IBM 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

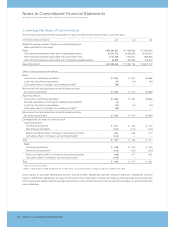

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_73

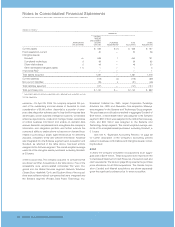

Thefollowingtables summarizethenetfairvalueofthecompany’sderivativeandotherriskmanagementinstrumentsatDecember

31,2005and2004(includedintheConsolidatedStatementofFinancialPosition).

RiskManagementProgram

(Dollarsinmillions)

HEDGEDESIGNATION

NET NON-HEDGE/

ATDECEMBER31,2005 FAIRVALUE CASHFLOW INVESTMENT OTHER

Derivatives—netasset/(liability):

Debtriskmanagement $«(116) $««(79) $«««««««— $«(109)

Long-terminvestmentsinforeignsubsidiaries(“netinvestments”) ——120—

Anticipatedroyaltiesandcosttransactions —324 — —

Subsidiarycashandforeigncurrencyasset/liabilitymanagement ——— (4)

Equityriskmanagement ———17

Otherderivatives ——— 4

Totalderivatives (116) (a) 245 (b) 120 (c) (92) (d)

Debt:

Long-terminvestmentsinforeignsubsidiaries(“netinvestments”) — — (2,027) (e) —

Total $«(116) $«245 $«(1,907) $«««(92)

(a) Comprisesassetsof$34 millionandliabilitiesof$150 million.

(b) Comprisesassetsof$363 millionandliabilitiesof$118 million.

(c) Comprises assets of$150 million andliabilitiesof$30million.

(d) Comprisesassetsof$25 millionandliabilitiesof$117 million.

(e) Represents foreign currency denominateddebt formallydesignatedasahedgeofnetinvestment.

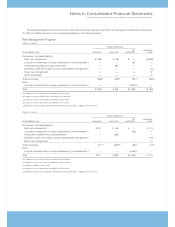

(Dollarsinmillions)

HEDGEDESIGNATION

NET NON-HEDGE/

ATDECEMBER31,2004 FAIRVALUE CASHFLOW INVESTMENT OTHER

Derivatives—netasset/(liability):

Debtriskmanagement $«221 $«««(53) $«««««««— $««(14)

Long-terminvestmentsinforeignsubsidiaries(“netinvestments”) — — (58) —

Anticipatedroyaltiesandcosttransactions — (939) — —

Subsidiarycashandforeigncurrencyasset/liabilitymanagement — — — (19)

Equityriskmanagement ——— (7)

Totalderivatives 221 (a) (992) (b) (58) (c) (40) (d)

Debt:

Long-terminvestmentsinforeignsubsidiaries(“netinvestments”) — — (2,490) (e) —

Total $«221 $«(992) $«(2,548) $««(40)

(a) Comprisesassetsof$440millionandliabilitiesof$219million.

(b)Comprisesassetsof$12millionandliabilitiesof$1,004million.

(c) Comprisesliabilitiesof$58million.

(d)Comprisesassetsof$60millionandliabilitiesof$100million.

(e) Represents foreigncurrencydenominateddebt formallydesignatedasahedgeofnetinvestment.