IBM 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

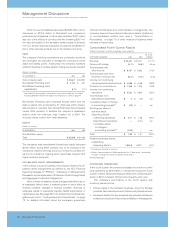

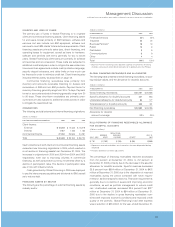

Thetablebelowrepresentsthewayinwhichmanagementreviewsitscashflowasdescribed onpage38.

(Dollarsinbillions)

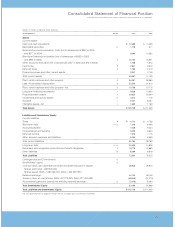

FORTHEYEARENDEDDECEMBER31: 2005 2004 2003 2002 2001

Netcashfromoperatingactivities

(ContinuingOperations): $«14.9 $«15.3 $«14.5 $«13.8 $«13.7

Less: GlobalFinancingaccountsreceivable 1.8 2.5 1.9 3.3 2.0

Netcashfromoperatingactivities(Continuing

Operations),excludingGlobalFinancingreceivables 13.1 12.9 12.6 10.5 11.7

InvestingActivities:

Capitalexpenditures,net (3.5) (3.7) (3.9) (4.6) (4.9)

GlobalFinancingaccountsreceivable 1.8 2.5 1.9 3.3 2.0

GlobalFinancingdebt (0.6) (1.7) (2.6) (3.1) (1.1)

NetGlobalFinancingdebt toaccountsreceivable 1.3 0.7 (0.7) 0.2 0.9

Acquisitions (1.5) «(1.7) (1.8) (3.2) (0.9)

Divestitures 0.9 — 0.1 1.2 —

Returntoshareholders:

ShareRepurchase ««(7.7) «(7.1) «««(4.3) ««(4.2) «««(5.3)

Dividends (1.2) (1.2) (1.1) (1.0) (1.0)

Changeinnon-GlobalFinancingdebt 1.2 0.7 (0.9) (0.1) 0.6

Other ««0.7 «2.5 «««1.9 ««1.4 «««1.4

Discontinuedoperations —(0.1) (0.2) (0.7) 0.1

Changeincash, cashequivalents

andmarketablesecurities ««$«««3.1 «$«««2.9 «««$«««1.7 ««$««(0.4) «««$«««2.7

Tablemaynotaddduetorounding.

Events that could temporarily change the historical cash flow

dynamicsdiscussed above include significantchangesinoper-

atingresults,material changes ingeographic sources of cash,

unexpected adverse impacts from litigation or future pension

fundingduringperiodsofsevereandprolongeddownturninthe

capital markets. Whether any litigation has such an adverse

impact will depend on a number of variables, which are more

completelydescribedonpage 78.Withrespecttopensionfund-

ing,onJanuary19,2005, thecompanycontributed$1.7billionto

the qualified portion of the company’s PPP. This contribution

positionsthecompanytofurtherreducevolatilityinpensioncon-

tributionsandearningsoverthelongterm.

Thecompany isnotquantifyinganyfurtherimpactfrompen-

sionfundingbecauseitisnotpossibletopredictfuturemovements

inthecapitalmarkets.However,for 2006,ifactualreturnsonplan

assetsforthePPPwerelessthan 2.3 percent,thePPP’saccumu-

latedbenefitobligation(ABO)wouldbegreaterthanitsplanassets

(assuming no other assumption change). As discussed on page

87,suchasituationmayresultinafurthervoluntarycontributionof

cashorstocktothePPPorachargetostockholders’ equity.

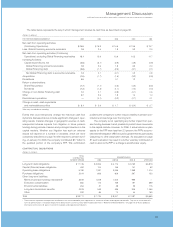

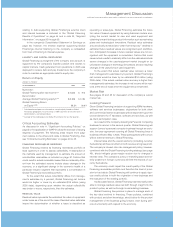

CONTRACTUAL OBLIGATIONS

(Dollarsinmillions)

TOTAL

CONTRACTUAL PAYMENTSDUEIN

PAYMENTSTREAM 2006 2007-08 2009-10 AFTER2010

Long-termdebtobligations $«17,745 $«2,906 $«4,174 $«3,752 $«6,913

Capital(finance)leaseobligations 452 104 155 141 52

Operatingleaseobligations 5,780 1,331 2,066 1,369 1,014

Purchaseobligations 2,104 809 906 267 122

Otherlong-termliabilities:

Minimumpensionfunding(mandated)* 3,816 1,818 1,002 996 —

Executivecompensation 850 115 169 197 369

Environmentalliabilities 254 27 29 23 175

Long-termterminationbenefits 2,378 549 436 308 1,085

Other 332 65 70 44 153

Total $«33,711 $«7,724 $«9,007 $«7,097 $«9,883

* Theseamountsrepresentfuturepensioncontributionsthataremandatedbylocalregulationsorstatuteforretireesreceivingpensionbenefits.Theyareallassociatedwith

non-U.S.pensionplans.Theprojectedpaymentsbeyond2010 arenotcurrentlydeterminable.Seenote V,“Retirement-RelatedBenefits,”onpages 85to95 foradditional

informationonthenon-U.S.plans’investmentstrategiesandexpectedcontributions.

_39