IBM 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

64_ NotestoConsolidatedFinancialStatements

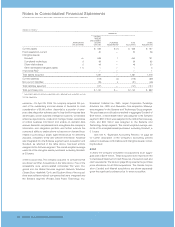

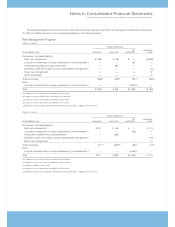

(Dollarsinmillions)

ASCENTIAL

ORIGINAL

AMOUNT

DISCLOSEDIN

AMORTIZATION SECOND PURCHASE TOTAL OTHER

LIFE(INYEARS) QTR. 2005 ADJUSTMENTS* ALLOCATION ACQUISITIONS

Currentassets $««««526 $««(1) $««««525 $«««137

Fixedassets/non-current 20 — 20 28

Intangibleassets:

Goodwill NA 639 1 640 791

Completedtechnology 3 56 — 56 35

Clientrelationships 5 46 — 46 22

Otheridentifiableintangibleassets 1–5 — — — 5

In-processR&D ——— 1

Totalassetsacquired 1,287 — 1,287 1,019

Currentliabilities (112) (4) (116) (89)

Non-currentliabilities (35) 4 (31) (48)

Totalliabilitiesassumed (147) — (147) (137)

Totalpurchaseprice $«1,140 $«— $«1,140 $«««882

* Adjustmentsprimarilyrelatetoacquisitioncosts,deferredtaxesandotheraccruals.

NA—NotApplicable

ASCENTIAL – On April 29, 2005, the company acquired100 per-

cent of the outstanding common shares of Ascential for cash

consideration of $1,140 million. Ascential is a provider of enter-

prisedataintegrationsoftwareusedtohelpbuildenterprisedata

warehouses, power business intelligence systems, consolidate

enterpriseapplications,createandmanagemasterrepositories

of critical business information and enable on demand data

access.Ascentialcomplementsandstrengthensthecompany’s

information and integration portfolio and further extends the

company’sabilitytoenableclientstobecomeondemandbusi-

nesses by providing a single, agile infrastructure for delivering

accurate,consistent,timely andcoherentinformation. Ascential

wasintegratedintotheSoftwaresegmentuponacquisitionand

Goodwill, as reflected in the table above, has been entirely

assignedtotheSoftwaresegment. Theoverallweightedaverage

usefullifeoftheintangibleassetspurchased,excludingGoodwill,

is3.9years.

OTHERACQUISITIONS –Thecompanyacquired 15 companies that

areshownasOtherAcquisitionsinthetable above. Fiveofthe

acquisitions were service-related companies that were inte-

grated into the Global Services segment: Network Solutions;

ClassicBlue;Healthlink;Corio;andEquitant. Nineoftheacquisi-

tionsweresoftware-relatedcompaniesthatwereintegratedinto

the Software segment: iPhrase; Data Power Technology, Inc.;

Bowstreet; Collation Inc.; DWL; Isogon Corporation; PureEdge

Solutions, Inc.; SRD; and Gluecode. One acquisition, Meiosys,

was integratedin theSystemsandTechnologyGroupsegment.

ThepurchasepriceallocationsresultedinaggregateGoodwillof

$791 million,ofwhich $456 millionwasassignedtotheSoftware

segment;$301 millionwasassignedtotheGlobalServicesseg-

ment; and $34 million was assigned to the Systems and

TechnologyGroupsegment. Theoverallweightedaverageuse-

fullifeoftheintangibleassetspurchased,excludingGoodwill, is

3.1 years.

Seenote A, “Significant AccountingPolicies,” on page 58

for further description of the company’s accounting policies

relatedtobusinesscombinationsandintangibleassets, includ-

ingGoodwill.

2004

In2004, the company completed14 acquisitionsat an aggre-

gatecostof$2,111 million.Theseacquisitionsarereportedinthe

ConsolidatedStatementofCashFlowsnetofacquiredcashand

cashequivalents.Thetable onpage65 representsthepurchase

priceallocationsfor all 2004acquisitions.The Candle Corpor-

ation (Candle) and Maersk acquisitions are shown separately

giventhesignificantpurchasepriceforeachacquisition.