IBM 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_67

Lenovoequitywasvaluedat$542millionattheclosingdateand

isrecordedinInvestmentsandsundryassetsintheConsolidated

Statement of Financial Position. In addition, the company

recordedanequitydeferral of $112million to reflectthevalueof

the lock-up provisions. This deferral was recorded as a contra-

investmentinInvestmentsandsundryassets.

AspartoftheagreementswithLenovo,thecompanywillpro-

videcertainservices. Theseservicesincludemarketingsupport,

information technology, human resourcessupport and learning

services. Theseservicearrangementsareprimarilyforperiodsof

threeyearsorlessandcanbeterminatedearlierbyLenovo. The

company estimatedthefairvalueoftheseservicearrangements,

and,asaresult,hasdeferred$262millionofthetransactiongain.

Thisamountwillberecordedasrevenue,primarilyinthecom-

pany’s Global Services segment, as services are provided to

Lenovo.Thedeferredamountwasrecordedindeferredincomein

OtherliabilitiesintheConsolidatedStatementofFinancialPosition.

Thecompanyalsorecordeddirectandincrementalexpenses

andrelatedprovisionsof$254millionassociatedwiththedivesti-

ture,consistingof$74millionforcertainindemnities;$64millionfor

employee-relatedcharges;$40millioninrealestateandinforma-

tiontechnologycosts;$20millionintransactionexpenses;$22mil-

lionofgoodwill;and$34millioninotherexpenses.Thecompany,

aspartoftheagreement,retainedtherightandwillbegivenapref-

erencetoprovidemaintenance,warrantyandfinancingservicesto

Lenovo. ThecompanyretainedthewarrantyliabilityforallPersonal

Computing business products sold prior to the closing date.

LenovowillhavetherighttousecertainIBMTrademarksundera

TrademarkLicenseAgreementforatermoffiveyears. Inaddition,

thecompanyenteredintoanarm’s-lengthsupplyagreementwith

Lenovoforatermoffiveyears,designedtoprovidethecompany

withcomputersforitsinternaluse.

Inthethirdquarterof2005,asaresultofthethird-party invest-

mentsdescribedabove, Lenovo was requiredtorepurchasethe

first equity tranche at a specified share price. The equity repur-

chaseresultedinthereceiptof$152millionofcashandapre-tax

gainof$17 million. As a resultof this transaction,the company’s

equity inLenovo atSeptember30,2005represented9.9percent

ofordinaryvotingsharesand14.88percentoftotalownership.

Also,inthe secondhalfoftheyear,thecompanyreceived

anadditional$23 millionofcashfromLenovorelatedtoworking

capitaladjustments,netofexpensesrelatedtoemployeemat-

ters. These transactions were consistent with the company’s

previousestimates. Overall, includingthegainontheequitysale

recorded in the third quarter, the company recorded an addi-

tionalnetpre-taxgainof$11 million;theresultingnetpre-taxgain

forthe year ending December31,2005is$1,108 million.

Inaddition,atDecember31,2005,thedeferred income bal-

ancerelatedtotheservicesarrangementsdiscussedaboveis

$169million.

D. FinancialInstruments(excluding derivatives)

FairValueofFinancialInstruments

Cashandcashequivalents,marketablesecurities andderivative

financialinstrumentsarerecognizedandmeasuredatfairvalue

inthecompany’sfinancialstatements.Notesandotheraccounts

receivable andotherinvestmentsarefinancialassetswithcarry-

ingvaluesthatapproximatefairvalue.Accountspayable,other

accrued expenses and short-term debt are financial liabilities

with carrying values that approximate fair value. The carrying

amountoflong-termdebtisapproximately$15.4billionand$14.8

billionandtheestimatedfairvalueis$16.7 billionand$15.7billion

atDecember31,2005and2004,respectively.

Intheabsenceofquotedpricesinactivemarkets,consider-

ablejudgmentisrequiredindevelopingestimatesoffairvalue.

Estimatesarenotnecessarilyindicativeoftheamountsthe com-

panycouldrealizeinacurrentmarkettransaction.Thefollowing

methodsandassumptionswereusedtoestimatefairvalues:

LOANS AND FINANCING RECEIVABLES

Estimatesoffairvaluearebasedondiscountedfuturecashflows

usingcurrentinterestratesofferedforsimilarloansto clients with

similarcreditratingsforthesameremainingmaturities.

RESTRICTED SECURITIES

Thefairvalueofrestrictedsecuritieswasestimatedbasedona

quoted price for an identical unrestricted security, adjusted to

reflecttheeffectoftherestriction.

LONG-TERM DEBT

For publicly-traded debt, estimates of fair value are based on

marketprices.Forotherdebt,fairvalueisestimatedbasedon

rates currently available to the company for debt with similar

termsandremainingmaturities.

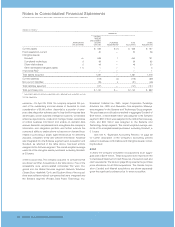

MarketableSecurities*

The following table summarizes the company’s marketable

securities, all of which are considered available-for-sale, and

allianceinvestments.

(Dollarsinmillions)

FAIRVALUE

ATDECEMBER31: 2005 2004

Marketablesecurities—current:

Auctionratesecurities

andotherobligations $«1,118 $«517

Marketablesecurities—non-current:**

Timedeposits andotherobligations $««««««««2 $«««36

Non-U.S.governmentsecuritiesand

otherfixed-termobligations 13 22

Total $««««««15 $«««58

Non-equitymethodallianceinvestments** $««««558 $«309

* Grossunrealizedgains(beforetaxes)onmarketablesecurities were$110 million

and$85million at December31,2005and2004,respectively.Grossunrealized

losses(beforetaxes)onmarketablesecurities were immaterialtothe Consolidated

FinancialStatements at December31,2005and2004. Grossunrealizedgainsand

losses(beforetaxes)onallianceinvestmentswereimmaterialtotheConsolidated

FinancialStatements atDecember31,2005and2004. Seenote N,“Stockholders’

EquityActivity,”onpages 75 and 76 fornetchangeinunrealizedgainsandlosses

onmarketablesecurities.

**IncludedwithinInvestmentsandsundryassetsintheConsolidatedStatementof

FinancialPosition.Seenote H,“InvestmentsandSundryAssets,”onpage 68.