershareofcommonstock $«««««0.18 $«««««0.20 $«««««0.20 $«««««0.20 $«««««0.78

Stockprices:++

High $«««99.10 $«««91.76 $«««85.11 $«««89.94

Low 89.09 71.85 74.16 78.70

FIRST SECOND THIRD FOURTH FULL

2004: QUARTER QUARTER QUARTER QUARTER YEAR

Revenue $«22,175 $«23,098 $«23,349 $«27,671 $«96,293

Grossprofit $«««7,892 $«««8,406 $«««8,533 $«10,738 $«35,569

Incomefromcontinuingoperations $«««1,364 $«««1,737 $«««1,554 $«««2,842 $«««7,497

Lossfromdiscontinuedoperations (1) (2) — (15) (18)

Netincome $«««1,363 $«««1,735 $«««1,554 $«««2,827 $«««7,479

Earnings/(loss)pershareofcommonstock:

Assumingdilution:

Continuingoperations $«««««0.79 $«««««1.01 $«««««0.92 $«««««1.68 $«««««4.39*

Discontinuedoperations — — — (0.01) (0.01)

Total $«««««0.79 $«««««1.01 $«««««0.92 $«««««1.67 $«««««4.38*

Basic:

Continuingoperations $«««««0.81 $«««««1.03 $«««««0.93 $«««««1.71 $«««««4.48

Discontinuedoperations — — — (0.01) (0.01)

Total $«««««0.81 $«««««1.03 $«««««0.93 $«««««1.70 $«««««4.47

Dividendspershareofcommonstock $«««««0.16 $«««««0.18 $«««««0.18 $«««««0.18 $«««««0.70

Stockprices:++

High $«100.43 $«««94.55 $«««88.44 $«««99.00

Low 89.01 85.12 81.90 84.29

* EarningsPerShare(EPS)ineachquarteriscomputedusingtheweighted-averagenumberofsharesoutstandingduringthatquarterwhileEPSforthefullyeariscomputed

usingtheweighted-averagenumberofsharesoutstandingduringtheyear.Thus,thesumofthefourquarters’EPSdoesnotequalthefull-yearEPS.

** ReflectsimplementationofFASBInterpretationNo.47.Seenote B,“AccountingChanges,” onpages61 and62 foradditionalinformation.

+ Doesnottotalduetorounding.

++ThestockpricesreflectthehighandlowpricesforIBM’scommonstockontheNewYorkStockExchangecompositetapeforthelasttwoyears.