IBM 2005 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

96_ NotestoConsolidatedFinancialStatements

reasonablefee,reflectingthearm’s-lengthvalueofprovidingthe

services.TheGlobalServicessegmententersintoarm’s-length

leases at prices equivalent to market rates with the Global

Financing segment to facilitate the acquisition of equipment

used in services engagements. Generally, all internal transac-

tionpricesarereviewedandresetannually,ifappropriate.

The company uses shared resources concepts to realize

economiesofscaleandefficientuseofresources.Thus,aconsid-

erableamountofexpenseissharedbyallofthecompany’sseg-

ments.Thisexpenserepresentssalescoverage,marketingand

support functions such as Accounting, Treasury, Procurement,

Legal, Human Resources, and Billing and Collections. Where

practical,sharedexpensesareallocatedbased on measurable

driversofexpense,e.g.,headcount. Whenaclearandmeasura-

bledrivercannotbeidentified,sharedexpensesareallocated

onafinancialbasisthatisconsistentwiththecompany’sman-

agementsystem;e.g.,imageadvertisingisallocatedbasedon

the gross profits of the segments. The unallocated corporate

amountsarisingfromcertain divestitures,indirectinfrastructure

reductions, miscellaneoustaxitemsandtheunallocatedcorpo-

rateexpensepoolarerecordedinnetincomebutarenotallo-

catedtothesegments.

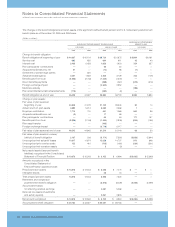

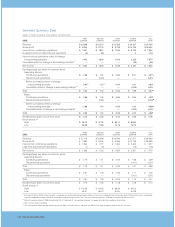

The following tables reflect the results of continuing opera-

tionsofthesegmentsand the PersonalComputingDivision con-

sistent with the company’s management system. These results

are not necessarily a depiction that is in conformity with GAAP;

e.g.,employeeretirementplancostsaredevelopedusingactuar-

ial assumptions on a country-by-country basis and allocated to

the segments based on headcount. Different amounts could

resultifactuarialassumptionsthatareuniquetothesegmentwere

used. Performance measurement is based on income before

incometaxes(pre-taxincome).Theseresultsareused,inpart,by

management,bothinevaluatingtheperformanceof,andinallo-

catingresourcesto,eachofthesegments.Asdiscussedinnote

U,“Stock-BasedCompensation” onpages83to85,thecompany

adopted the fair value method of accounting for stock-based

awards granted to employees. The following segments’ pre-tax

incomeincludestheimpactofthisaccountingchange.

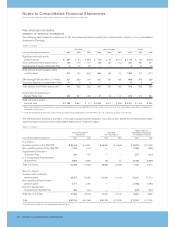

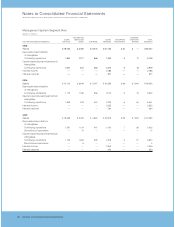

ManagementSystemSegmentView

(Dollarsinmillions)

SYSTEMSAND PERSONAL

GLOBAL TECHNOLOGY GLOBAL ENTERPRISE COMPUTING TOTAL

FORTHEYEARENDEDDECEMBER31: SERVICES GROUP SOFTWARE FINANCING INVESTMENTS DIVISION SEGMENTS

2005:

Externalrevenue $«47,357 $«20,981 $«15,753 $«2,401 $«1,203 $«««2,876 $«««90,571

Internalrevenue 2,891 1,118 1,970 1,506 8 33 7,526

Totalrevenue $«50,248 $«22,099 $«17,723 $«3,907 $«1,211 $«««2,909 $«««98,097

Pre-taxincome/(loss) $«««3,382 $«««1,966 $«««4,882 $«1,583 $«««(145) $«««««(165) $«««11,503

Revenueyear-to-yearchange 1.8% 4.9% 4.9% 0.3% 1.9% NM (5.0) %

Pre-taxincomeyear-to-yearchange (15.8) % (8.1) % 18.0% 8.6% 27.1% NM (0.4) %

Pre-taxincomemargin 6.7% 8.9% 27.5% 40.5% (12.0) % NM 11.7%

2004:

Externalrevenue $«46,213 $«19,973 $«15,094 $«2,607 $«1,180 $«10,737 $«««95,804

Internalrevenue 3,131 1,095 1,805 1,287 8 129 7,455

Totalrevenue $«49,344 $«21,068 $«16,899 $«3,894 $«1,188 $«10,866 $«103,259

Pre-taxincome/(loss) $«««4,018 $«««2,140 $«««4,138 $«1,458 $«««(199) $«««««««(10) $«««11,545

Revenueyear-to-yearchange 8.5% 8.6% 6.1% (5.6) % 11.0% 14.4% 8.1%

Pre-taxincomeyear-to-yearchange 5.1% 25.6% 21.7% 26.6% 26.3% 97.1% 22.1%

Pre-taxincomemargin 8.1% 10.2% 24.5% 37.4% (16.8) % (0.1) % 11.2%

2003:

Externalrevenue $«42,635 $«18,505 $«14,311 $«2,827 $«1,065 $«««9,351 $«««88,694

Internalrevenue 2,837 890 1,613 1,300 5 146 6,791

Totalrevenue $«45,472 $«19,395 $«15,924 $«4,127 $«1,070 $«««9,497 $«««95,485

Pre-taxincome/(loss) $«««3,823 $«««1,704 $«««3,399 $«1,152 $«««(270) $«««««(349) $«««««9,459

Revenueyear-to-yearchange 16.0% 2.4% 11.4% (0.4) % 4.3% 3.8% 10.0%

Pre-taxincomeyear-to-yearchange 31.1% NM 9.4% 24.8% 14.6% (53.7) % 39.4%

Pre-taxincomemargin 8.4% 8.8% 21.3% 27.9% (25.2) % (3.7) % 9.9%

NM—NotMeaningful