IBM 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

66_ NotestoConsolidatedFinancialStatements

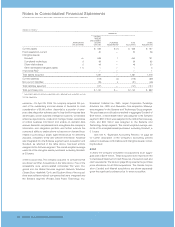

(Dollarsinmillions)

RATIONAL

ORIGINAL

AMOUNT

DISCLOSED

AMORTIZATION INFIRST PURCHASE TOTAL OTHER

LIFE(INYEARS) QTR. 2003 ADJUSTMENTS* ALLOCATION ACQUISITIONS

Currentassets $«1,179 $««51 $««1,230 $«««19

Fixedassets/non-current 83 28 111 2

Intangibleassets:

Goodwill NA 1,365 40 1,405 335

Completedtechnology 3 229 — 229 12

Clientrelationships 7 180 — 180 1

Otheridentifiableintangibleassets 2–5 32 — 32 21

In-processR&D 9— 9—

Totalassetsacquired 3,077 119 3,196 390

Currentliabilities (347) (81) (428) (28)

Non-currentliabilities (638) 33 (605) 11

Totalliabilitiesassumed (985) (48) (1,033) (17)

Totalpurchaseprice $«2,092 $««71 $««2,163 $«373

* Adjustmentsprimarilyrelatetoacquisitioncosts,deferredtaxesandotheraccruals.

NA—NotApplicable

RATIONAL – On February 21, 2003, the company purchased the

outstandingstockofRationalfor$2,092 millionincash.Inaddi-

tion, the company issued replacement stock options with an

estimatedfairvalueof$71 milliontoRationalemployees foratotal

purchasepriceof$2,163million.Rationalprovidesopen,industry-

standard tools and best practices and services for developing

businessapplicationsandbuilding softwareproductsand sys-

tems. The Rational acquisition provided the company with the

abilitytoofferacompletedevelopmentenvironmentforclients.

Rational was integrated into the company’s Software segment

uponacquisitionandGoodwill,as reflectedinthetable above,

has been assigned to the Software segment. The overall

weighted-average life of the identified intangible assets

acquired, excludingGoodwill, is4.7years.

As indicated above, $2,092 million of the gross purchase

pricewaspaidincash.However,aspartofthetransaction,the

companyassumedcashandcashequivalentsheldinRational

of$1,053million,resultinginanetcashpaymentof$1,039 mil-

lion.Inaddition,thecompanyassumed$500millioninoutstand-

ing convertible debt. The convertible debt was subsequently

calledonMarch26,2003.

OTHERACQUISITIONS –Thecompany acquiredeightothercompa-

niesthatareshownasOtherAcquisitionsinthetable above.The

company paidsubstantially all cashfortheother acquisitions.

Fiveoftheacquisitionswereforsoftwarecompanies,tworelated

toStrategicOutsourcingandBusinessConsultingServicescom-

paniesandonewasahardwarebusiness. Thecompanyassigned

approximately$74millionoftheGoodwilltotheSoftwareseg-

ment; $203millionofGoodwilltotheGlobalServicessegment;

and$58millionofGoodwilltotheSystemsandTechnologyGroup

segment. The overall weighted-average life of the intangible

assetspurchased,excludingGoodwill, is4.3years.

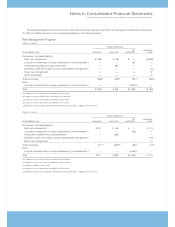

Divestitures

2005

OnApril30,2005(“closingdate”),thecompanycompletedthe

divestitureofitsPersonalComputing businesstoLenovo,apub-

licly traded company on the Hong Kong Stock Exchange. The

totalconsiderationthatthecompanyagreedtoonDecember7,

2004(thedatethedefinitiveagreementwassigned)was$1,750

million which included $650 million in cash, $600 million in

Lenovo equity (valued at the December 6, 2004 closing price)

andthetransferofapproximately$500millionofnetliabilities. At

theclosingdate,totalconsiderationwasvaluedat$1,725million,

comprisedof:$650millionincash,$542millioninLenovoequity

and$533millioninnetliabilitiestransferred. Transactionrelated

expensesandprovisionswere$628million,resultinginanetpre-

taxgainof$1,097millionwhichwasrecordedinOther(income)

and expense in the Consolidated Statement of Earnings in the

secondquarter of 2005. Inaddition, thecompanypaidLenovo

$138millionincashprimarilytoassumeadditionalliabilitiesout-

sidethescopeoftheoriginalagreement. Thistransactionhadno

impact on Income from Continuing Operations. Total net cash

proceeds,lessthedepositreceivedattheend of2004 for$25

million,relatedtothesetransactionswere$487million.

Theequityreceivedattheclosingdaterepresented9.9per-

centofordinaryvotingsharesand18.9percentoftotalownership

inLenovo.Subsequenttotheclosingdate,Lenovo’scapitalstruc-

turechangedduetonewthird-partyinvestments. Asaresult,the

company’sequityatJune30,2005represented9.9percentof

ordinary voting shares and17.05 percent of total ownership in

Lenovo. The equity securities have been accounted for under

thecostmethodofaccounting. Theequityissubjecttospecific

lock-upprovisionsthatrestrictthecompanyfromdivestingthe

securities. These restrictions apply to specific equity tranches

andexpireoverathree-yearperiodfromtheclosingdate. The