IBM 2005 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

78_ NotestoConsolidatedFinancialStatements

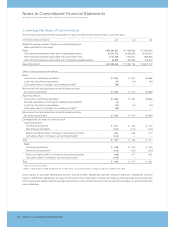

companyalsoagreed,subjecttocertainlimitations,thatitwillnot

assertantitrustclaimsfordamagesrelatedtoitsserverhardware

andserversoftwarebusinessesfortwoyearsand,inanycase,

willnotseektorecoverdamagesonsuchclaimsincurredpriorto

June 30, 2002. Microsoft also released antitrust claims. Under

theagreement,Microsoftagreedtopaythecompany$775mil-

lionandextend$75millionincreditstowardsfuturepurchases

forinternaldeploymentofMicrosoftsoftwareatthecompany.The

$775millionwasreflectedinOther(income)andexpenseinthe

ConsolidatedStatementofEarningsinthesecondquarter,with

thecashreceivedbythecompanyinthethirdquarter.

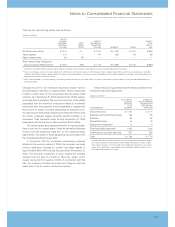

Thecompanyispartyto,orotherwiseinvolvedin,proceed-

ings brought by U.S. federal or state environmental agencies

under the Comprehensive Environmental Response,

Compensation and Liability Act (“CERCLA”), known as

“Superfund,” or laws similar to CERCLA. Such statutes require

potentially responsible parties to participate in remediation

activitiesregardlessoffaultorownershipofsites.Thecompany

isalsoconductingenvironmentalinvestigationsorremediations

atorin the vicinity of several currentor formeroperating sites

pursuant to permits, administrative orders or agreements with

state environmental agencies, and is involved in lawsuits and

claimsconcerningcertaincurrentorformeroperatingsites.

In accordance with SFAS No. 5, “Accounting for Contin-

gencies,” the company records a provision with respect to a

claim,suit,investigationorproceedingwhenitisprobablethat

aliabilityhasbeenincurredandtheamountofthelosscanbe

reasonably estimated. Any provisions are reviewed at least

quarterly and are adjusted to reflect the impact and status of

settlements, rulings, advice of counsel and other information

pertinent to a particular matter. Any recorded liabilities for the

aboveitems,includinganychangestosuchliabilitiesforthe year

endedDecember31,2005,werenotmaterialtotheConsolidated

Financial Statements. Based on its experience, the company

believes that the damage amounts claimed in the matters

referredtoabovearenotameaningfulindicatorofthepotential

liability.Claims,suits,investigationsandproceedingsareinher-

entlyuncertainanditisnotpossibletopredicttheultimateout-

comeof thematterspreviouslydiscussed.Whilethecompany

willcontinuetodefenditselfvigorouslyinallsuchmatters,itis

possible that the company’s business, financial condition,

resultsofoperations,orcashflowscouldbeaffectedinanypar-

ticularperiodbytheresolutionofoneormoreofthesematters.

Whether any losses, damages or remedies finally deter-

minedinanysuchclaim,suit,investigationorproceedingcould

reasonably have a material effect on the company’s business,

financial condition, results of operations, or cash flow will

depend on a number of variables, including the timing and

amount of such losses or damages, the structure and type of

any such remedies, the significance of the impact any such

losses, damages or remedies may have on the company’s

Consolidated Financial Statements, and the unique facts and

circumstances of the particular matter which may give rise to

additionalfactors.

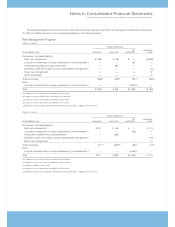

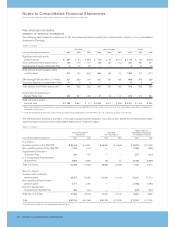

Commitments

The company’s extended lines of credit to third-party entities

includeunusedamountsof$3,019 millionand$2,714 millionat

December31, 2005 and2004,respectively.Aportion of these

amounts was available to the company’s business partners to

support their working capital needs. In addition, the company

hascommittedtoprovidefuturefinancingtoitsclientsincon-

nection with client purchase agreements for approximately

$2,155 million and $1,686 million at December 31, 2005 and

2004, respectively. The change over the prior year is due to

increasedsigningsoflong-termITinfrastructurearrangements

in which financing is committed by the company to fund a

client’sfuturepurchasesfromthecompany.

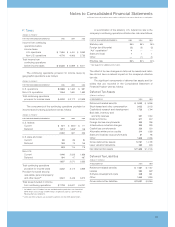

The company has applied the provisions of FIN 45 to its

agreementsthatcontainguaranteeorindemnificationclauses.

These provisions expand those required by SFAS No. 5, by

requiringaguarantortorecognizeanddisclosecertaintypesof

guarantees, even if the likelihood of requiring the guarantor’s

performance is remote. The following is a description of

arrangementsinwhichthecompanyistheguarantor.

Thecompanyisapartytoavarietyofagreementspursuant

to which it may be obligated to indemnify the other party with

respecttocertainmatters.Typically,theseobligationsariseinthe

contextofcontractsenteredintobythecompany,underwhich

thecompanycustomarilyagreestoholdtheotherpartyharmless

against losses arising from a breach of representations and

covenantsrelatedtosuchmattersastitletoassetssold,certain

IP rights, specified environmental matters, and certain income

taxes.Ineachofthesecircumstances,paymentbythecompany

isconditionedontheotherpartymakingaclaimpursuanttothe

procedures specified in the particular contract, which proce-

durestypicallyallowthecompanytochallengetheotherparty’s

claims. Further, the company’s obligations under these agree-

ments may be limited in terms of time and/or amount, and in

someinstances,the company mayhaverecourseagainstthird

partiesforcertainpaymentsmadebythecompany.

Itisnotpossibletopredictthemaximumpotentialamount

offuturepaymentsundertheseorsimilaragreementsduetothe

conditionalnatureofthecompany’sobligationsandtheunique

factsandcircumstancesinvolvedineachparticularagreement.

Historically, payments made by the company under these

agreements have not had a material effect on the company’s

business,financialconditionorresultsofoperations.Thecom-

panybelievesthatifitweretoincuralossinanyofthesemat-

ters, such loss should not have a material effect on the com-

pany’sbusiness,financialconditionorresultsofoperations.

In addition, the company guarantees certain loans and

financialcommitments.Themaximumpotentialfuturepayment

underthese financialguaranteeswas$39 millionand$58 mil-

lionatDecember31,2005and2004,respectively. Thefairvalue

of the guarantees recognized in the company’s Consolidated

StatementofFinancialPosition(otherthanthe$74millionforcer-

tain indemnities to Lenovo discussed in note C, “Acquisitions/

Divestitures” onpages66and67)isnotmaterial.