IBM 2005 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_87

Inaddition,certainofthecompany’snon-U.S.subsidiaries

havedefinedbenefitnonpensionpostretirementplansthatpro-

videmedicalanddentalbenefitsforeligible non-U.S. retirees

andeligibledependents,aswellaslifeinsuranceforcertaineli-

gible non-U.S. retirees. However, most of the retirees outside

theUnitedStates arecoveredbygovernment sponsoredand

administeredprograms.

AccountingPolicy

DEFINED BENEFIT PENSION AND NONPENSION

POSTRETIREMENT BENEFIT PLANS

Thecompanyaccountsforitsdefinedbenefitpensionplansand

itsnonpensionpostretirementbenefitplansinaccordancewith

theprovisionsoftheapplicableGAAP,whichrequiresthecom-

panytorecordits obligation totheparticipants,aswell as the

corresponding net periodic cost. The company determines its

obligationtotheparticipantsanditsnetperiodiccostprincipally

usingactuarialvaluationsprovidedbythird-partyactuaries.

Theamount that thecompany recordsinits Consolidated

StatementofFinancialPositionisreflectiveofthetotalprojected

benefitobligation(PBO), the fair valueof planassetsand any

deferred gains or losses at the measurement date. The com-

panyusesaDecember31 measurementdateforthemajorityof

its pension plans and nonpension postretirement plans. The

PBO is the actuarial present value of benefits expected to be

paidupon retirementbaseduponestimated futurecompensa-

tionlevels.Thefairvalueofplanassetsrepresentsthecurrent

marketvalueofcumulativecompanycontributionsmadetoan

irrevocabletrust fund, heldforthesolebenefitof participants,

whichareinvestedbythetrust.Deferredgainsorlossesariseas

a result of events that impact the plan and affect current and

future net periodic cost/(income), as permitted by accounting

standards. Examples of such “events” include plan amend-

mentsandchangesinactuarialassumptionssuchasdiscount

rate,rateofcompensationincreasesandmortality.

Theprincipleunderlying recognitionofincome/expenseis

thatemployeesrenderserviceovertheirservicelivesonarela-

tivelysmoothbasisandtherefore,theincomestatementeffects

of pensions or nonpension postretirement benefit plans are

earnedin,andshouldfollow,thesamepattern.Theamountof

netperiodiccost/(income)thatisrecordedintheConsolidated

StatementofEarningsconsistsofseveralcomponentsincluding

servicecost,interestcost,expectedreturnonplanassets,and

amortizationofpreviouslyunrecognizedgainsorlosses.Service

costrepresentsthevalueof thebenefits earnedin the current

yearbytheparticipants.Interestcostrepresentsthetimevalue

ofmoneycostassociatedwiththepassageoftime.Inaddition,

the net periodic cost/(income) is impacted by the anticipated

income/loss from the return oninvestedassets,as well as the

income/expense resulting from the recognition of previously

deferred items. Certain items such as changes in employee

base, planchangesandchangesinactuarialassumptionshave

resulted in deferral of the income/expense impact of such

events. Accounting standards require the use of an attribution

approach which generally spreads income/expense of the

deferreditemsovertheservicelivesoftheemployeesintheplan,

provided such amounts exceed thresholds which are based

upon the obligation or the value of plan assets. The average

servicelivesoftheemployeesin thePPP currentlyapproximates

11 years and varyforemployeesin non-U.S.plans.

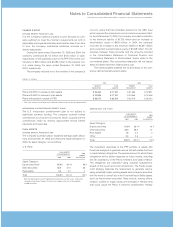

Underlying both the calculation of the PBO and net peri-

odic cost/(income) are actuarial valuations, as discussed

above.Thesevaluationsreflectthetermsoftheplansanduse

participant-specificinformationsuchassalary,ageandyears

ofservice,aswellascertain assumptionswhichincludeesti-

matesofdiscountrates,expectedreturnonplanassets,rateof

compensation increases and mortality rates. For additional

informationregardingassumptions,seethesectioninthisfoot-

note entitled “Assumptions Used to Determine Plan Financial

Information,” onpage91.

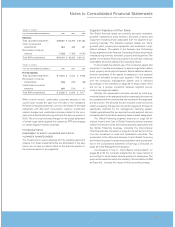

As noted above, the PBO is the actuarial present value of

benefitsexpectedtobepaiduponretirementbaseduponfuture

compensationlevels.Theaccumulatedbenefitobligation(ABO)

isthepresentvalueoftheactuariallydeterminedcompanyobli-

gation for pension payments, assuming no further salary

increasesforemployees.Forinstancesinwhichthefairvalueof

planassetsarelessthantheABO,asofthe measurementdate

(definedasanunfundedABOposition),aminimumliabilityequal

tothisdifferenceisrecognizedintheConsolidatedStatementof

Financial Position. The offset to the minimum liability results in

establishing an intangible asset not exceeding unrecognized

priorservice cost. Anyremainingoffsettingamount results in a

net of tax charge to the Accumulated gains and (losses) not

affectingretainedearningssectionofStockholders’ Equityinthe

ConsolidatedStatementofFinancialPosition.

DEFINED CONTRIBUTION PLANS

Thecompanyrecordsexpensefordefinedcontributionplansfor

the company’s matching contribution when the employee ren-

dersservicetothecompany,essentiallycoincidingwiththecash

contributionstotheplans.