IBM 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_71

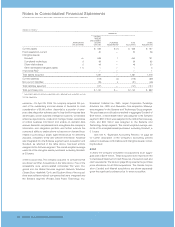

Post-SwapBorrowing(long-termdebt, includingcurrentportion)

(Dollarsinmillions)

2005 2004

ATDECEMBER31: AMOUNT AVERAGERATE AMOUNT AVERAGERATE

Fixedratedebt $«««8,099 «4.84% $«««9,112 «4.13%

Floatingratedebt* «10,314 «4.82% «««9,324 «3.22%

Total $«18,413 « $«18,436 «««

* Includes$7,811 millionin2005and $8,326 millionin2004ofnotionallong-terminterestrateswapsthateffectivelyconvertthefixed-ratedebtintofloating-ratedebt.(Seenote

L,“DerivativesandHedgingTransactions,”onpages 71 to74).

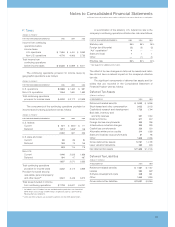

Pre-swap annual contractual maturities of long-term debt out-

standing atDecember31,2005,are asfollows:

(Dollarsinmillions)

2006 $«««3,013

2007 2,843

2008 1,485

2009 2,195

2010 1,690

2011 andbeyond 6,961

Total $«18,187

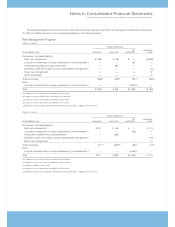

InterestonDebt

(Dollarsinmillions)

FORTHEYEARENDEDDECEMBER31: 2005 2004 2003

CostofGlobalFinancing $«525 $«428 $«503

Interestexpense 220 139 145

Interestcapitalized 16 415

Totalinterest ondebt $«761 $«571 $«663

Refer to the related discussion on page 97 in note W,

“SegmentInformation,” fortotalinterestexpenseoftheGlobal

Financing segment. See note L, “Derivatives and Hedging

Transactions,” onpages 71 to74 foradiscussionoftheuseof

currencyand interestrateswaps in thecompany’s debt risk

managementprogram.

LinesofCredit

OnMay27,2004,thecompanycompletedtherenegotiationofa

new$10billion 5-yearCreditAgreement with JP Morgan Chase

Bank,asAdministrativeAgent,andCitibank,N.A.,asSyndication

Agent,replacingcreditagreementsof$8billion(5-year)and$2

billion (364 day). The total expense recorded by the company

related to these facilities was $8.9 million for the years ended

December31,2005and2004, and$7.8 millionfortheyear ended

December 31, 2003. The new facility is irrevocable unless the

companyisin breachofcovenants, includinginterestcoverage

ratios,orifitcommitsanevent ofdefault,suchasfailingtopay

any amount due under this agreement. The company believes

that circumstances that might give rise to a breach of these

covenants or an event of default, as specified in these agree-

ments,areremote.Thecompany’s otherlinesof credit, most of

whichareuncommitted,totaled$10,057 millionand$9,041 million

atDecember31,2005 and2004,respectively.Interestratesand

other terms of borrowing under these lines of credit vary from

countrytocountry,dependingonlocalmarketconditions.

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

Unusedlines:

Fromthecommitted

globalcreditfacility $«««9,913 $«««9,804

Fromothercommittedand

uncommittedlines 6,781 6,477

Totalunusedlinesofcredit $«16,694 $«16,281

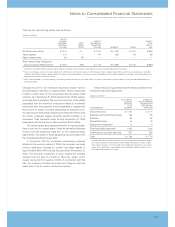

L.DerivativesandHedgingTransactions

Thecompanyoperatesinmultiplefunctionalcurrenciesandisa

significantlenderandborrowerintheglobalmarkets.Inthenor-

malcourseofbusiness,thecompanyisexposedtotheimpactof

interestratechangesandforeigncurrencyfluctuations,andtoa

lesser extent equity price changes and client credit risk. The

companylimitstheserisksbyfollowingestablishedriskmanage-

mentpoliciesandprocedures,including theuseof derivatives,

and,wherecost-effective,financingwithdebtinthecurrenciesin

which assets are denominated. For interest rate exposures,

derivativesareusedtoalignratemovementsbetweentheinter-

estratesassociatedwiththecompany’sleaseandotherfinancial

assetsandtheinterestratesassociatedwithitsfinancingdebt.

Derivativesarealsousedtomanagetherelatedcostofdebt.For

foreign currency exposures, derivatives are used to limit the

effectsofforeignexchangeratefluctuationsonfinancialresults.

Asaresultofthecompany’suseofderivativeinstruments,

the company is exposed to the risk that counterparties to

derivativecontractswillfailtomeettheircontractualobligations.

To mitigate the counterparty credit risk, the company has a

policy of only entering into contracts with carefully selected

majorfinancial institutions basedupontheir creditratings and

other factors, and maintains strict dollar and term limits that

correspond to the institution’s credit rating. The company’s

establishedpoliciesandproceduresformitigatingcreditriskon

principaltransactionsincludereviewingandestablishinglimits

forcreditexposureand continually assessingthecreditworthi-

nessofcounterparties.Masteragreementswithcounterparties

include master netting arrangements as further mitigation of

creditexposure to counterparties. These arrangementspermit