IBM 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_31

primarilydriven by the final paymentreceivedfromHitachi for

thepurchaseoftheHDDbusiness,and$1,637millionduetothe

effectsofcurrency;andadecreaseof$475millionininventories

primarily driven by the Personal Computing divestiture and

reductionsintheSystemsandTechnologyGroupserverbrands.

These declines werepartiallyoffsetby the$3,116millionincrease

(approximately$3,905millionbeforenegativecurrencyimpact

of$789million) in Cash and cash equivalents and Marketable

securities(seetheCashFlowanalysis below).

Currentliabilities decreased$4,634 millionprimarilydueto

declinesof: $2,095 millionin Accounts payable ofwhichapprox-

imately $1,100 million was due to the Personal Computing

divestiture and $332 million due to the effects of currency;

$1,303 million in other accruals driven primarily by a decline

in derivative liabilities due to year-to-year changes in foreign

currencyrates;and$883millioninShort-termdebtprimarilydue

to the settlement of $2,300 million in commercial paper debt,

partiallyoffsetbynewdebtissuancesof approximately$1,500

milliontofacilitate foreignearningsrepatriationactions.

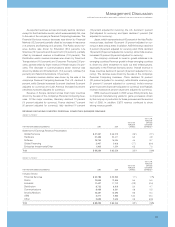

CASH FLOW

Thecompany’scashflowfromoperating,investingandfinanc-

ingactivities,asreflectedintheConsolidatedStatementofCash

Flows on page 50, are summarized in the table below. These

amountsincludethecashflowsassociatedwiththecompany’s

GlobalFinancingbusiness.Seepages 43 through 47.

(Dollarsinmillions)

FORTHEYEARENDEDDECEMBER31: 2005 2004

Netcashprovidedby/(usedin)

continuingoperations:

Operatingactivities $«14,914 $«15,349

Investingactivities (4,423) (5,346)

Financingactivities (7,147) (7,562)

Effectofexchangeratechanges

oncashandcashequivalents (789) 405

Netcashusedindiscontinued

operations* (40) (83)

Netchangeincashand

cashequivalents $«««2,515 $«««2,763

* Doesnotinclude$319millionin2005ofnetproceedsfromthesaleoftheHDD

business.$51 millionisincludedin Operatingactivities fromcontinuingoperations

and$268millionisincludedin Investingactivities fromcontinuingoperations.

Netcash fromoperatingactivitiesfor theyearendedDecember

31, 2005 decreased $435 million as compared to 2004. The

decrease was primarily driven by an increase in restructuring

paymentsof$1,012million and anincreasein pensionfunding in

theUnitedStates ofapproximately$1,015 million, partiallyoffset

bythe$775million legal settlementpaymentfromMicrosoft and

$493millionduetoimprovedmanagementofinventoryprimarily

inthe SystemsandTechnologyGroup.

Net cashusedin investingactivitiesdecreased$923million

onayear-to-yearbasisdrivenby:a$907millionimprovementin

divestiture-related cash due to the divestiture of the Personal

Computing business and disposition of a portion of Lenovo

shares (approximately $662 million) and the final net payment

received from Hitachi for the purchase of the HDD business

(approximately$268million);a$218 milliondeclineinnetcapi-

talspending and$256million in lower cashspendingfor acqui-

sitions;however,thecompanydidexpend$1,482 millioninnet

cash on acquisitions in 2005. These declines were partially

offset by a $458 million increase in marketable securities and

otherinvestments.

Thedecreaseinnetcash usedinfinancingactivitiesof$415

millionwasprimarilytheresultofanincreaseinnetcash inflows

relatedtodebtofapproximately$1,636million,partiallyoffsetby

highernetpaymentsforcommonstockactivityof$1,145million

andhigherdividendpaymentsof$76million.Within total debt,

on a net basis, in 2005, the company had $609 million in net

cash proceeds from new debt versus $1,027 million used to

retire debt in 2004. The net cash proceeds of $609 million in

2005 comprise $4,363millionofcashproceedsfromnewdebt

partiallyoffsetby$3,522millionofcashpaymentstosettledebt

andby $232million inshort-term repayments.Thehigherpay-

mentsforcommonstockweredriven by increasesofapproxi-

mately$594millionincashpaymentstorepurchasestockand

decreases of approximately $551 million in cash received for

stock issued under the company’s stock option plan and

employeestockpurchaseplan.

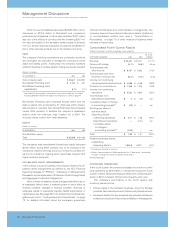

NON-CURRENT ASSETS AND LIABILITIES

(Dollarsinmillions)

AT DECEMBER31: 2005 2004

Non-currentassets $«60,087 $«63,860

Long-termdebt $«15,425 $«14,828

Non-currentliabilities (excludingdebt) $«22,073 $«24,701

ThedecreaseinNon-currentassetsof$3,773millionwasprima-

rily driven by declines of: $2,141 million in Investments and

sundryassets;$1,419millioninPlant,rentalmachines,andother

property-net which was driven by the effects of currency

(approximately$562million)andassetsales;and$1,322 million

inLong-termfinancingreceivables(seepage 45). Thedecline

inInvestmentsandsundry assets was mainly dueto a$2,839

milliondecrease($252millionduetotheeffectsofcurrency)in

deferredtaxassetsdrivenby theutilizationofincometaxcredit

carryforwardsandU.S.andnon-U.S.pensionactivity,partially

offset by increases of $314 million in deferred transition costs

drivenbygrowthinservicesarrangementswithclients,$155mil-

lion in alliance investments primarily due to the company’s

equityinterestinLenovo,and$112millioninnon-currentderiva-

tive assets dueto theappreciationoftheU.S.dollaragainstcer-

tainforeigncurrencies. Thesedeclineswerepartially offsetby

increasesof$1,004millioninGoodwilldrivenbythecompany’s

acquisitions and $231 million (approximately $1,220 million

beforenegativecurrencyimpactof$989million)inPrepaidpen-

sionassetsdueprimarilytothe$1,700 million fundingoftheIBM

PersonalPensionPlan(PPP) inthefirstquarterof2005.

Long-term debt increased $597 million due to new debt

issuances. Thecompanycontinuallymonitorsits liquidityprofile

andinterestrates, andmanagesitsshort- andlong-term debt

portfoliosaccordingly.