IBM 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TRANSACTIONAL ANNUITY

COMMODITY

TRANSACTIONAL ANNUITY

COMMODITY

SOLUTIONS

SOLUTIONS

POINT

PRODUCTS

POINT

PRODUCTS

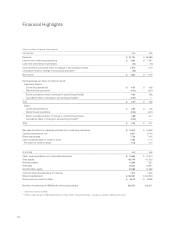

IBM’s Segment Pre-Tax

Income in 2005 was

balanced among its three

primary businesses.

_5

Business Revenue Mix

The company’s business mix has

shifted away from commoditizing seg-

ments, such as PCs, hard disk drives

and DRAMs, and toward higher value

businesses:

transactional

, which

provide near-term income; and

annuity

, which provide predictable,

long-term income, supplying capital to

invest in future growth.

Transaction Revenue Mix

IBM uses the cash from its reliable

annuity businesses to fund investment

in high-value integrated solutions:

offerings that integrate services

and technology to solve a business

or infrastructure problem. Clients

increasingly seek solutions rather than

“point-product” purchases of particular

technologies and products.

Profitability

As a result of these shifts, the

company has improved its gross

profit margins over the past five

years. IBM’s margin is the highest

it has been since 1996.

The company has steadily shifted its business mix toward more profitable,

innovation-based segments.

1996

Today*

* Post PC divestiture

* Excludes 2Q restructuring charges and PCs.

Software includes Enterprise Investments.

1996

Today*

Moving to a high-value model

01 02 03 04 05

37.9% 36.6% 36.5% 36.9%

40.1%

30%_

40%_

50%_

20%_

Systems and Financing

World leader in server sales. IBM has improved its server market position

by 9.5points since 2000. Blade server revenue grew by 65 percent in 2005.

IBM leads in supercomputers, with 219 of the top 500 systems —including

number one (BlueGene/L) and five of the top ten.

Software

World leader in middleware and the second-largest software business overall.

IBM is the market leader in information management software, all application

integration and middleware categories; instant messaging software for

corporations; portal software; and systems management and systems

operations software.

Services

World leader in IT services and consulting. IBM has approximately 198,000

services professionals globally. Offerings include datacenter outsourcing,

business transformation services, consulting, systems integration, application

management services, infrastructure and system maintenance and Web

hosting. IBM Global Services signings grew 9percent in 2005.

Pre-Tax Income 2005*

Gross Profit Margin

SYSTEMS

AND FINANCING

SOFTWARE

SERVICES

28% 37%

35%

01 02 03 04 05

37.9% 36.6% 36.5% 36.9%

40.1%

30%_

40%_

50%_

20%_