IBM 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

32_ ManagementDiscussion

Othernon-currentliabilitiesdecreased$2,628milliondueto

decreases of $2,104 million in Retirement and nonpension

postretirementobligationsofwhichapproximately$1,137 million

wasduetotheeffects ofcurrencyandtheremaining$967 mil-

lionwasattributabletothe favorablefundedstatusofprimarily

non-U.S. pensionplansasdiscussedon page93;and$524mil-

lioninotheraccrualsprimarilyduetotheeffectsofcurrency.

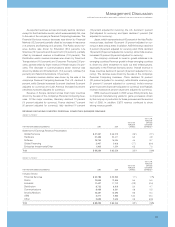

DEBT

Thecompany’sfundingrequirementsarecontinuallymonitored

andstrategiesareexecutedtomanage the company’soverall

asset and liability profile. Additionally, the company maintains

sufficientflexibilitytoaccessglobalfundingsourcesasneeded.

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

Totalcompanydebt $«22,641 $«22,927

Non-GlobalFinancingdebt* $«««2,142 $««««««607

Non-GlobalFinancingdebt/

capitalization 6.7% 2.1%

* Non-GlobalFinancingdebtisthecompany’stotalexternaldebtlesstheGlobal

FinancingdebtdescribedintheGlobalFinancingbalancesheetonpage 44.

Non-Global Financing debt increased $1,535 million and the

debt-to-capitalratio at December31, 2005 was within accept-

ablelevelsat 6.7 percent.Non-GlobalFinancingdebtincreased

versus 2004 primarily to facilitate the company’s repatriation

actions under the American Jobs Creation Act of 2004. The

increaserelatesto short-termdebtissuances.

EQUITY

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

Stockholders’equity:

Total $«33,098 $«31,688

Thecompany’stotalconsolidatedStockholders’ equityincreased

$1,410 million during 2005 primarily due to an increase in the

company’sretainedearningsdrivenbynetincome,partiallyoff-

setby the company’songoingstockrepurchaseprogram and

higherdividendpayments.

OFF-BALANCE SHEET ARRANGEMENTS

In theordinarycourseofbusiness, thecompanyenteredintooff-

balance sheet arrangements as defined by the SEC Financial

Reporting Release 67 (FRR-67), “Disclosure in Management’s

DiscussionandAnalysisaboutOff-BalanceSheetArrangements

andAggregateContractualObligations.”

Noneoftheseoff-balancesheetarrangementseitherhas,or

isreasonablylikely to have,a material currentorfutureeffecton

financial condition, changes in financial condition, revenues or

expenses, results of operations, liquidity, capital expenditures or

capitalresources.Seepage 39 forthecompany’scontractualobli-

gations and note O,“ContingenciesandCommitments,” onpage

78, for detailed information about the company’s guarantees,

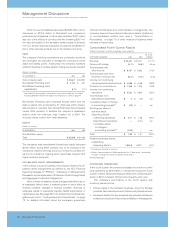

ConsolidatedFourth-QuarterResults

(Dollars andshares inmillionsexceptpershareamounts)

YR. TOYR.

FORFOURTHQUARTER: 2005 2004 CHANGE

Revenue $«24,427 $«27,671 (11.7) % *

Grossprofitmargin «44.1% «38.8% 5.3 pts.

Totalexpenseand

otherincome $«««6,197 $«««6,690 (7.4) %

Totalexpenseandother

income-to-revenueratio 25.4% 24.2% 1.2 pts.

Incomefromcontinuing

operationsbefore incometaxes $«««4,568 $«««4,048 12.8%%

Provisionforincometaxes $«««1,348 $«««1,206 11.6%%

Incomefromcontinuing

operations $«««3,220 $«««2,842 13.3%

Income/(loss)from

discontinuedoperations $««««««««««3 $«««««««(15) NM

Cumulativeeffectofchange

inaccountingprinciple** $«««««««(36) $««««««««— NM

Earningspershareof

commonstock:

Assumingdilution:

Continuingoperations $«««««2.01 $«««««1.68 19.6%

Discontinuedoperations ««««««««— «« (0.01) NM

Cumulativeeffect

ofchangein

accountingprinciple** «««(0.02) «««««««— NM

Total $«««««1.99 $«««««1.67 19.2%

Weighted-averageshares

outstanding:

Assumingdilution 1,604.8 1,692.1 (5.2) %

* (8.5)percentadjustedforcurrency.

** Reflects implementationofFASBInterpretationNo.47.Seenote B,“Accounting

Changes,”onpages61 and62 foradditionalinformation.

NM—NotMeaningful

CONTINUING OPERATIONS

Inthefourthquarter,thecompanyincreasedIncomefromcontin-

uingoperationsby$378millionor13.3percentversusthefourth

quarterof2004.Dilutedearningspersharefromcontinuingoper-

ationsof$2.01 increased19.6percentversustheprioryear.

The company’s performance in the fourth quarter was

drivenbyseveralfactors:

• Strongresultsinthehardwarebusiness, driven by Storage

products,Microelectronicsand zSeriesandpSeriesservers.

• Increaseddemandforthecompany’skeybrandedmiddleware

softwareproductsandimprovedprofitabilityinthatsegment.

financialcommitments and indemnification arrangements. The

companydoesnothaveretainedinterestsinassetstransferred

to unconsolidated entities (see note J, “Securitization of

Receivables,” on page 70) or other material off-balance sheet

interestsorinstruments.