IBM 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

34_ ManagementDiscussion

PriorYearinReview

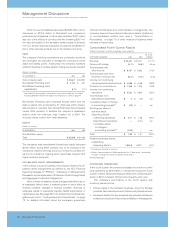

(Dollars andshares inmillionsexceptpershareamounts)

YR. TOYR.

FOR THEYEARENDEDDECEMBER31: 2004 2003 CHANGE

Revenue $«««96,293 $«««89,131 8.0% *

Grossprofitmargin «36.9% «36.5% 0.4 pts.

Totalexpenseand

otherincome $«««24,900 $«««23,130 7.7%

Totalexpenseandother

income-to-revenueratio 25.9% 26.0% (0.1) %

Incomefromcontinuing

operationsbefore

incometaxes $«««10,669 $«««««9,417 13.3%

Provisionforincometaxes $«««««3,172 $«««««2,829 12.1%

Incomefromcontinuing

operations $«««««7,497 $«««««6,588 13.8%

Lossfromdiscontinued

operations $««««««««««18 $««««««««««30 (41.3) %

Earningspershare of

commonstock:

Assumingdilution:

Continuingoperations $«««««««4.39 $«««««««3.76 16.8%

Discontinuedoperations ««««««(0.01) ««««««(0.02) (39.8) %

Total $«««««««4.38 $«««««««3.74 17.1%

Weighted-averageshares

outstanding:

Assumingdilution 1,707.2 1,752.8 (2.6) %

Assets** $«111,003 $«106,021 4.7%

Liabilities** $«««79,315 $«««76,490 3.7%

Equity** $«««31,688 $«««29,531 7.3%

* 3.4percent adjusted for currency.

** AtDecember31

of the economy and continued market share gains for

zSeries, xSeries and pSeries server products, as well as

increasedrevenueforpersonalcomputers

• Continued demand growth in emerging countries (up over

25percent)andinBPTS(upapproximately45percent)

• Favorableimpactofcurrencytranslation

Revenuefromallindustrysectorsincreasedin2004whencom-

paredto2003,reflectingthecompany’sbroadcapabilitiesand

industry-specificsolutionswhichcombinetechnologyandhigh-

valueservicestosolveaclient’sbusinessorITproblems.These

solutions also provide for a longer-term relationship with the

client, rather than a transaction-oriented sale. The Financial

Services sector revenue growth of 9.3 percent was led

by Financial Markets (15 percent), Banking (9 percent) and

Insurance(8percent).TheCommunicationssectorhadrevenue

growth of10.4 percent with growth in Telecommunications (15

percent), while the Distribution sector revenue growth was 7.5

percent, led by the Retail Industry (12 percent). The Small &

Mediumbusinesssectorrevenueincreased8.3percentasthe

companycontinuedtorolloutnewproductsundertheExpress

labelthataredesignedandpricedspecificallyfor clients inthe

100to1,000employeesegment.

Revenue across all geographies increased in 2004 when

compared to 2003. In the Americas, U.S. (6 percent) and

Canada(9percent)revenuegrewasdidLatinAmerica(12per-

cent),notablyBrazil,whichgrewat15percent.

Within Europe/Middle East/Africa, Eastern Europe, the

Nordiccountries,Spain(7percent)andFrance(3percent)had

revenuegrowth,whiletheU.K.(2percent),Germany(3percent)

andItaly(8percent)declined whenadjusted forcurrency.Asia

Pacifichadstronggrowthin2004,ledbyChina,whichgrewat

25 percent, and the ASEAN region (17 percent), while Japan,

which is about 60 percent of Asia Pacific’s revenue, also had

growth of 5 percent. Collectively, as a result of the company’s

targetedinvestments,theemergingcountriesofChina,Russia

(75percent),India(45percent)andBrazilhadrevenuegrowth

over25percentin2004toover$4.0billioninrevenue.

OEMrevenueincreasedin2004versus2003dueprimarily

to continued strong growth in the company’s E&TS business

and improved operational performance in the Microelectron-

icsbusiness.

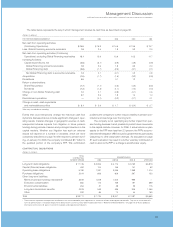

Thefollowingisananalysisofexternalsegmentresults.

GLOBAL SERVICES

Global Services revenue increased 8.4 percent (3.1 percent

adjustedforcurrency).SOrevenuegrew 12.8 percentandcon-

tinuedtodemonstrateitscompetitiveadvantageindeliveringon

demand solutions by leveraging both its business transforma-

tionalskills and scale during2004.Eachgeography continued

year-to-yeargrowth,withsevenconsecutivequartersofdouble-

digit growth in Europe/Middle East/Africa, excluding currency

benefits.WithinSO,e-businessHostingServices,anofferingthat

providesWebinfrastructureandapplicationmanagementasan

Internet-basedservice,continueditspatternofrevenuegrowth.

ITSrevenue,whichexcludesMaintenance,increased4.8percent

ContinuingOperations

In2004,thecompanydemonstratedthatitcouldextenditslead-

ershipinagrowthenvironment.Thecompanydeliveredrevenue

growthof8.0percentanddilutedearningspersharegrowthof

16.8percent.Theincreaseinthecompany’sIncomefromcontin-

uingoperationsanddilutedearningspersharefromcontinuing

operationsascomparedto2003wasprimarilydueto:

• Improvingdemandassociatedwiththemoderateexpansion

oftheeconomyandcontinuedmarketsharegainsforzSeries

andxSeriesserverproducts

• Continued operational improvements in the Microelec-

tronicsbusiness

• Continueddemandgrowthinemergingcountries

• Favorableimpactofcurrencytranslation

Theincreaseinrevenuein2004ascomparedto2003waspri-

marilydueto:

• ImproveddemandinGlobalServicesandkeyindustrysectors

• Improvingdemandassociatedwiththemoderateexpansion